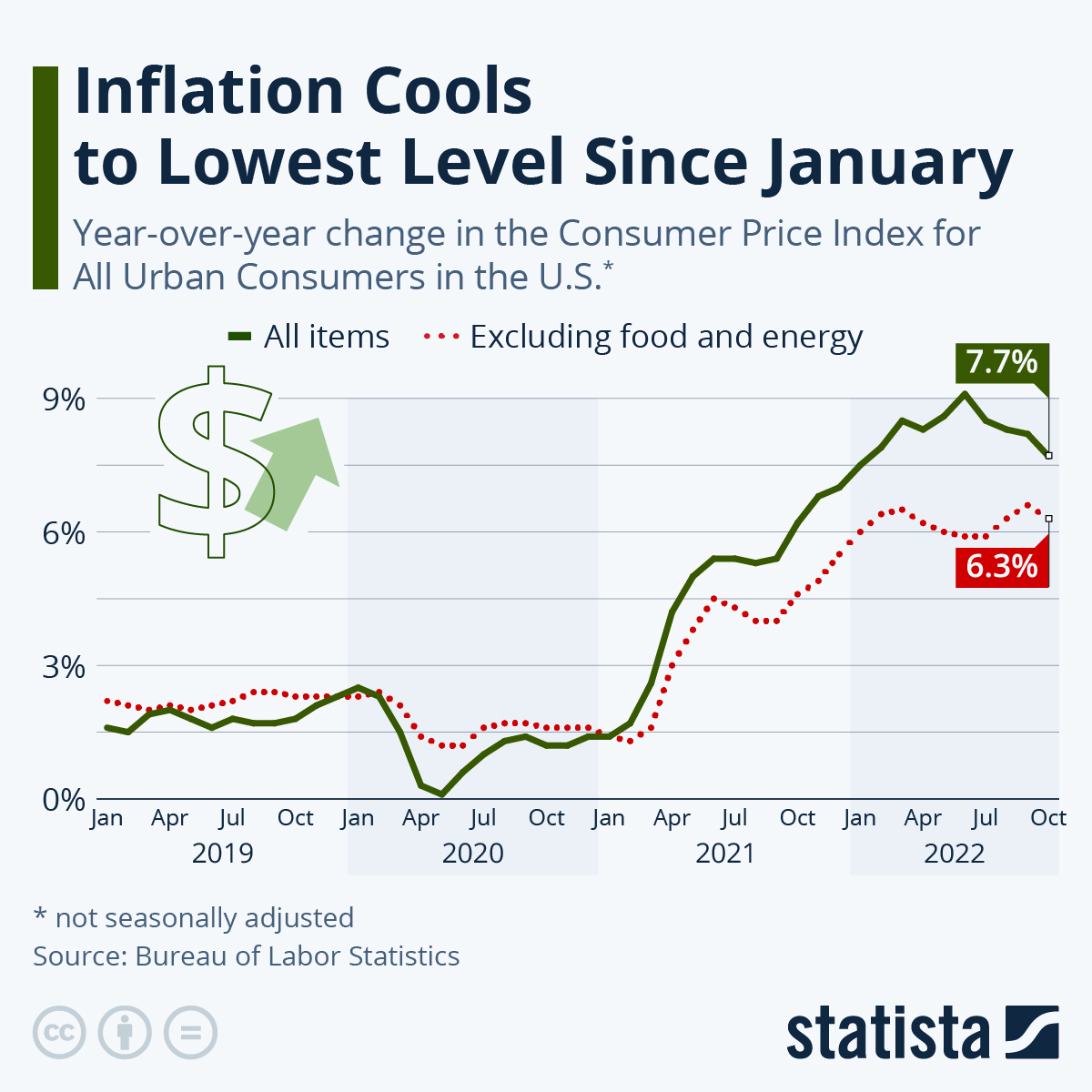

Alright, tech fam, listen up! The US 1-year inflation expectation just dropped to 6.5% – FINALLY some good news! This is according to reports from DeepTechFlow today, beating the predicted 6.8% and down from the previous reading of 6.70%. This isn’t just numbers, people, this is a glimmer of hope in a relentlessly expensive world. It suggests those relentless price hikes might be starting to ease, which could be huge for everyone from Wall Street to your everyday grocery shopper.

Photo source:www.electronicsweekly.com

Let’s break down what this means a bit deeper. Inflation expectations are crucially important because they shape future economic behavior. If people expect prices to keep climbing, they demand higher wages, and businesses raise prices further, creating a self-fulfilling prophecy.

Conversely, if expectations fall, it takes pressure off that cycle. This drop in 1-year expectations is significant. It indicates consumers are starting to believe the Fed’s tightening policies are working, or that supply chain issues are genuinely resolving.

It’s not time to pop the champagne just yet, folks. One data point doesn’t make a trend. But it’s a damn good sign that the economic pain could be starting to subside. We’re still a long way from the Fed’s 2% target, but at least we’re heading in the right direction. Let’s hope this momentum continues – because honestly, we deserve a break.

Knowledge Point Expansion:

Inflation expectations represent what consumers and businesses believe future price changes will be. These expectations have a powerful impact on actual inflation.

Central banks, like the US Federal Reserve, heavily monitor inflation expectations. They use tools like interest rate adjustments to influence these expectations and control inflation.

A decrease in inflation expectations can indicate a cooling economy and potentially lower future interest rates. This is typically viewed positively by financial markets.

Short-term (like 1-year) expectations are particularly relevant as they influence immediate spending and investment decisions. Sustained declines are crucial for bringing down overall inflation.