Alright, let’s break down what’s really happening in the natural gas market. The CFTC’s latest Commitment of Traders report, as of May 6th, shows a significant surge in bullish sentiment. We saw a hefty increase of 12,286 contracts in net longs on NYMEX and ICE natural gas futures, bringing the total to a robust 197,717 contracts.

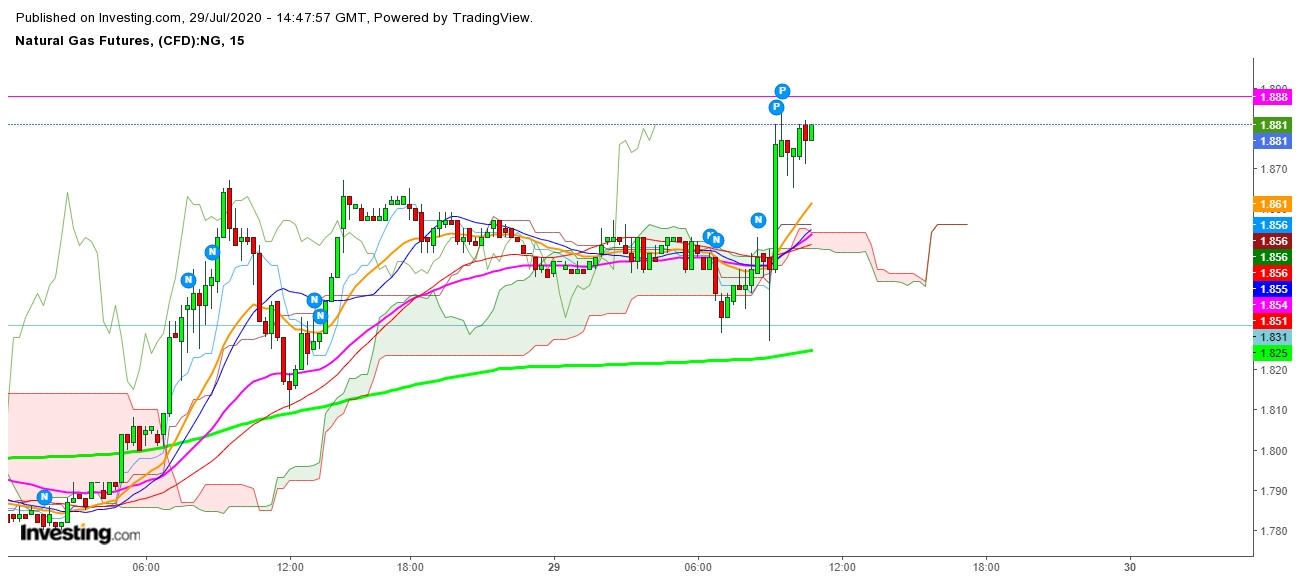

Photo source:www.investing.com

That’s a bold move, folks. It signals traders are betting big on prices heading higher. But is this justified? Or a classic case of chasing momentum? That’s what we need to dissect.

Understanding Speculative Positioning: A Quick Primer

Speculative positioning in futures markets offers a crucial glimpse into market sentiment. Net longs represent the difference between long positions (bets on price increases) and short positions (bets on price decreases).

A significant increase in net longs, like we’ve seen here, usually suggests confidence in the asset’s future performance. Traders are actively building bullish exposure.

However, it’s not always a clear indicator of fundamental strength. Sometimes, it’s fueled by technical factors, fear of missing out (FOMO), or even coordinated activity. It’s a critical distinction.

We’ve seen similar large build-ups of long positions before, only to be met with corrections. Smart money often fades such extremes. Keeping a close eye on storage levels and weather patterns – the real drivers of natural gas – will be essential in the coming weeks. Don’t get caught leaning into the wind!