Alright, folks, let’s break down today’s market action. Asia absolutely charged higher, while Europe showed some cracks, and the US delivered a mixed bag. Don’t be fooled by the overall gains; volatility is still very much a factor.

Photo source:brucewilds.blogspot.com

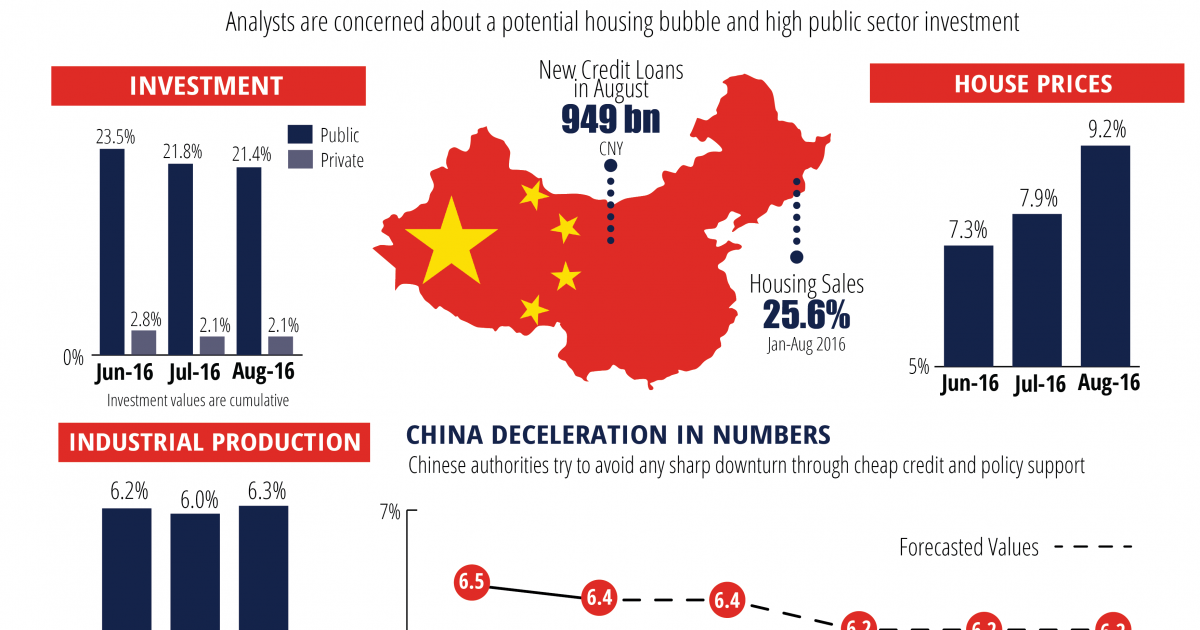

Let’s start with the good news: Chinese markets were on fire! The Shanghai Composite climbed 0.86%, the Shenzhen Component notched up 0.64%, and the CSI 300 jumped a solid 1.21%. The ChiNext and STAR 50 also saw gains, signaling a strong appetite for risk in the region. Hong Kong followed suit, with the Hang Seng soaring 2.3% and the Hang Seng Tech Index rising 2.13%. This is a clear signal of optimism taking hold in Asian economies.

Now, for the reality check. Europe? Not so much. The German DAX, FTSE 100, and French CAC 40 all closed in the red, dragging down the broader European Stoxx 50. Spain and Italy bucked the trend with modest gains, but the overall sentiment was decidedly cautious.

Across the pond, US markets were indecisive. The Dow Jones took a hit, falling 0.21%, while the S&P 500 managed a small gain of 0.10%. The Nasdaq was the clear winner, jumping 0.72%, showing tech’s continued resilience.

Let’s talk about indices a bit – a quick primer for those newer to the game:

First, understand that major indices (like the S&P 500 or Shanghai Composite) are weighted averages of stock prices. Their movement reflects the overall health of a market.

The CSI 300, a vital indicator, tracks the performance of the 300 largest companies listed on the Shanghai and Shenzhen stock exchanges. It’s a good gauge of China’s big players.

Then, you have the tech-focused indices like the Nasdaq and the Hang Seng Tech, influenced heavily by the performance of technology companies. Their strength signals innovation and growth potential.

Finally, don’t underestimate the importance of regional differences. Economic conditions, political factors, and investor sentiment all contribute to these variations. Stay informed, stay diversified, and don’t just follow the headlines!