Hold onto your hats, folks, because Jue Wei Food’s 2024 results are…well, let’s just say they’re a steaming pile of disappointment. The company just announced a net profit of 227 million yuan for the year – a gut-wrenching 34.04% drop compared to last year. Seriously, 34%! What the actual f happened?

Revenue also took a hit, falling 13.84% to 6.257 billion yuan. And earnings per share? Down a depressing 35.71% to just 0.36 yuan. Look, even your grandma knows that’s not a good sign.

Now, they’re trying to soothe investors with a cash dividend of 3.30 yuan for every ten shares held. That’s…nice, I guess. But a little cash isn’t going to erase the stench of these numbers.

Let’s break down what’s happening here. Jue Wei, famous for its duck necks and other spicy snacks, is facing a rapidly changing market. Consumption patterns are shifting, and competition is fierce.

Understanding China’s Snack Food Market & Jue Wei’s Challenge

China’s snack food market is gigantic and dynamic, with huge potential but also extreme competition. It’s no longer enough to just have a tasty product.

Changing consumer preferences are a key issue. Younger generations are looking for healthier, more innovative options, and Jue Wei’s traditional offerings might be losing their appeal.

Increased competition, particularly from emerging brands leveraging e-commerce and social media, is putting immense pressure on established players like Jue Wei. They need to adapt, and quickly.

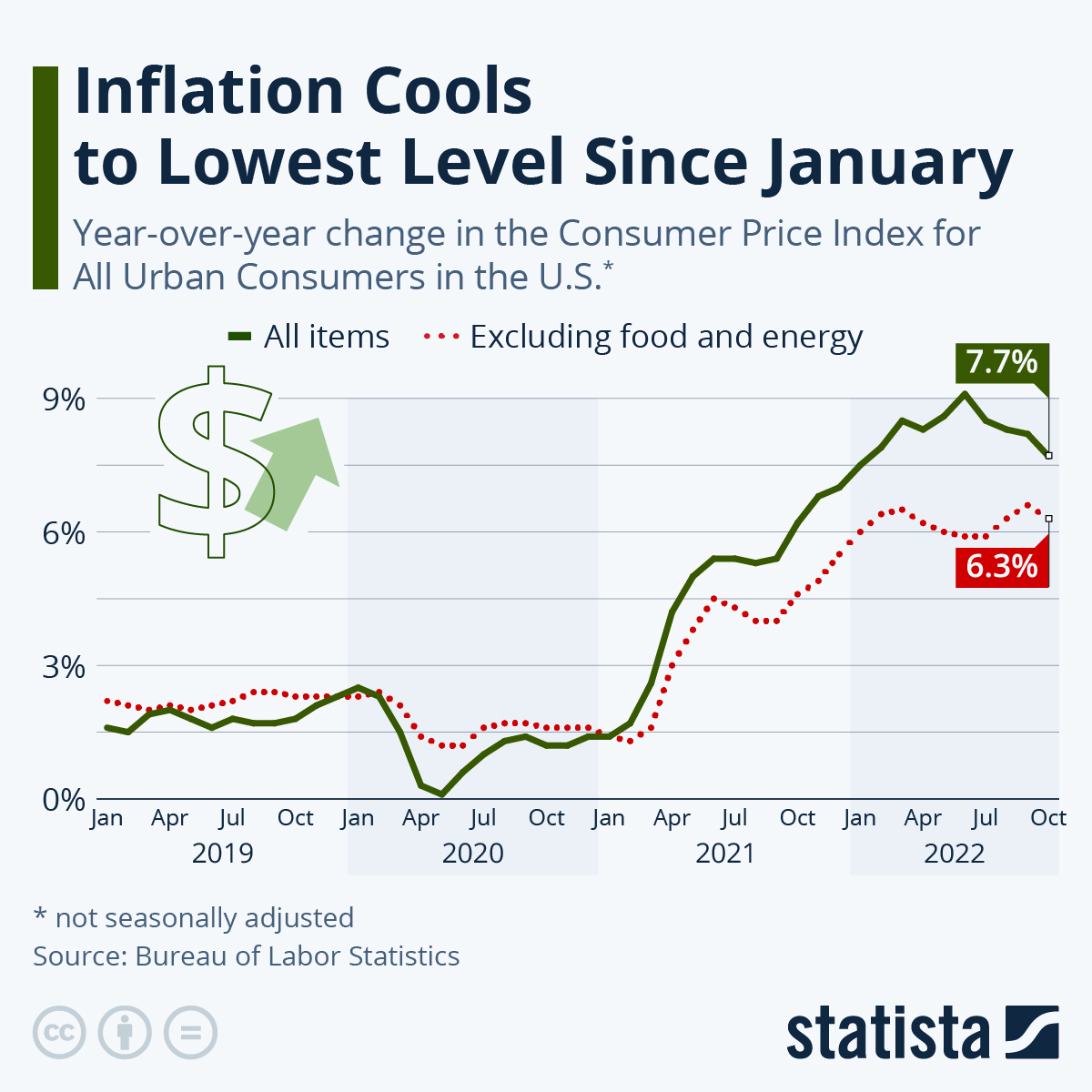

Finally, macroeconomic factors like slowing economic growth and rising inflation also contribute to decreased consumer spending, impacting discretionary purchases like snacks.

Honestly, Jue Wei needs a serious overhaul. They’ve become complacent, resting on their laurels. This isn’t just a blip; it’s a warning sign. They need to innovate, diversify, and frankly, get their act together if they want to survive the next decade. This isn’t just about numbers folks; it’s about a potential snack food empire crumbling before our eyes!