The Federal Reserve just dropped its semi-annual Financial Stability Report, and let me tell you, it’s a chilling read. Forget about rosy economic forecasts; the Fed is screaming about a cocktail of risks that could seriously destabilize the financial system.

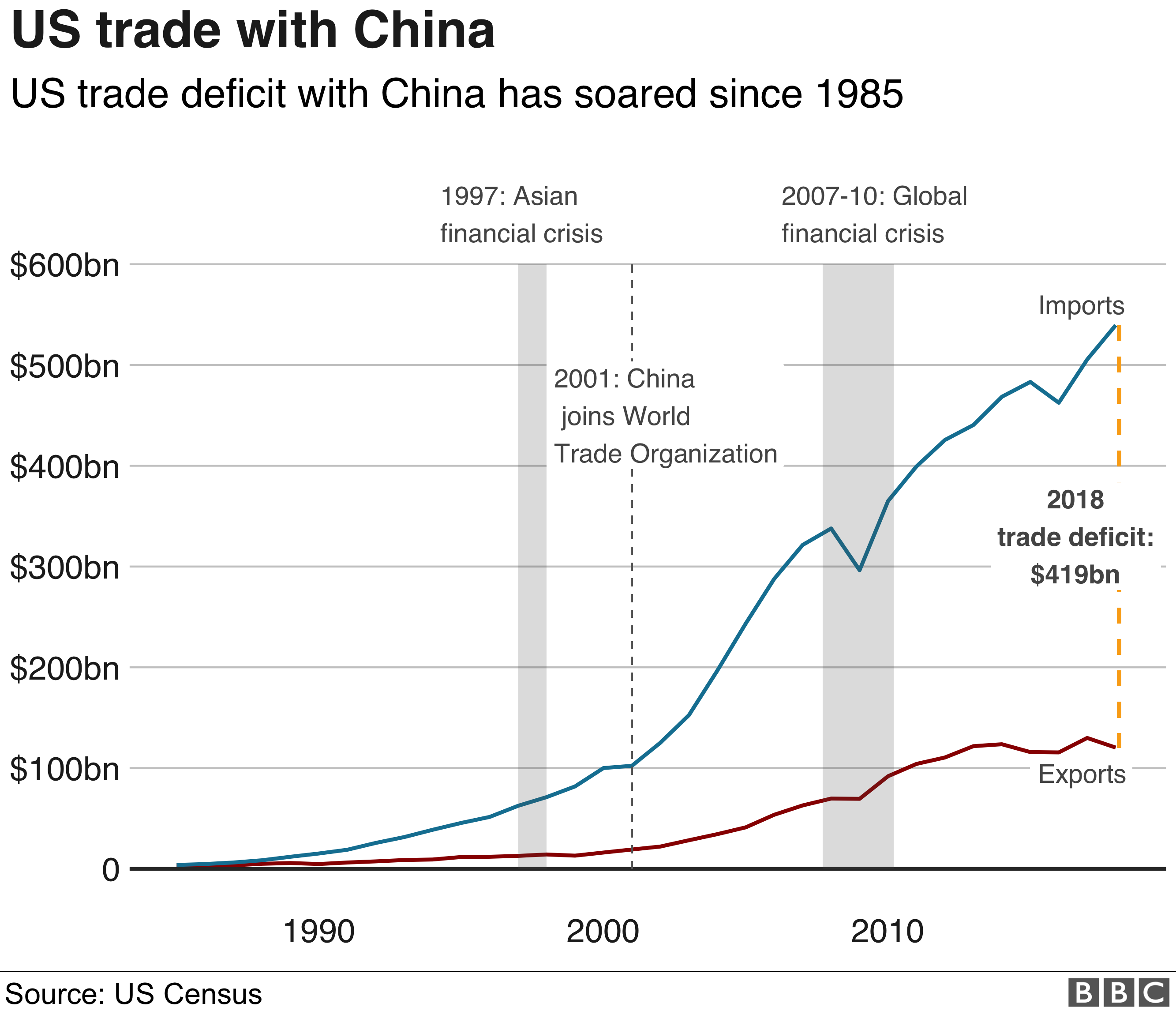

The biggest worry? A surging tide of global trade wars and a deeply unsettling level of policy uncertainty. This isn’t some academic debate – 73% of respondents to the Fed’s survey flagged global trade risks as their top concern. That’s more than double the anxiety level from just six months ago!

And it’s not just trade. Half of those surveyed are losing sleep over overall policy uncertainty, a jump from last year. We’re talking about Washington’s unpredictable moves, shifting regulations, and the sheer chaos stemming from prolonged political battles. Frankly, it’s a mess.

But wait, there’s more. The report reveals growing fears about the smooth functioning of the US Treasury market, with 27% of respondents expressing concern – a significant increase from 17% last fall. Capital flight from US assets and the shifting value of the dollar are also raising red flags.

Let’s quickly break down why this matters.

Trade wars disrupt global supply chains and stifle economic growth, leading to corporate earnings declines and market volatility. This is basic economics, people.

Policy uncertainty breeds investor hesitation, reducing capital investment and slowing down economic activity. No one likes to gamble when the rules keep changing.

The US Treasury market is the bedrock of the global financial system. Any dysfunction there could have cascading effects – think 2008, but potentially worse.

Finally, a weakening dollar could trigger a wave of inflation, eroding purchasing power and complicating the Fed’s already tricky job.

The bottom line? The Fed is sounding the alarm. These aren’t theoretical risks; they’re very real threats to financial stability. Prepare for potential turbulence ahead.