Hold onto your hats, folks, because the oil market just took a serious beating! Brent crude oil tanked a whopping 5.00% today, currently trading at a shockingly low $66.12 a barrel. This isn’t just a dip, this is a freakin’ dive!

What’s going on? Well, several factors are at play. Fears of a global economic slowdown are mounting, naturally dampening demand expectations. When the economy coughs, oil demand sneezes.

Let’s talk specifics. The market’s increasingly worried that major economies like the US and China might be heading for recessions. Slower growth means less industrial activity, and less activity means fewer trucks, planes, and factories burning fuel. Simple as that.

We’re also seeing increased speculation about the potential for further interest rate hikes by central banks, which will almost certainly put further pressure on economic expansion. This is not something to ignore, trust me.

Let’s dive a little deeper into understanding crude oil price dynamics.

Crude oil pricing isn’t arbitrary. It’s fundamentally driven by supply and demand. When demand exceeds supply, prices soar. Conversely, when supply outstrips demand, prices fall.

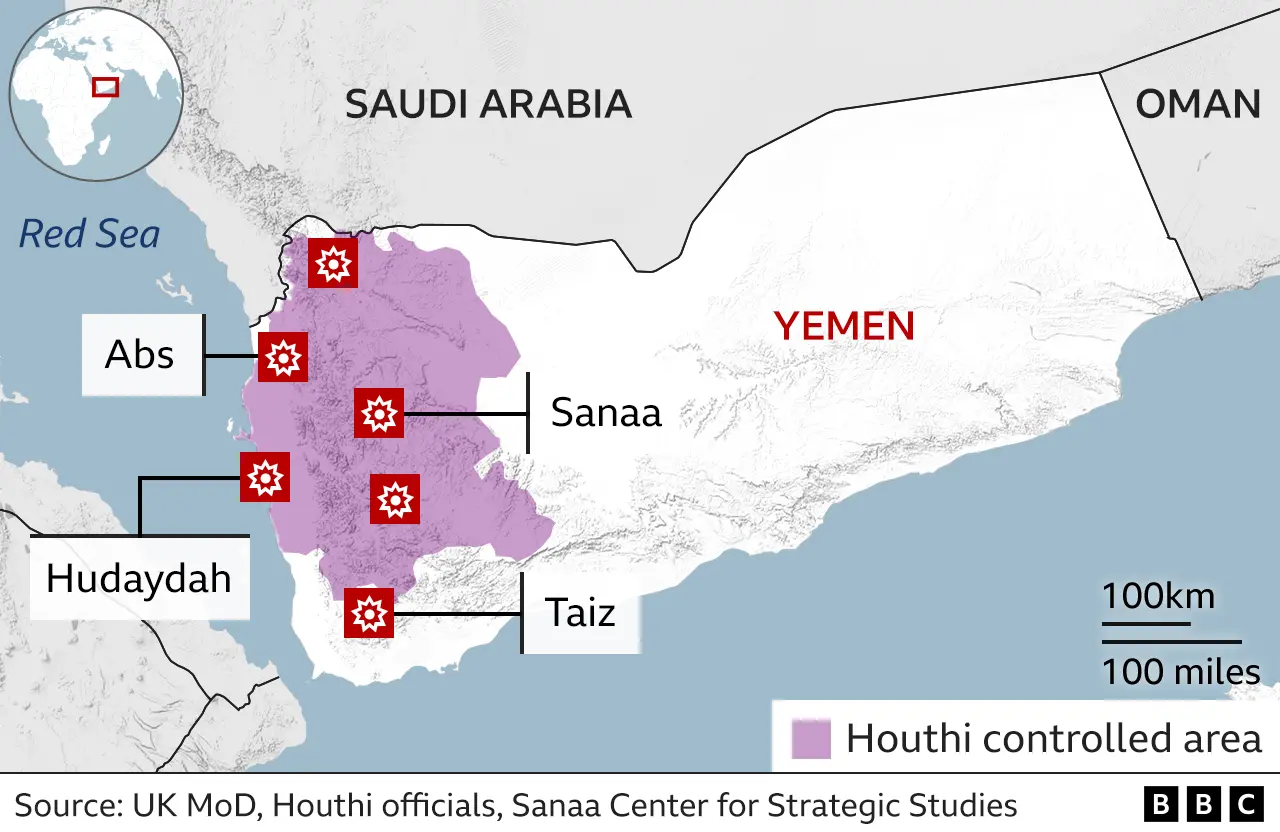

Geopolitical events are also crucial catalysts. Wars, political instability, and even OPEC+ decisions can dramatically shift the supply landscape. Anything that disrupts production sends prices spinning.

Finally, investor sentiment plays a significant role. Fear and greed can amplify market movements, creating volatile swings in prices. Right now, fear is definitely winning.

So, where do we go from here? Honestly, it’s a bit murky. Red alert for energy sector investors. Buckle up, it could be a bumpy ride!