Let’s be real, folks. The metal sector is quietly staging a comeback, and Citics Securities just dropped a research report highlighting where the real money is going to be made. We’re looking at steady earnings growth through the first quarter of 2025, but it’s not a rising tide lifting all boats.

Photo source:www.milkenreview.org

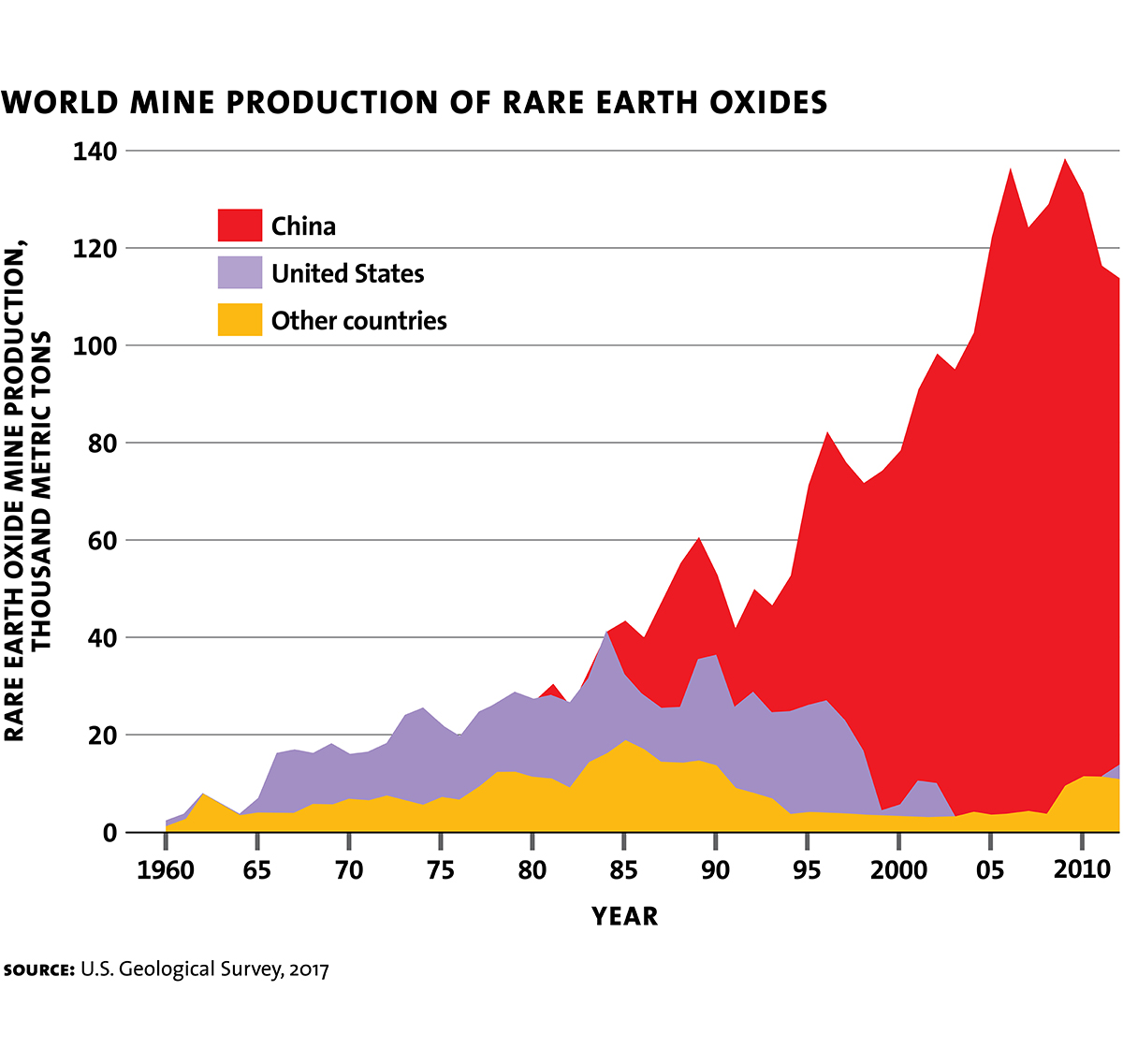

Gold, rare earths, copper, and a select few others are leading the charge, while battery metals are…well, let’s just say they’re struggling to get off the ground. Valuations are still sitting pretty low across the board, especially in aluminum, copper, and the nickel-cobalt-tin-antimony space – a setup ripe for a major correction upwards.

And here’s something to really get excited about: dividends are improving! We’re seeing some stocks yield over 5%, meaning companies are sharing the wealth with their shareholders. That’s the kind of action I like to see.

Now, looking ahead to the second half of 2025, things get interesting. With trade tensions brewing and the potential for easing monetary and fiscal policy, we need to be strategic. This is where the spotlight truly shines on gold, rare earths, copper, aluminum, tin, and tungsten. Don’t sleep on these names!

Digging Deeper: Resource Allocation & Macro Trends

First, understanding the cyclical nature of commodity markets is key. Profitability typically follows economic cycles, with metals performing strongly during periods of growth.

Second, geopolitical risks – like ongoing trade disputes – drive demand for safe haven assets like gold and strategic metals essential for technology and defense, like rare earths.

Third, shifting policy orientations around liquidity and fiscal stimulus heavily impact demand and investment in the resource sector, opening up opportunities for strategic allocation.

Finally, the focus on shareholder returns through dividends signals increased confidence from metal companies, showing they believe their future earnings are sustainable. Don’t ignore!