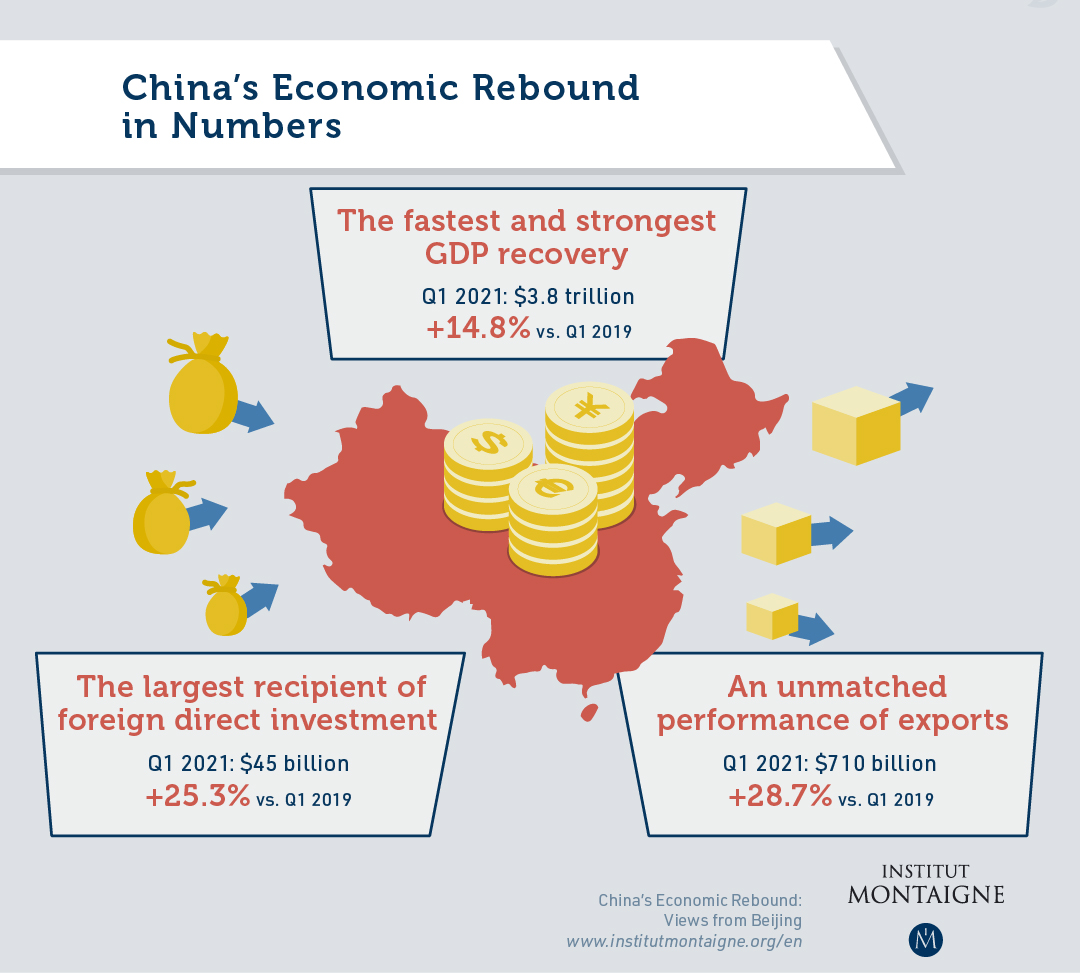

Alright, buckle up, folks! The economic landscape is shifting, and China’s sending a very clear signal. Let’s break down the key headlines, with a healthy dose of reality.

Photo source:www.institutmontaigne.org

First, Beijing is doubling down on long-term data infrastructure, a move that speaks volumes about their commitment to the digital future. This isn’t just about faster internet; it’s about control, innovation, and ultimately, economic dominance.

The ‘May Day’ holiday saw a 6.3% jump in retail and catering sales, indicating consumer spending is picking up. However, let’s not get carried away – this is a single data point, and we need sustained growth to declare a true recovery.

Geopolitically, the US is extending olive branches, reportedly eager to re-engage with China. While talk is cheap, China is wisely evaluating the sincerity and potential benefits before jumping into discussions. Don’t expect a quick resolution.

On the regulatory front, the Shenzhen Stock Exchange is adding ESG negative screening to its ChiNext Index. This is a big deal, signaling a greater emphasis on responsible investing, no matter how much scoffing you see from some corners.

Central Bank Governor Pan Gengsheng hosted the ASEAN+3 Finance Ministers and Central Bank Governors’ Meeting, underlining China’s regional financial leadership. Alongside, new regulations governing direct-to-satellite internet access are rolling out – expect tighter control and potential innovation in that space.

And let’s not forget the impending strategic communication between President Xi Jinping and Putin. This is a partnership forged in mutual interests, and it has implications for the entire global order.

Here’s a quick knowledge boost surrounding the recent focus on supply chain finance:

China’s central bank is cracking down on delayed payments to SMEs, setting a 6-month deadline for electronic invoice settlements. This is crucial for preventing smaller businesses from suffocating under the weight of unpaid bills.

It’s a direct response to liquidity issues hindering innovation and growth in the private sector – imagine needing to wait a year to get paid!

This move aims to improve cash flow and boost the competitiveness of the entire supply chain, effectively releasing capital tied up in overdue invoices.

Now, let’s dive into the stock-specific moves. Zhaojin Mining is planning a spin-off of its foreign subsidiary. Hainan Airport is acquiring a majority stake in Meilan Airport. Fudan Zhangjiang is slashing drug prices – a positive step for healthcare affordability.

The usual suspects are also present: Jiangbo Dragon faces potential share reduction from the National Integrated Circuit Industry Investment Fund, and Tianmao Group suspended trading due to disclosure delays (red flag!). And, unfortunately, Yong’an Pharmaceutical’s chairman is under investigation – let this be a lesson about compliance.

Finally, Cambricon is seeking nearly $700 million for AI chip development, while AVIC Avionics is selling stakes to its parent company. It’s a mixed bag, to say the least. As always, do your homework and remember, in this market, volatility is the only constant.