Alright, folks, let’s cut through the noise. Today’s data shows margin debt – that’s the money investors are borrowing to buy stocks – increased by a solid 4.686 billion yuan across both Shanghai and Shenzhen exchanges yesterday. Shanghai saw a 2.492 billion yuan increase, while Shenzhen added 2.194 billion yuan, bringing the total to a hefty 17.88563 trillion yuan.

Photo source:www.investing.com

Now, what does this really mean? On the surface, it suggests a bit more confidence is creeping back into the market. Investors are willing to leverage up, meaning they think prices will continue to rise. But let’s not get carried away. Remember, margin debt is a double-edged sword. It amplifies gains, and losses.

Let’s break down margin financing a bit:

Margin financing allows investors to borrow funds from their brokers to purchase securities. This essentially magnifies potential returns, but also increases risk. It’s like using a financial lever.

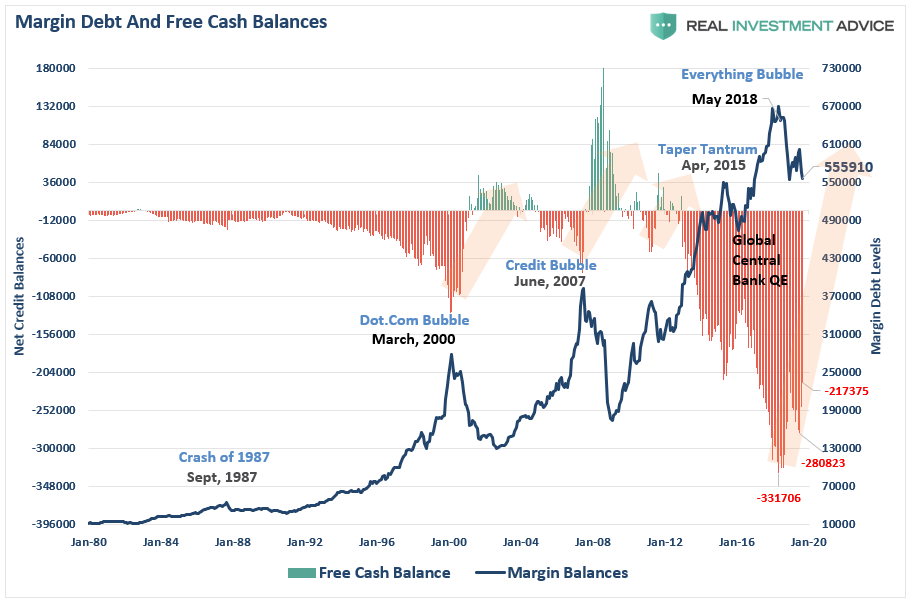

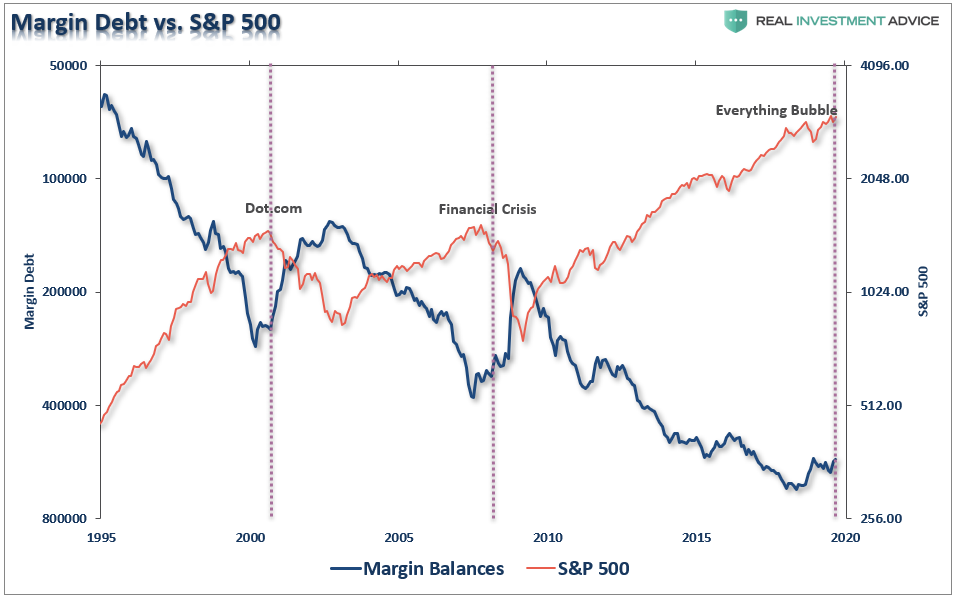

Increased margin debt can indicate rising investor optimism, fueling further market rallies. However, it can also be a sign of excessive risk-taking and a potential bubble.

When the market reverses, margin calls happen, forcing investors to sell assets to cover their loans, accelerating the downturn. This can create a vicious cycle.

Historically, a rapid increase in margin debt has often preceded market corrections. So, while this increase could be bullish, it’s a crucial signal to remain cautious, manage risk, and don’t chase this market blindly. Don’t let greed dictate your decisions. We’ve seen this movie before, and it rarely ends well for the latecomers. Keep your eyes peeled, and protect your capital.