Holy moly, folks! Spot gold has just punched through the $3200 mark per ounce, achieving a new all-time high! It’s barely been over ten days since it cleared $3100, and already it’s soaring even higher – a blistering 0.74% gain today alone. Year-to-date, we’re looking at nearly a 22% jump. This isn’t just a rally, it’s a full-blown gold rush!

Now, why is this happening? Well, let’s break it down.

Firstly, the geopolitical climate is a total dumpster fire. Wars, tensions, and instability – gold thrives on uncertainty. Investors are scrambling for a safe haven, and gold is the classic safe haven.

Secondly, central banks are playing a HUGE role. Many are aggressively buying gold, diversifying away from the damn US dollar. They’re smelling the coffee and preparing for the future.

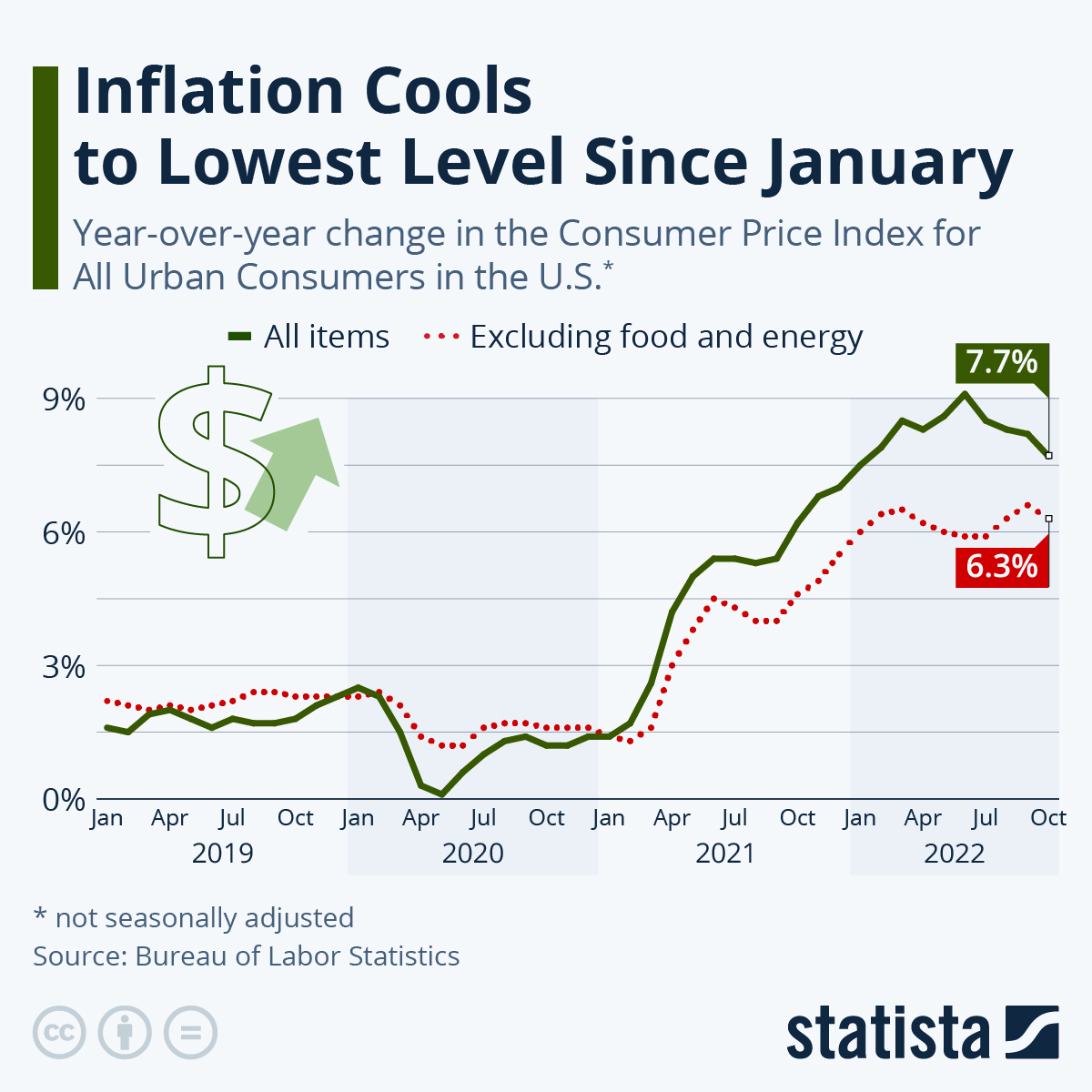

Thirdly, inflation, while cooling slightly, isn’t gone. It’s still lurking, and gold is a decent hedge against that pesky erosion of buying power.

Essentially, all hell is breaking loose in the financial world, and gold is where the smart money is flowing. Get ready for more fireworks, because I have a feeling this is just the beginning. Don’t say I didn’t warn you!

Let’s delve deeper into gold as a safe haven asset:

Gold has been considered a store of value for millennia. Its limited supply and inherent characteristics have given it a unique position.

Historically, during periods of economic turbulence, geopolitical crises, or high inflation, investors flock to gold. This demand drives up its price.

Unlike currencies which can be printed at will, gold’s supply is constrained by mining output and existing reserves. This scarcity offers protection.

Central banks hold gold as part of their reserves, bolstering confidence. Their buying activity signals broader market sentiment.

Furthermore, gold doesn’t yield interest or dividends, instead its value relies on price appreciation, an advantage in inflationary times.