S&P 500 speculative positioning surged to 805,062 contracts. This extreme bullishness could hint at a looming market...

CFTC

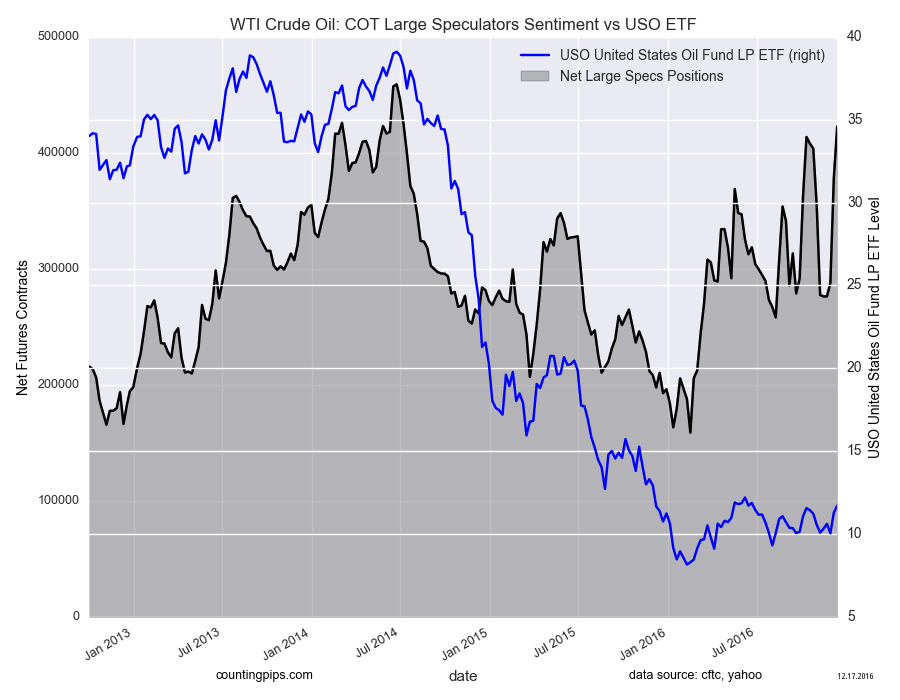

Speculators aggressively increased their bullish bets on WTI crude oil, pushing net long positions to 76,370 contracts....

Speculators are aggressively increasing their short positions in US Treasury futures, signaling a bearish outlook on bond...

The latest CFTC report reveals a surge in Yen bullishness, a stable Euro position, a concerning dip...

S&P 500 speculators reduced their short positions last week, but a large net short of 239,649 contracts...

CFTC data reveals a significant decrease in natural gas net long positions, signaling a potential shift in...

Gold speculators are pulling back! CFTC data shows a significant decrease in net longs as of April...

CFTC data reveals wheat specs are cautiously covering shorts, but corn and soybean shorts are surging to...