Alright folks, let’s break down what’s happening in the market. We just got the numbers – margin debt across Shanghai and Shenzhen exchanges decreased by a substantial 2.862 billion yuan yesterday, May 15th. That’s a noteworthy pullback.

Specifically, Shanghai saw a reduction of 1.156 billion yuan, leaving the total at 908.349 billion yuan. Shenzhen’s margin balance dropped by 1.706 billion yuan, now standing at 882.977 billion yuan. Combined, the total margin debt sits at 17.913 trillion yuan.

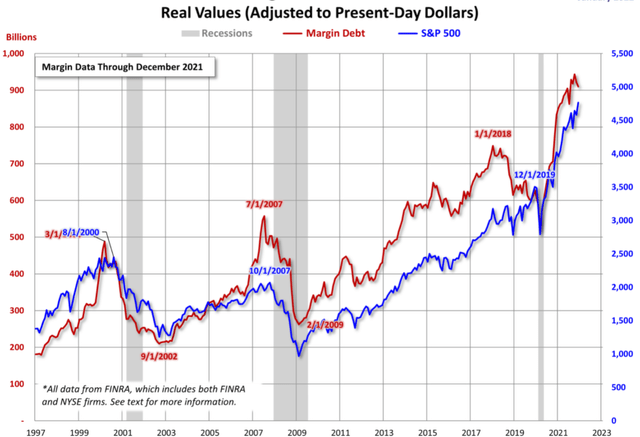

Now, what does this mean? It’s a sign that investors are becoming more cautious, folks. Less money is being borrowed to fuel purchases. While not a definitive predictor of a market downturn, it’s a yellow flag we need to acknowledge.

Let’s delve deeper into margin trading:

Margin trading allows investors to borrow funds from brokers to increase their purchasing power. It amplifies both potential gains and losses. It’s a powerful tool, but it’s also inherently risky.

The amount of margin debt outstanding is often viewed as a sentiment indicator. Rising levels suggest optimism and a willingness to take on risk. Declining levels, like we’re seeing now, indicate increasing hesitance.

It’s critical to understand that margin trading isn’t for the faint of heart. Unexpected market movements can trigger margin calls, forcing investors to sell assets at potentially unfavorable prices.

Furthermore, these trends often tie into broader macroeconomic conditions and sentiment towards specific sectors. Keep a close watch on fund flows and economic data to gain a more complete picture.