Friends, buckle up! Pro Farmer, the respected voice from Farm Journal, just dropped their outlook report covering the week of May 19th-23rd, and let me tell you, it’s a wake-up call. They’ve meticulously dissected the fundamentals and technical levels for soybeans, corn, wheat, and cotton, and the picture isn’t always pretty.

Photo source:openknowledge.worldbank.org

Let’s break down what’s brewing. It’s crucial to understand, in commodity markets, knowing the ‘why’ behind the price moves is paramount, not just reacting to the ‘what’.

Understanding the Fundamentals:

Fundamentally, supply and demand remain the driving forces. Weather patterns play a significant role, particularly regarding planting and growth. Pro Farmer’s report delves into these aspects, offering a sobering assessment of current conditions.

Technical Analysis – Decoding the Charts:

Beyond the fields, technical analysis offers a vital perspective. Key support and resistance levels are identified, helping traders pinpoint potential entry and exit points. Ignoring these technical signals is akin to flying blind.

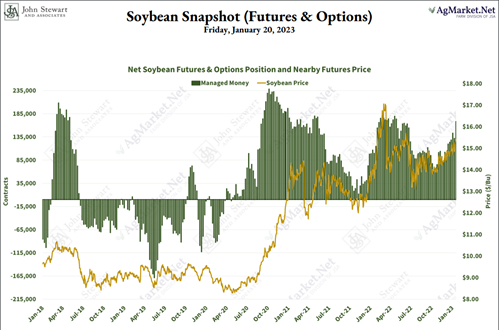

Soybeans: A Complex Equation:

Soybean prices are navigating a tricky landscape. Global demand certainly supports prices, however, South American production plays a crucial factor, and Pro Farmer is weighing those variables.

Corn: Weather is King:

Corn’s fate is tightly coupled with Midwestern weather. Delayed planting or unfavorable conditions could significantly impact yields, boosting prices. Expect volatility.

Wheat: Global Tensions & Supply:

The ongoing geopolitical instability impacts wheat significantly. Supply chain issues and export restrictions could drive prices higher, even as global stockpiles remain decent.

Cotton: Demand and Global Economy:

Cotton’s performance mirrors consumer spending. A slowdown in the global economy will depress the demand for cotton directly. This is something to consider.

Pro Farmer’s report isn’t just a snapshot; it’s a roadmap. It’s time to sharpen your pencils, analyze the data, and prepare for potentially significant shifts in these key commodity markets. Don’t get caught flat-footed – knowledge is your best defense. This is not investment advice, folks, just a seasoned observer sharing crucial insights.