Friends, buckle up! The latest data from the Commodity Futures Trading Commission (CFTC) is flashing a warning sign for natural gas bulls. As of the week ending April 15th, we’ve seen a substantial pullback in net long positions on NYMEX and ICE exchanges – a whopping 30,684 contracts evaporated, bringing the total net long positions down to 226,207 contracts. What does this really mean? It suggests a cooling in bullish sentiment.

Let’s break it down. These ‘net long positions’ represent the difference between bets that prices will rise versus bets that they’ll fall. A decrease signifies more traders are either closing their long positions (taking profits) or, crucially, opening short positions (betting on a price decline).

This doesn’t necessarily scream ‘crash,’ but it’s a clear signal that the market is becoming more cautious. We’ve enjoyed a decent run-up in natural gas, fueled by storage concerns and geopolitical uncertainties, but this data reflects a growing belief that the upside might be limited – at least in the short term.

Digging Deeper: Understanding CFTC Commitment of Traders Reports

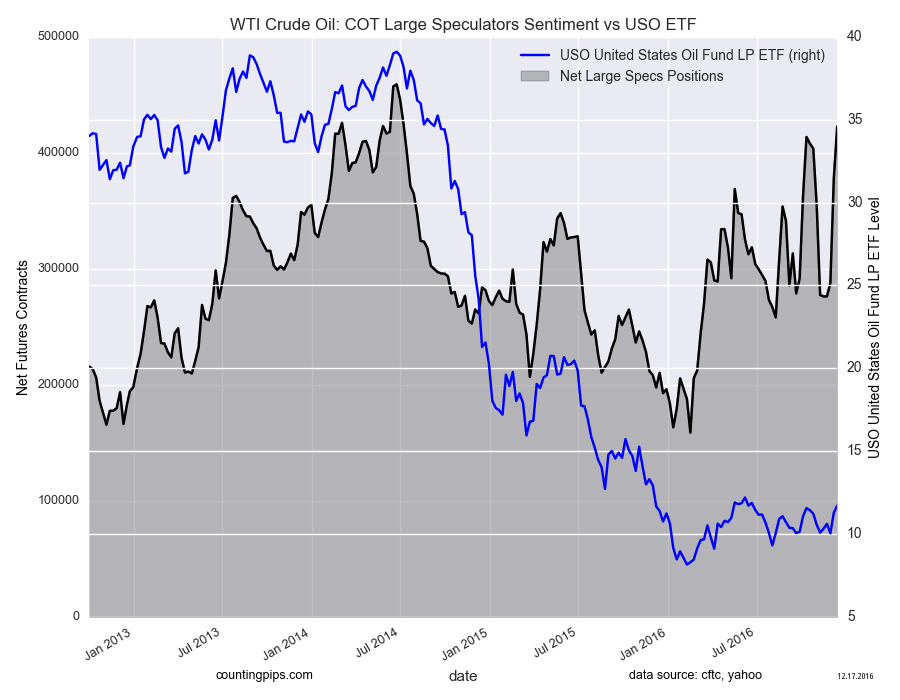

The CFTC’s Commitment of Traders (COT) reports are a critical tool for understanding market positioning. They provide a snapshot of how different types of traders – from commercial hedgers to large speculators – are positioned in various futures markets.

Commercial traders, typically companies that produce or consume the underlying commodity, tend to take positions to hedge their price risk. Speculators, on the other hand, are betting on price movements. Monitoring the net positioning of these different groups can offer valuable clues about market direction.

A significant reduction in net longs, as we’re seeing with natural gas, warrants close attention. It suggests that even some of the bullish speculators are starting to question the rally’s sustainability. It’s time to manage your risk!