Alright, folks, let’s talk about what’s really happening in the market. We’ve just seen a notable dip in margin financing – a collective decrease of 7.43 billion yuan across both Shanghai and Shenzhen exchanges as of May 23rd. Shanghai saw a reduction of 2.06 billion yuan, while Shenzhen experienced a more significant pull-back of 5.36 billion yuan, bringing the total outstanding margin debt to 17.83878 trillion yuan.

Now, what does this mean? It’s rarely a simple answer, but it’s a temperature check on investor sentiment. Less leverage being used suggests caution. Are investors starting to think twice about piling into positions? Possibly. Or, it could simply be a tactical repositioning as we navigate this tricky market environment.

Let’s dive a little deeper into what margin trading actually is. Essentially, it’s borrowing money from your broker to buy stocks. It amplifies both potential gains and losses. Think of it like using a magnifying glass – it makes the good stuff bigger, but also the bad.

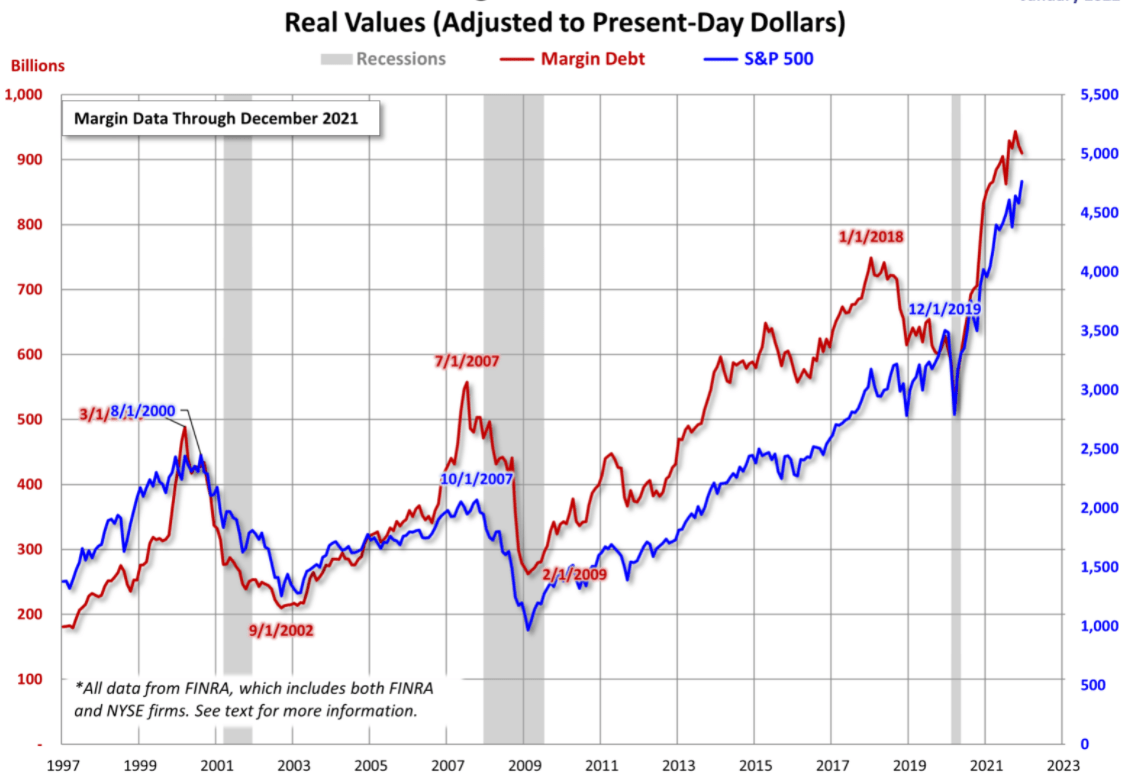

Margin debt levels are often seen as a contrarian indicator. When debt is climbing rapidly, it can signal exuberance, and a potential correction. Conversely, a decline like this could suggest investors are de-risking.

Here’s a quick look at how margin trading works:

Margin trading involves borrowing funds from a brokerage to increase potential investment returns.

It’s a powerful tool, but carries substantial risk due to leverage.

Regulation around margins is strict, with maintenance requirements to prevent excessive losses.

The total margin balance reflects the aggregated borrowing used by investors.

Monitoring changes in margin debt can provide insight into market sentiment and potential near-term trends.

Don’t mistake this drop for a definitive “sell” signal, but it’s a data point we absolutely need to be paying attention to. The market is complex, and we need to be prepared for volatility. Stay vigilant, folks!