Alright folks, hold onto your hats! Brent crude just took a massive hit, tanking a stomach-churning 5.00% today to hit $66.12 a barrel. Let that sink in. This isn’t just a dip; it feels like a damn freefall.

What’s driving this bloodbath? Honestly, it’s a cocktail of anxieties. Global economic slowdown fears are mounting, particularly with China’s recovery looking increasingly shaky. Demand concerns are swirling like a hurricane, people.

Let’s talk fundamentals, shall we? Oil is fundamentally tied to economic activity. When economies slow down, demand for oil drops. It’s basic supply and demand, folks.

Furthermore, increased US oil production is adding to the supply side pressure. They’re pumping out the black gold like there’s no tomorrow.

And here’s a little knowledge for you, because I know you appreciate a sprinkle of financial wisdom with your panic:

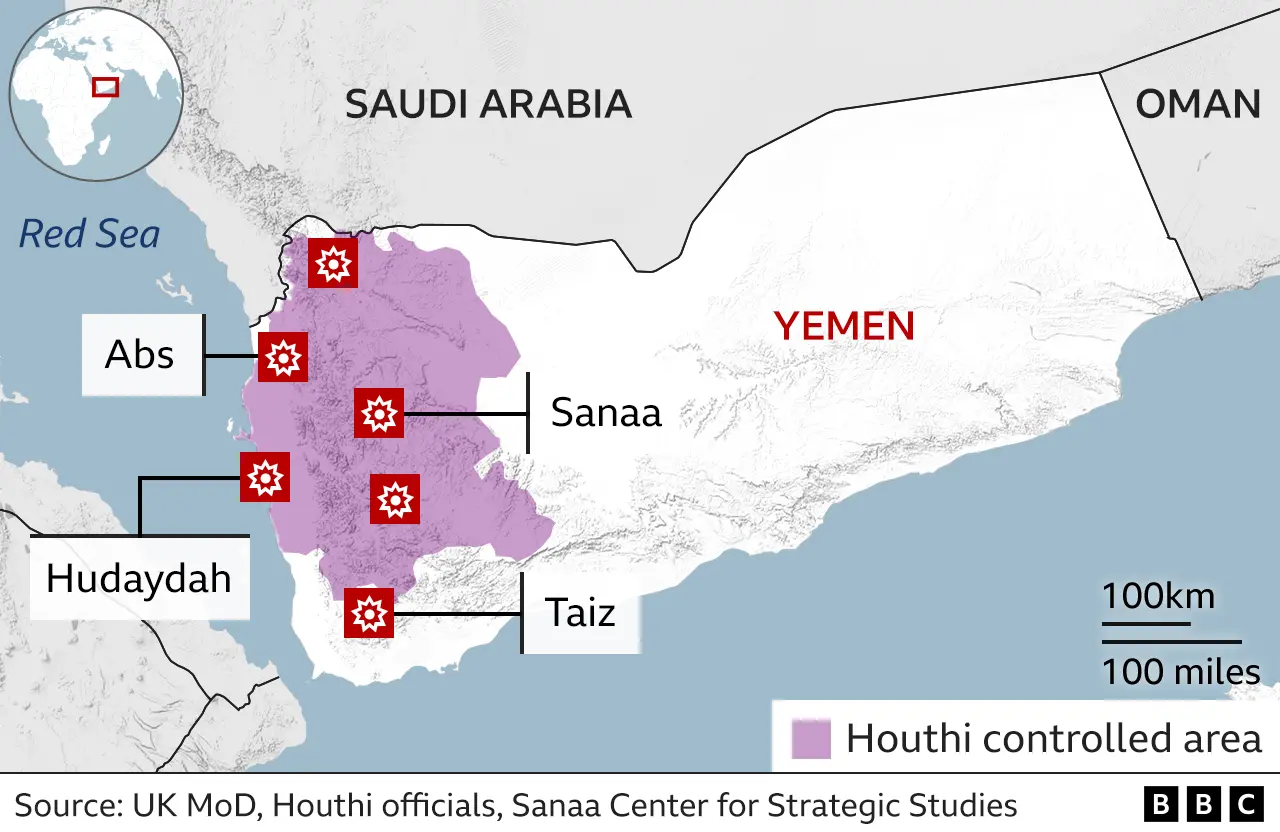

Oil pricing is a complex game. It’s not just about barrels of oil; it’s about geopolitical risk, speculative trading, and even weather patterns. Consider the impact of OPEC+ decisions, which significantly influence supply levels.

Understanding Brent crude’s role as a global benchmark is crucial. It’s priced in US dollars, making its value sensitive to dollar fluctuations. A stronger dollar typically means cheaper oil for those using other currencies.

Volatility is inherent in oil markets. Events like war, political instability, or unexpected economic shifts can cause rapid price swings, and the current situation displays that.

Finally, don’t forget about inventory levels. High inventory signals a potential price decline, while low levels can indicate tightening supply and possible price increases.

Is this a buying opportunity? Maybe. But be careful, my friends. This could get uglier before it gets better. Don’t chase falling knives!