Okay, folks, listen up! Cartwright Corporate Treasury, a respected UK pension consulting firm, is absolutely slamming the insurance industry for its continued reluctance to embrace Bitcoin. They’re not just suggesting a little dip of the toe, they’re demanding insurers reconsider Bitcoin as a genuine strategic asset. Frankly, it’s about damn time!

Cartwright isn’t mincing words—they see massive potential here. We’re talking about boosting returns, battling that relentless inflation monster, and surprisingly, reducing overall portfolio risk. They’ve bluntly stated, “Bitcoin rightfully deserves a place in institutional investment discussions.” Seriously? It’s 2024, people!

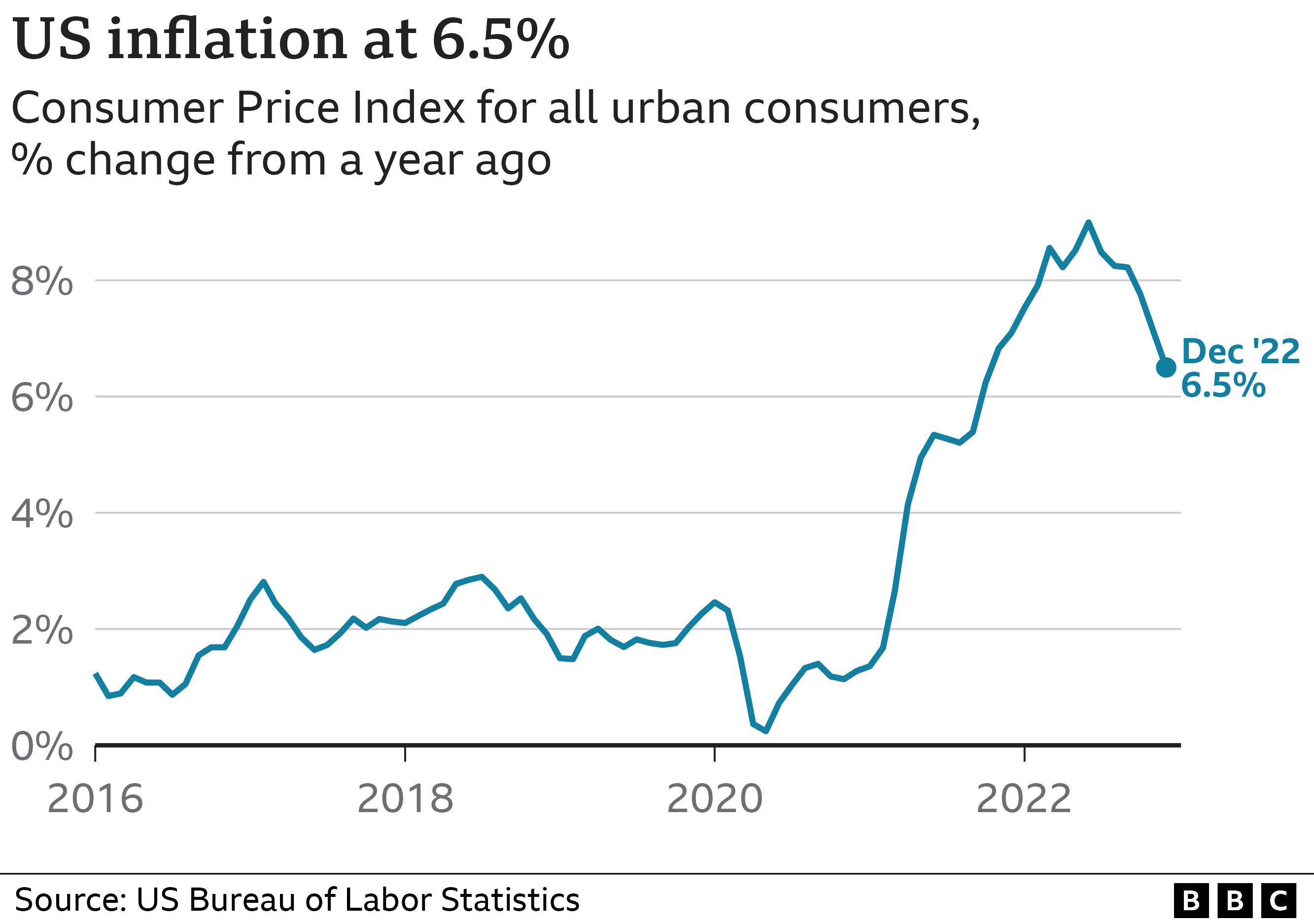

Let’s break down why this is a big deal. Bitcoin’s scarcity, a hard cap of 21 million coins, inherently provides a hedge against inflationary pressures. Unlike fiat currencies that governments can print at will, Bitcoin’s supply is fixed, preserving purchasing power.

Furthermore, Bitcoin’s decentralized nature offers diversification benefits. It boasts a low correlation with traditional asset classes like stocks and bonds, potentially cushioning portfolios during market downturns. This reduced correlation is critical for modern portfolio theory.

Finally, the increasing institutional adoption of Bitcoin signals a maturing market. Major players are entering the space, offering infrastructure and custody solutions that make Bitcoin a more viable option for large investors. Ignoring this signals stagnation, not prudence.