Alright, folks, buckle up! We’re seeing a serious green wave across Asian chip stocks today, and the whispers on the street point to a major catalyst: a potential reversal of Biden’s AI chip restrictions under a possible Trump administration. Let’s break down the moves.

Japan is leading the charge. Tokyo Electron jumped 3%, Disco surged an impressive 6.5%, Screen gained 2.1%, Lasertec saw a 3.6% boost, and Advantest climbed 3.9%. Not to be left out, South Korea is joining the party with Hynix up 2.7%, Samsung climbing 1.7%, Wonik IPS adding 2%, and DB Hitek increasing 1.8%.

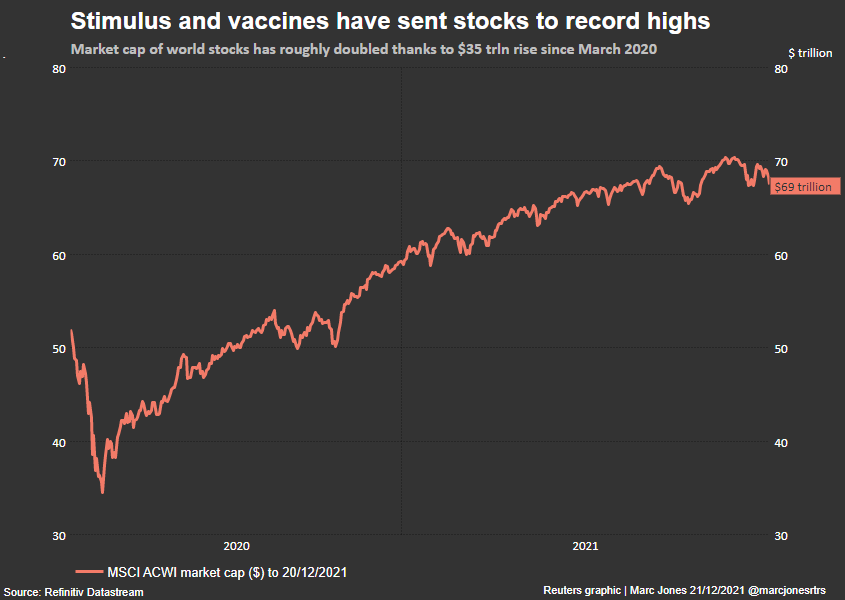

Even overnight, the Philadelphia Semiconductor Index saw a solid 1.7% gain, fueled particularly by Nvidia – up a hefty 3.1%. This isn’t just noise, people. This suggests real money is flowing back into the sector.

Let’s quickly unpack what’s driving this frenzy:

Firstly, the Biden administration imposed significant restrictions on the export of advanced chips and chipmaking equipment to China, aiming to slow Beijing’s technological advancement.

Secondly, sources indicate Trump is considering rolling back those restrictions. Why? Because he believes it unfairly hurts US companies and doesn’t truly impede China’s long-term progress. It’s a provocative stance, for sure.

Thirdly, the market hates uncertainty. A potential shift means predictable revenues for those key players involved in supplying the Chinese market again.

However, don’t go all-in just yet! This is based on “sources,” and a lot can change. But the market reaction tells us something crucial: investors are pricing in the possibility. We need to watch closely how this develops. Is this a short-term blip or the start of a more substantial rally? My gut says pay attention, especially to companies heavily exposed to the Chinese market. This could be a golden opportunity…or a trap. Tread carefully, and do your own research!