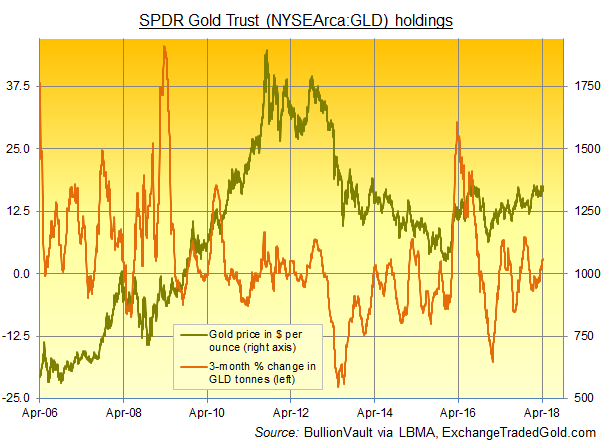

Friends, followers, gold bugs! Pay attention! The world’s largest gold ETF, the SPDR Gold Trust, just signaled a potential shift in sentiment. Yesterday, they added a solid 4.01 tonnes to their holdings, pushing the total to a hefty 923.89 tonnes. This isn’t just a number; it’s a tell.

Photo source:citygoldbullion.com.au

For weeks we’ve seen investors chase yield, flocking to risk assets. But the cracks are beginning to show. Rising geopolitical tensions, persistent inflation worries, and the ever-present threat of recession are driving a renewed interest in safe haven assets – and gold is the classic safe haven.

Let’s dive a bit deeper. The SPDR Gold Trust is a key barometer. Its holdings directly mirror investor appetite for physical gold. When investors are bullish, they buy; when they’re fearful, they sell.

Understanding Gold’s Allure:

Gold has historically served as a hedge against inflation. Its value often increases when the purchasing power of currencies declines. It’s a store of value, relatively immune to the whims of central banks and government policy.

Furthermore, gold has always been seen as a safe haven during periods of economic uncertainty. Global instability and market volatility often lead investors to seek the safety and liquidity of gold.

The 4.01-tonne increase suggests a concerning mood among institutional investors. They’re not panicking yet, but they ARE positioning for potential downside. This is a signal we can’t ignore. Don’t be caught flat-footed. Prepare for a possible rally in the precious metal – and potentially, a rougher patch for risk assets.