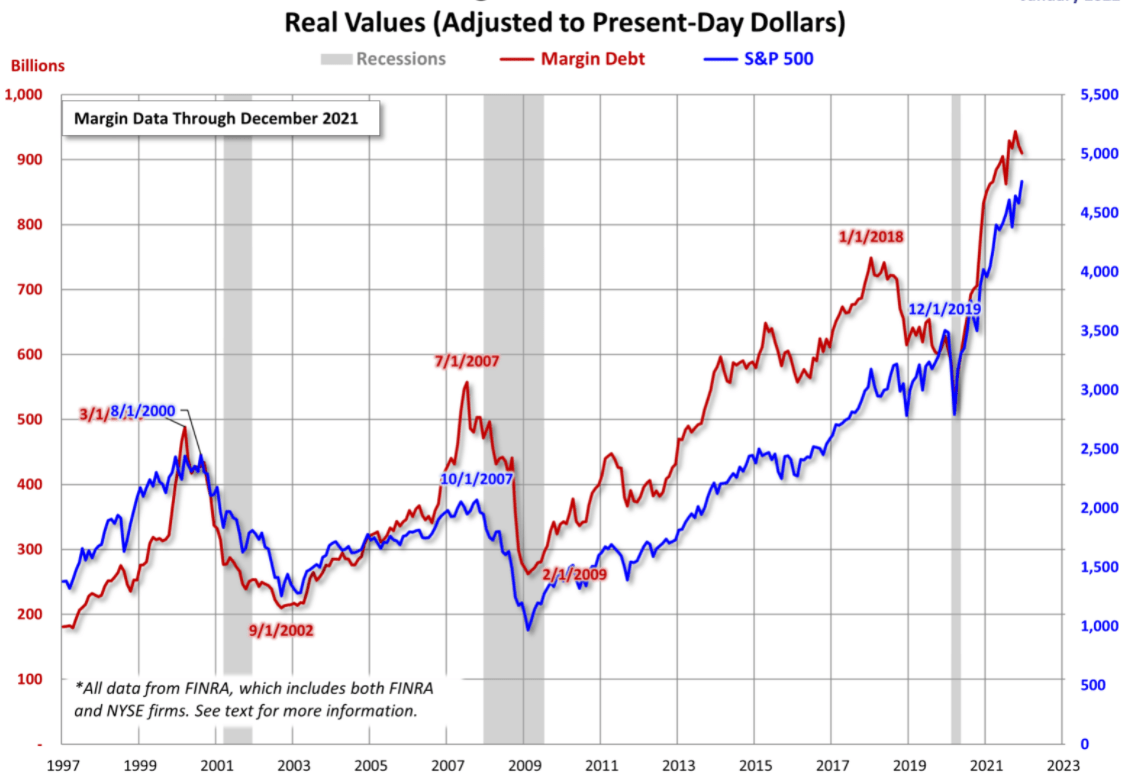

Alright, folks, let’s cut to the chase. We just got the latest margin debt numbers, and they’re up. Significantly. As of May 7th, Shanghai Stock Exchange margin debt clocked in at RMB 911.175 billion, a jump of RMB 2.938 billion from the previous session. Shenzhen wasn’t shy either, adding RMB 42.16 billion to reach RMB 880.929 billion. Combined, that’s a total increase of RMB 71.54 billion across both exchanges, bringing the grand total to RMB 1792.104 trillion.

Now, what does this mean? A rise in margin debt usually points to increasing investor confidence. People are borrowing to buy, betting on further gains. But let’s be real, it’s a double-edged sword.

Let’s unpack the implications of margin trading a bit:

Margin trading allows investors to leverage their capital, potentially amplifying returns. However, it also amplifies losses. Think of it like using a magnifying glass – it makes small gains bigger, but also turns small losses into painful ones.

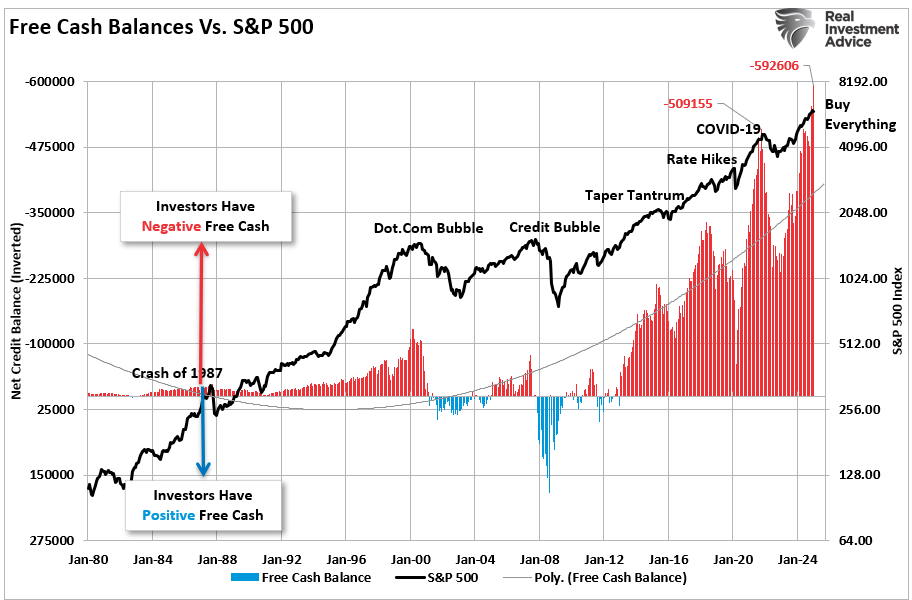

The level of margin debt relative to overall market capitalization is a key indicator. A very high ratio can suggest excessive speculation and an increased risk of a correction. Keep a close eye on this.

Furthermore, increased margin buying frequently comes as a delayed reaction to a market rally. Meaning, people jump in after the initial gains, hoping to catch the rest of the wave. This often leads to buying high.

Finally, remember that margin calls haunt the unwary. If the market turns south, brokers can demand immediate repayment of borrowed funds, forcing investors to sell, potentially deepening the downturn. Don’t get caught off guard! We need to stay vigilant and approach these rallies with a healthy dose of skepticism. Don’t chase returns blindly.