Alright folks, let’s talk iron ore. The price has absolutely tanked, hitting a six-month low! And let me tell you, it’s not a pretty sight. We’re seeing a confluence of factors here, and it’s making even seasoned traders sweat.

The primary driver, as always, is demand. Or, more accurately, the lack of it. China, the world’s iron ore behemoth, is showing signs of slowing down. Construction is sluggish, and the property sector continues to be a mess – a seriously messy situation, honestly.

But wait, there’s more! Geopolitical tensions are adding fuel to the fire. Trade disputes are brewing, and that’s creating serious uncertainty. Nobody wants to be caught holding the bag when the music stops. This isn’t some minor squabble, either – it’s potentially a game-changer.

Now, let’s dive a little deeper into why iron ore matters. It’s the cornerstone of steel production, and steel is the backbone of modern infrastructure. Global economic health is deeply interlinked with its price.

Understanding iron ore’s supply-demand dynamics is crucial. Major producers like Australia and Brazil have significant influence. Changes in their production levels, or even disruptions due to weather events, can ripple through the entire market.

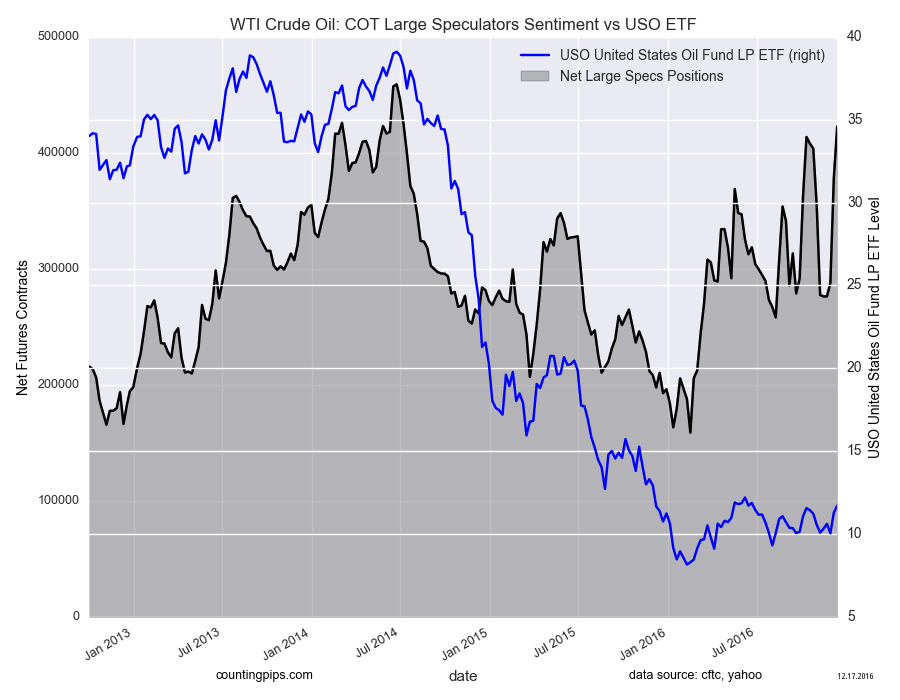

And then there’s the futures market. It’s a crazy beast, full of speculation and leverage. Right now, it’s screaming caution. Keep a close eye on inventory levels at Chinese ports, that’s a key indicator.

So, where do we go from here? Honestly, it’s tough to say. A short-term bounce is possible, but the underlying headwinds are strong. I’m leaning towards further downside. This could be a good opportunity for patient investors, but be prepared for volatility – lots of it. Don’t go all-in, but a cautiously optimistic dip-buy strategy might be worth considering. Just remember: do your own damn research!