Good morning, traders! The domestic futures market kicked off with a seriously mixed bag this morning. Let’s cut through the noise and get straight to what matters. Alumina is absolutely rocketing – up over 6%! Seriously, that’s a move that demands attention. We’re also seeing decent gains in pulp, asphalt, gold (both Shanghai and standard), and soda ash, all pushing past the 1% mark.

But hold on, it’s not all sunshine and roses. The energy sector is getting slammed, with coking coal, rubber, and soda ash leading the decline, all down over 1%. And don’t even get me started on copper – international and Shanghai contracts are both taking a nearly 1% hit, along with nickel.

Here’s a quick breakdown for those new to the game:

Futures contracts are agreements to buy or sell an asset at a predetermined price at a specified time in the future. They’re used for hedging risk or speculating on price movements.

Alumina’s surge often indicates strong demand from the aluminum smelting industry, reflecting broader economic activity. Keep a close eye on this one – it could signal things to come.

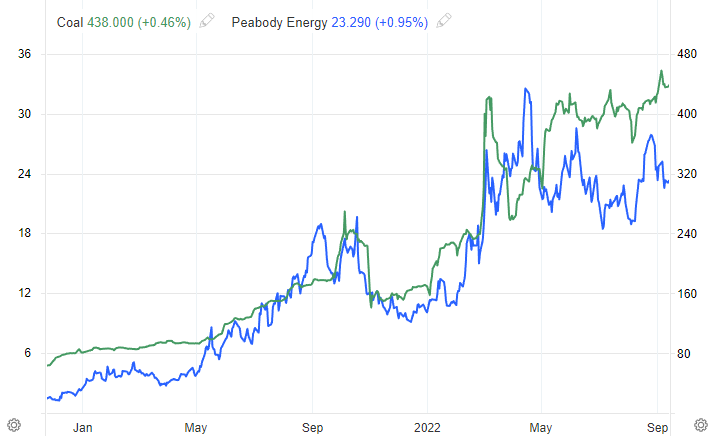

Coal’s drop, especially coking coal, frequently correlates with concerns about industrial output and potential softening in steel demand. This is a warning sign for that sector.

Commodity prices are notoriously volatile. Understanding these micro-movements is crucial for navigating the market – and protecting your capital. Don’t just react, understand.

This volatility highlights the complex interplay between supply, demand, and global economic sentiment. We need to monitor these trends closely throughout the day. Don’t just blindly follow the herd – do your research!