Look, folks, the Shanghai Gold Exchange is sending a very clear signal this morning. Gold for immediate delivery (T+D) just ripped higher, jumping nearly 1% to 776.0 yuan per gram. Silver isn’t lagging behind either, climbing 0.84% to 8268.0 yuan per kilogram.

Photo source:www.marketwatch.com

This isn’t just noise. This is a potent move in a market that’s been bracing for something…and I think we’re starting to see what that something is.

Let’s break down what’s happening underneath the surface.

Firstly, understanding ‘T+D’ is crucial. ‘T+D’ stands for ‘transaction day plus delivery’. This means settlement and physical delivery happen on the day following the trade, making it a crucial benchmark for physical demand.

Secondly, the Chinese market isn’t always perfectly correlated with western markets, but it is a leading indicator of physical demand, especially for silver. China is a massive consumer of precious metals.

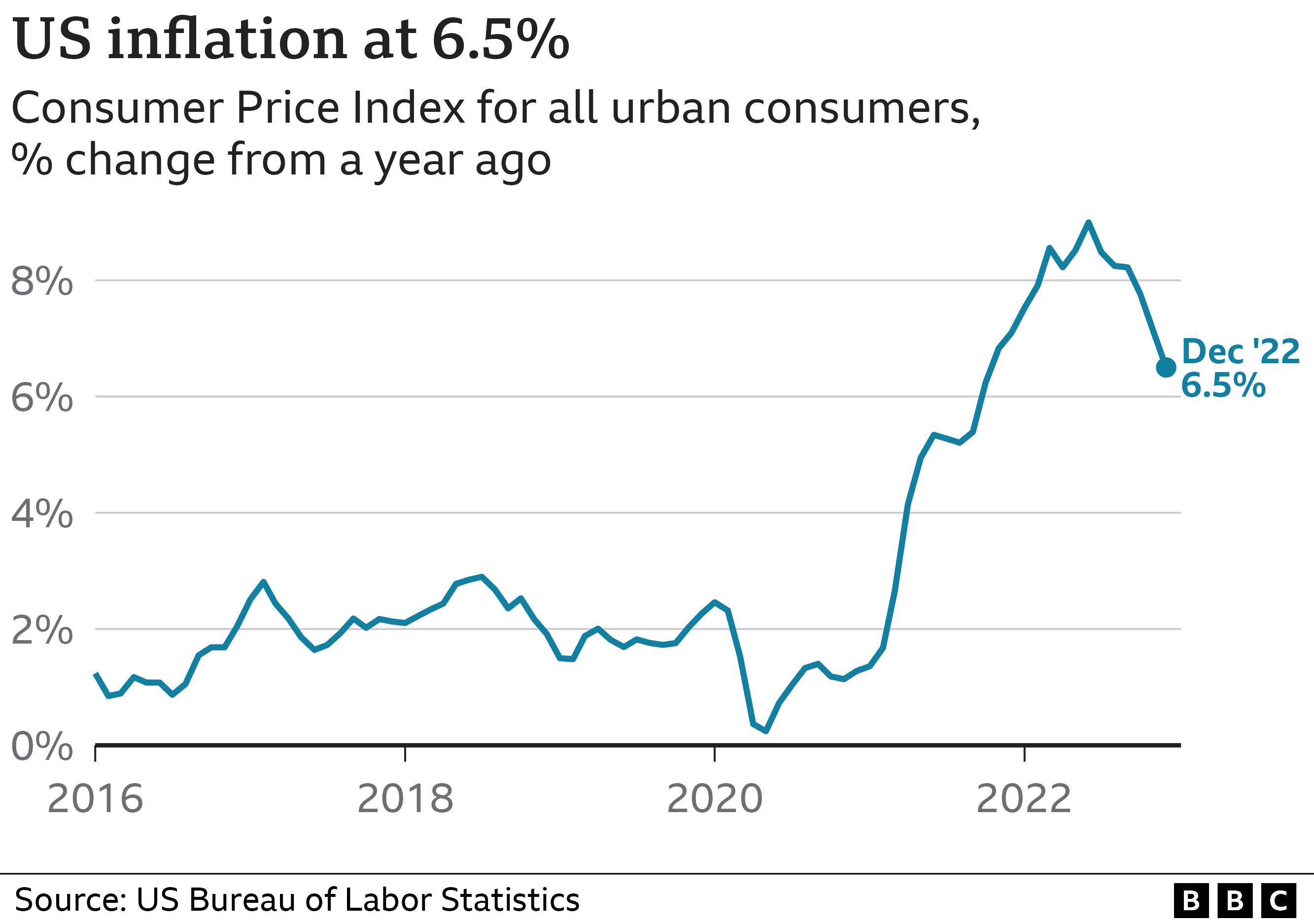

Consider this: geopolitical tensions are escalating globally, central banks are playing a dangerous game with inflation, and the dollar’s dominance is being questioned. This is the perfect storm for a rush to safe-haven assets, and gold and silver consistently perform in these environments.

While a single morning spike isn’t a definitive signal, the strength of this move is noteworthy. We need to keep a very close eye on the Shanghai Gold Exchange in the coming days; it’s likely telegraphing broader market sentiment. This increase is a sign that investors are beginning to cautiously invest in gold and silver.

I’m telling you now, expect volatility. Don’t get caught flat-footed.