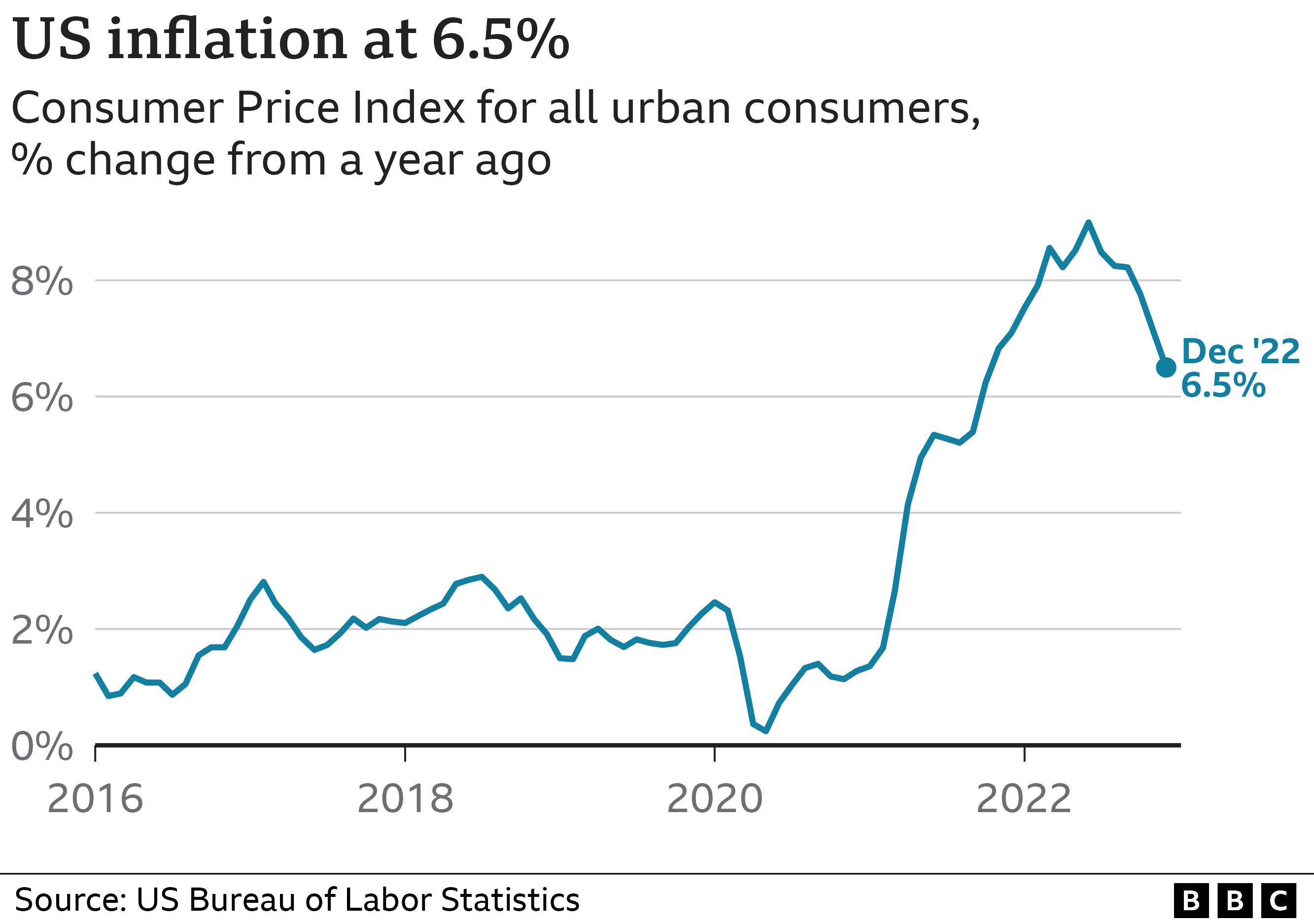

Okay, folks, hold onto your hats! A Reuters survey just dropped, and the news isn’t exactly a champagne-popping moment. They’re forecasting a US Consumer Price Index (CPI) of 3.1% for 2025, creeping down to 2.8% in 2026. And honestly? It feels… underwhelmed.

