Alright folks, buckle up, because the palm oil market just took a hit! Yesterday’s rally? Gone. Vanished. Wiped out faster than my patience with bad market analysis. We’re seeing palm oil futures retreat, and frankly, it’s no surprise.

The culprit? A toxic combination of escalating trade tensions and a bloody nose for crude oil. When oil tanks, everything feels the pain, and edible oils are absolutely no exception. They’re all dragging their feet downwards.

Seriously, this isn’t pretty. The market’s acting like a bunch of panicked gamblers, and frankly, until we get some clarity on these trade disputes – and a bottom in oil – things could get uglier. Don’t let anyone tell you otherwise.

Let’s dig a little deeper:

Palm oil prices are highly sensitive to both global economic conditions and the performance of competing vegetable oils. A slowdown in major economies, like those threatened by trade wars, reduces demand.

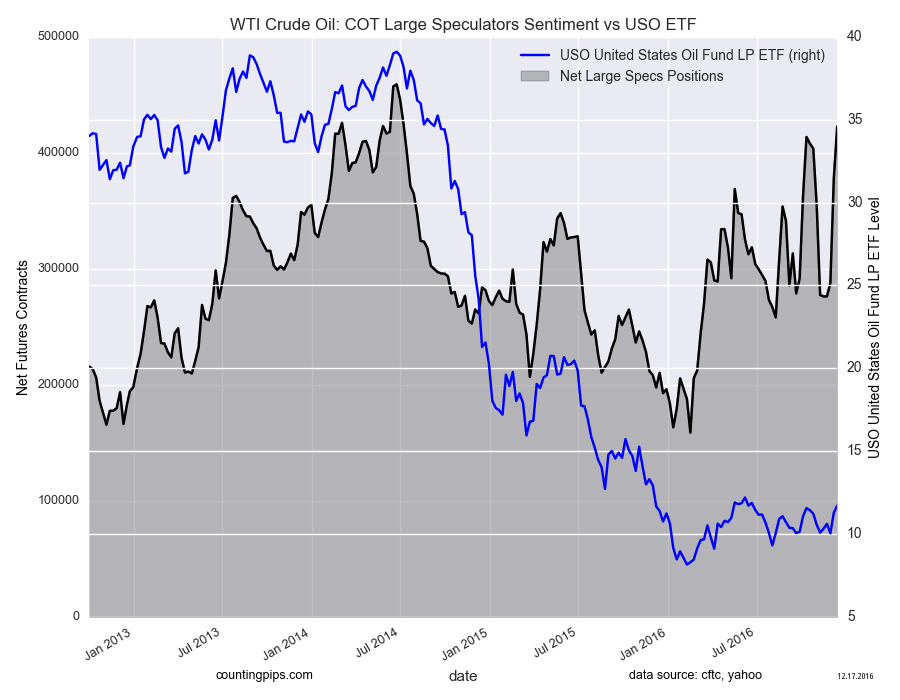

Crude oil’s influence stems from its role in biodiesel production. Lower oil prices incentivize biodiesel production, increasing the demand for alternative feedstocks like palm oil, though this effect isn’t always straightforward.

Trade disputes create uncertainty and disrupt supply chains. For palm oil, major players like Indonesia and Malaysia are directly affected. Protectionist policies and tariffs can significantly impact export volumes.

Finally, remember the fundamental principle: correlated markets move together. When broader commodities fall, palm oil rarely stands alone, regardless of its underlying fundamentals.