Hold onto your hats, folks! Goldman Sachs is throwing a serious wrench into the narrative of persistent hawkishness from the Federal Reserve. According to Kay Hagerty, Global Co-Head of Fixed Income and Liquidity Solutions at Goldman Asset Management, the initial response from the Fed to cooling CPI numbers will likely be cautious – a polite tap on the brakes, if you will.

But here’s where it gets really interesting. Hagerty believes the economic slowdown could be far more dramatic than anyone’s letting on. We’re talking potentially a much steeper descent than the Fed is currently factoring in. And that, my friends, could force their hand into reversing course on rate hikes and potentially even diving back into an easing cycle!

Let’s break down why this is huge. A shift to an easing cycle signifies the Fed is actively trying to stimulate the economy – typically by lowering interest rates.

Understanding the Fed’s Dual Mandate: The Federal Reserve operates under a ‘dual mandate’ – maintaining stable prices (controlling inflation) and maximizing employment.

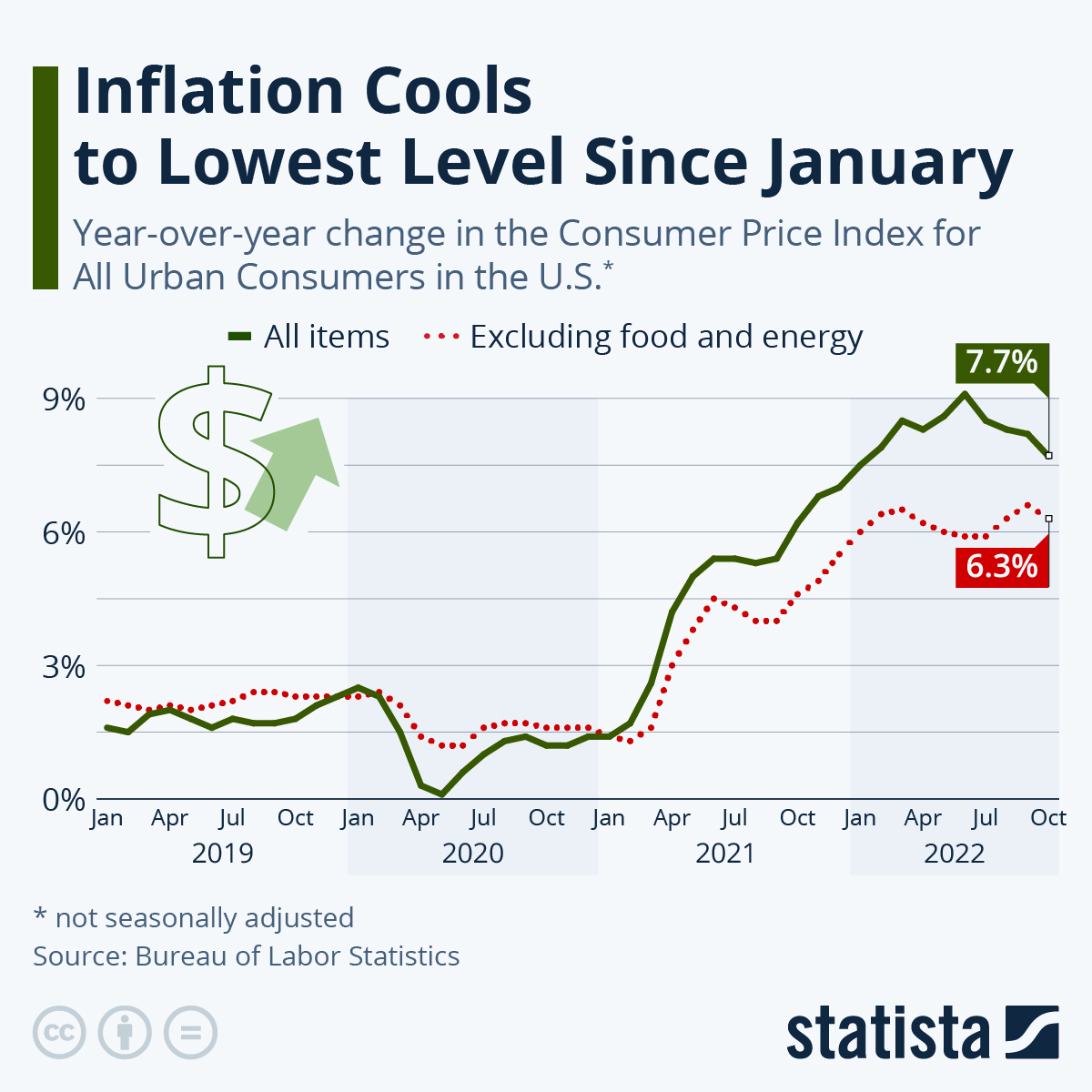

CPI and its Significance: The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It’s a key inflation indicator.

Economic Slowdown as a Catalyst: A pronounced economic slowdown, even with moderating inflation, could pressure the Fed to prioritize job growth and overall economic health over further inflation suppression.

Potential U-Turn Implications: This isn’t just market chatter; a Fed U-turn could mean lower mortgage rates, cheaper loans, and a potential boost for stocks. But remember, it all hinges on how bad things actually get. Don’t get your hopes up too high just yet – this is a developing situation, and the Fed has a habit of blindsiding us all!