Friends, let’s talk about something that’s quietly brewing under the surface – margin debt. Data out today, May 21st, shows that total margin financing balance across the Shanghai and Shenzhen exchanges increased by a collective 21.88 billion yuan. While not a massive jump, it’s a concerning trend, especially given the recent market volatility.

Let’s break down the numbers: Shanghai Stock Exchange margin debt decreased slightly by 0.55 billion yuan, closing at 909.602 billion yuan. Shenzhen, however, saw a significant increase of 22.43 billion yuan, reaching 885.61 billion yuan. The combined 17.95212 trillion yuan figure signals a growing appetite for leveraged positions.

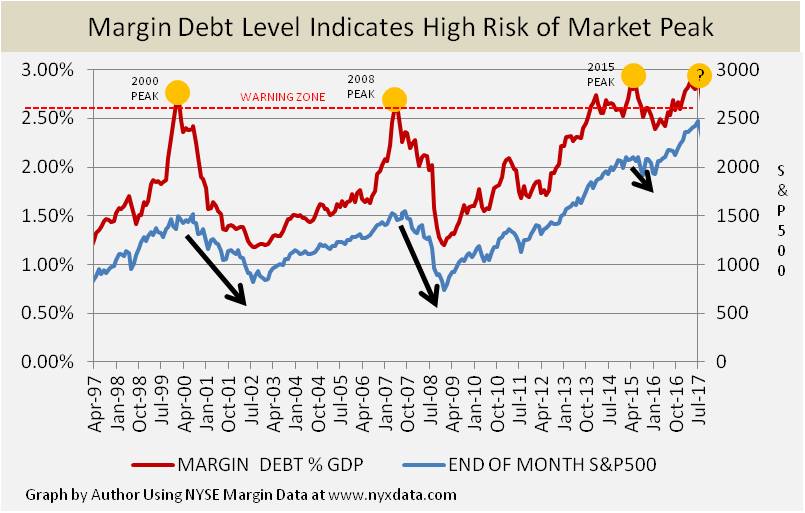

Now, why should you care? Because rising margin debt often foreshadows a potential correction. It indicates investors are becoming increasingly reliant on borrowed money to participate in the market.

Here’s a quick primer on margin financing:

Margin financing allows investors to borrow funds from their brokers to increase their purchasing power. It can amplify gains…but also significantly magnify losses. Think of it as turbocharging your portfolio – potentially faster returns, but a much higher risk of burnout.

When the market turns south, margin calls kick in, forcing investors to sell assets to cover their loans. This selling pressure can exacerbate a downturn, creating a vicious cycle.

Historically, a rapid increase in margin debt has often been followed by a market pullback. We’re not saying this is a guarantee, but it’s definitely a red flag we need to monitor closely. Watch your positions, manage your risk, and don’t get caught overextended. The market doesn’t wait for anyone. Don’t chase returns with borrowed money; prudence is key.

This incremental increase, while seeming minor, showcases a persistent willingness to leverage. This is occurring despite persistent economic uncertainty, which is frankly, a bit unsettling. I’m keeping a very close eye on this.