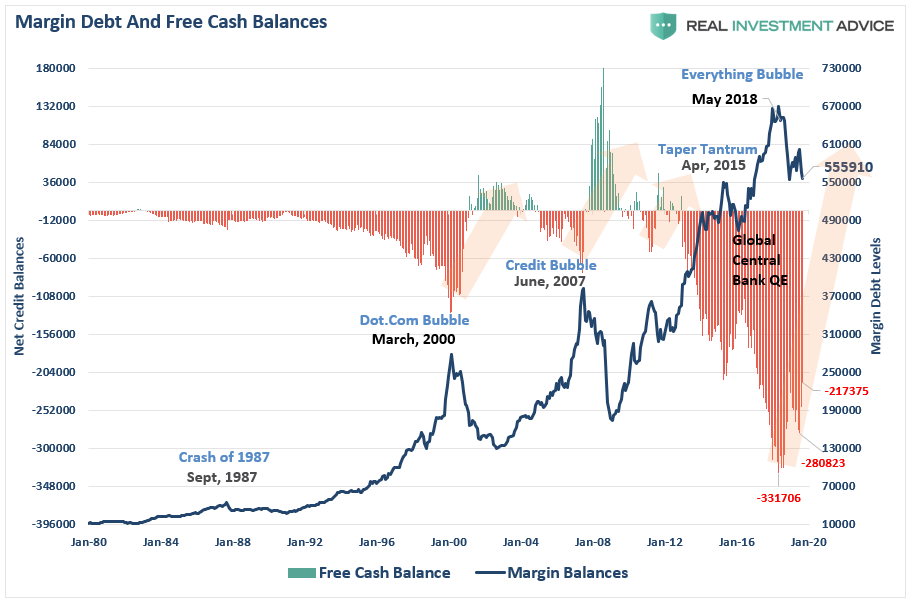

Friends, let’s talk about what’s really happening in the market. We’ve just seen a notable increase in margin debt – a cool 4.358 billion yuan across both Shanghai and Shenzhen exchanges as of yesterday, May 27th. Shanghai saw a 2.265 billion yuan increase, while Shenzhen jumped by 2.093 billion yuan, bringing the total to a hefty 17.929 trillion yuan.

Now, what does this mean? It’s a double-edged sword, folks. On the one hand, it can signal growing investor confidence—people are willing to borrow to buy, believing prices will continue to climb. But let’s be real: excessive margin use is a huge risk. It amplifies both gains and losses.

Let’s dive a little deeper into margin trading. Essentially, margin trading allows investors to leverage their capital. Think of it like buying a house with a mortgage. You’re controlling a larger asset with a smaller upfront investment. This is where the potential for higher returns comes in.

However, if the market turns south, those leveraged positions can quickly become a nightmare. Margin calls—demands from brokers to deposit more funds—can force investors to sell at unfavorable prices, exacerbating the downward spiral. That risk is real and it’s increasing.

Keep in mind, a rising margin balance doesn’t automatically mean a crash is imminent. It’s just one piece of the puzzle. But it’s a piece we absolutely need to pay attention to. We need to monitor this closely to see if it is a signal of sustained bullish conviction or building fragility within the market. We will continue the analysis in the following videos.