Alright folks, buckle up because the bond market is sending a seriously ominous signal! The yield on the 2-year US Treasury note just kept sliding, hitting 3.5205% – the lowest level we’ve seen since September 2022. Let that sink in. This isn’t just some technical blip, this is a freaking warning flare.

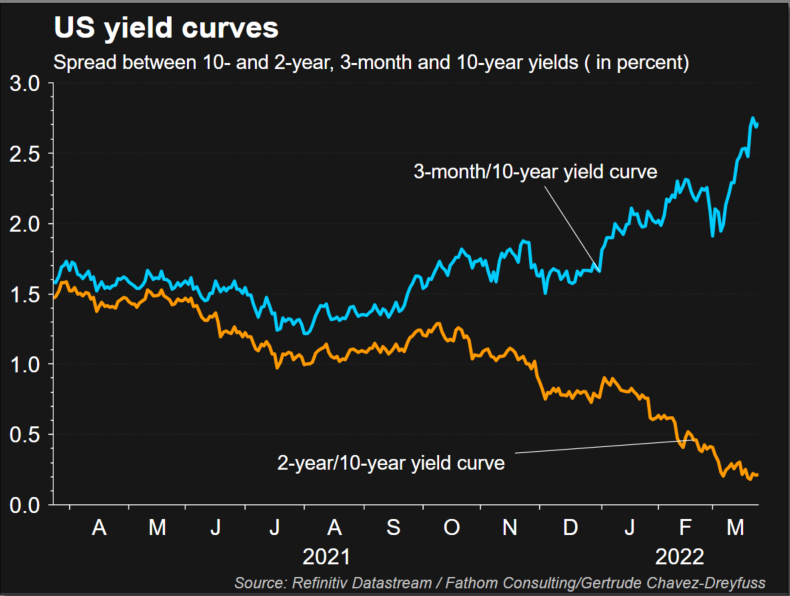

What does this even mean? Well, the 2-year Treasury is incredibly sensitive to expectations about future Federal Reserve policy. A falling yield suggests investors are betting the Fed will have to cut interest rates sooner rather than later – and that usually only happens when the economy is slowing down, or frankly, heading for a recession.

Here’s a quick breakdown for those playing catch-up:

Treasury yields represent the return an investor receives for holding a US government bond. They move inversely to bond prices – when demand for bonds rises (likely during economic uncertainty), prices go up, and yields fall.

The 2-year Treasury is particularly focused on short-term economic expectations. It reflects what the market thinks the Fed will do in the next couple of years.

A steep decline in the 2-year yield, as we’re seeing now, often foreshadows economic weakness. It’s like the market is saying, “The Fed’s gonna have to bail us out soon!”

Now, some will try to spin this as a ‘soft landing’ scenario, but come on. Don’t buy the hype. The Fed has been relentlessly hiking rates for over a year and the lagged effects are finally starting to bite. This yield curve action is screaming that they might be about to panic and reverse course.

Honestly? I’m starting to think Powell’s a bit of a gambler, and he’s running out of chips. This whole situation is a powder keg, and it’s gonna be a wild ride.