Alright, folks, let’s talk about something crucial happening under the surface of the market. Today, we’re seeing a pullback in margin debt. As of May 22nd, Shanghai Stock Exchange margin financing balance clocked in at 9075.36 billion yuan, down 11.37 billion yuan from the previous day. Shenzhen isn’t far behind, with a decrease of 9.72 billion yuan, bringing its total to 8837.72 billion yuan.

Combined, both exchanges witnessed a reduction of 21.09 billion yuan in margin debt. Now, before you panic, let’s break down what this actually means.

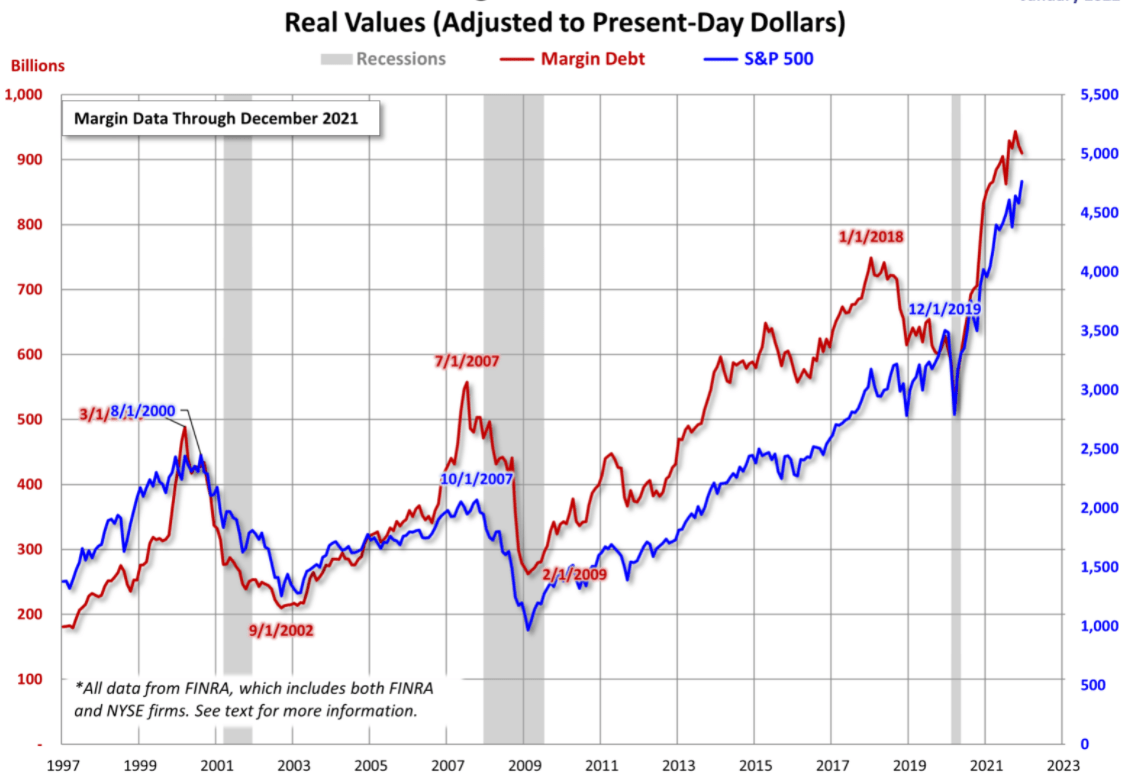

Margin trading, for those unfamiliar, allows investors to borrow money from brokers to buy stocks. It amplifies both potential gains and losses. A decrease in margin debt can signal a few things.

Firstly, it could indicate investors are de-leveraging – reducing their risk exposure by paying down their borrowed funds. This is often a healthy sign, representing a bit of prudence in an often-irrational market.

However, it can also be a sign of dwindling confidence. If investors are forced to sell to cover margin calls (when their positions fall below a certain value), this can accelerate a downturn. We need to watch closely if this trend continues.

Think of it like this: margin debt is fuel for the market. Less fuel means less potential for explosive growth, but also potentially less intensity to the fall. This decrease feels more like cautious de-risking than outright panic, but vigilance is key. Keep a close eye on this number; it’s a pulse check on investor sentiment.