Photo source:mathiasakoch.pages.dev

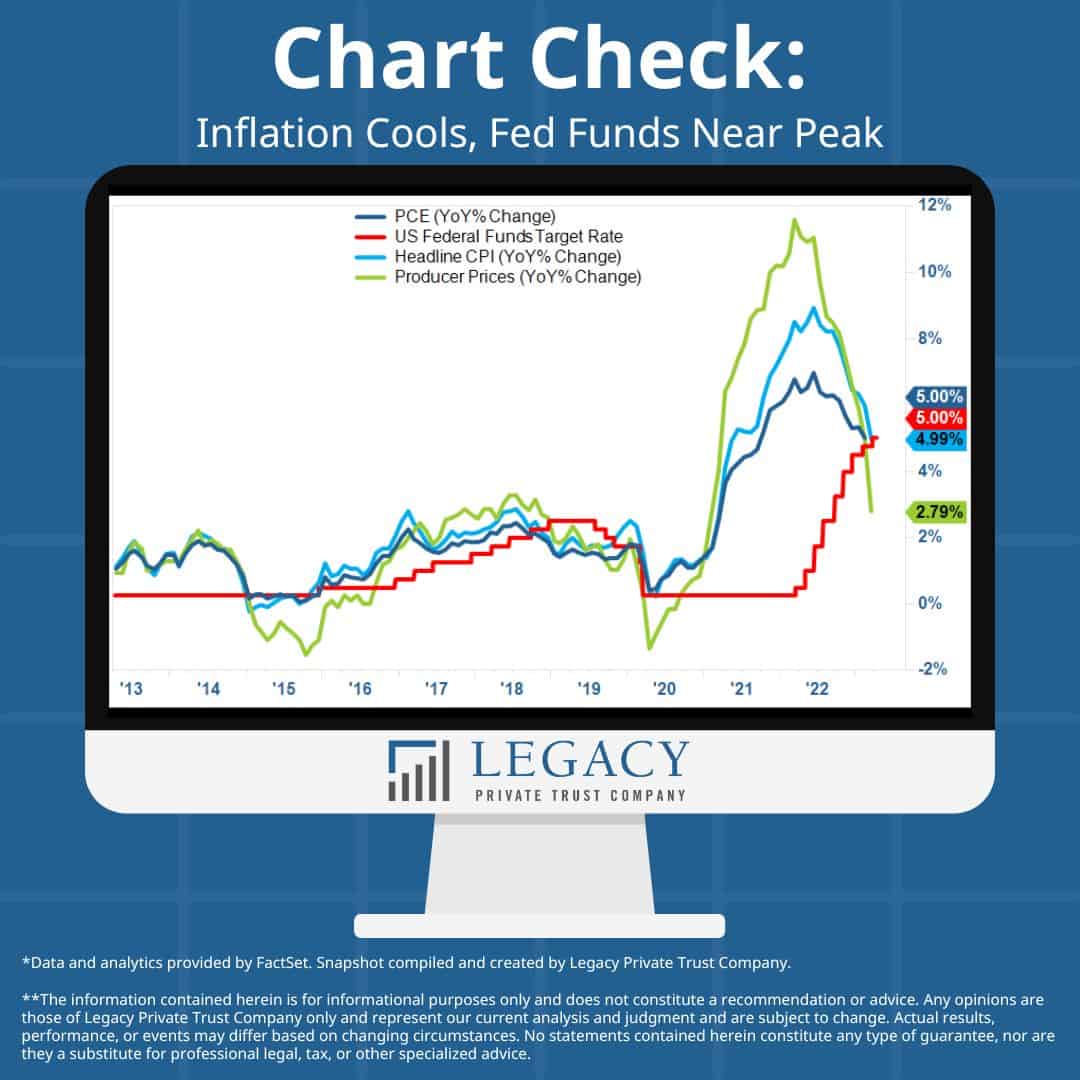

Compared to the April predictions (3.2% and 2.9% respectively), it’s a slight nudge downwards, but let’s be real, it’s hardly the victory lap the Fed wants to declare. It’s like they’re tiptoeing around the fire instead of actually putting it out.

Let’s break down what CPI actually is for those new to the game:

CPI represents the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It’s a huge indicator of inflation.

Why does this matter? Persistent inflation erodes purchasing power. Your dollar simply buys less. It disproportionately hits those on fixed incomes, and frankly, it’s just plain annoying.

So what’s driving these numbers? A complex brew of supply chain issues, labor market tightness, and overall economic demand. It’s all interconnected and stubbornly resistant to quick fixes.

Honestly, I’m not buying the optimistic spin. We need to see real action, not just revised projections. This feels like a case of hoping for the best while bracing for…well, more of the same. They’re basically saying inflation is going to be a frustrating, slow drag, and I’m calling BS on the ‘slow’ part. It’s still too high, and frankly, I’m starting to lose patience.