Friends, let’s talk real talk. The latest data out of the Chinese stock market is flashing a warning sign, and you better pay attention. As of May 16th, margin debt across the Shanghai and Shenzhen exchanges has decreased by a collective 1.845 billion yuan. That’s a significant pullback – 9.22 billion yuan less on the Shanghai exchange and 9.23 billion yuan less in Shenzhen.

Now, what does this actually mean? It’s not as simple as ‘good’ or ‘bad’. A decrease in margin debt could indicate investors are becoming more cautious, trimming their leveraged positions before things get dicey. This could be a healthy correction, preventing excessive risk-taking.

But let’s be frank, a sudden reduction can also signal fear. Are investors preemptively de-risking as they anticipate a further downturn? Are they getting margin calls they desperately need to cover? This is where things get a little murky.

Let’s break down margin trading a bit:

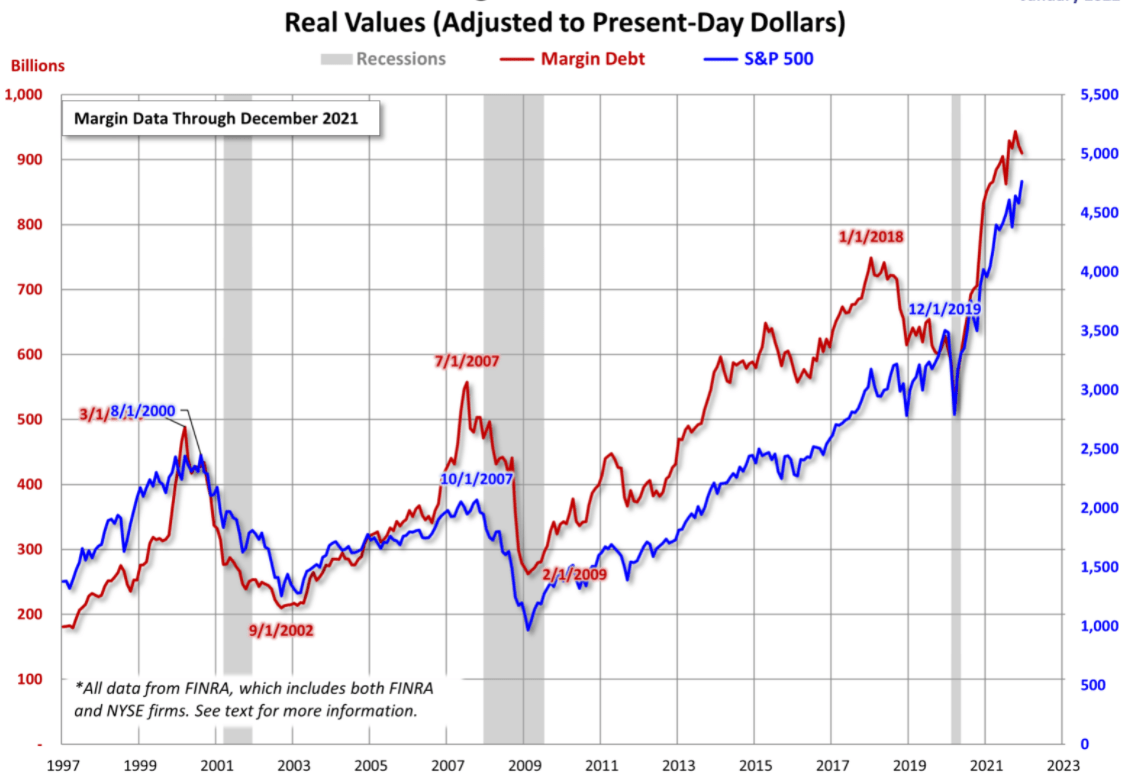

Margin trading allows investors to borrow funds from their broker to buy more stock. It amplifies both potential gains and potential losses. Think of it like using a magnifying glass – it makes everything bigger, both the good and the bad.

When markets are bullish, margin trading can supercharge returns. But when markets stumble, it can lead to devastating losses, forcing investors to sell assets to cover their debts.

Keep a close eye on this number. A sustained decrease in margin debt can be a leading indicator of a larger market shift. Right now, it’s a yellow flag, not necessarily a red one, but definitely something to watch closely. Don’t get caught holding the bag!