Folks, the market just wrapped up a pretty interesting Friday session. We saw a mixed bag overall, but let’s cut to the chase: tech is back. The Dow eked out a minor 0.05% gain, while the S&P 500 managed a solid 0.74% pop. But the real fireworks? That was over in the Nasdaq, surging a robust 1.26%.

Photo source:finance.yahoo.com

Tesla (TSLA) was the star of the show, rocketing up a phenomenal 9.8%. I’ve been telling you, don’t count Tesla out! And Nvidia (NVDA) continued its impressive run, adding another 4.3% to its already hefty gains.

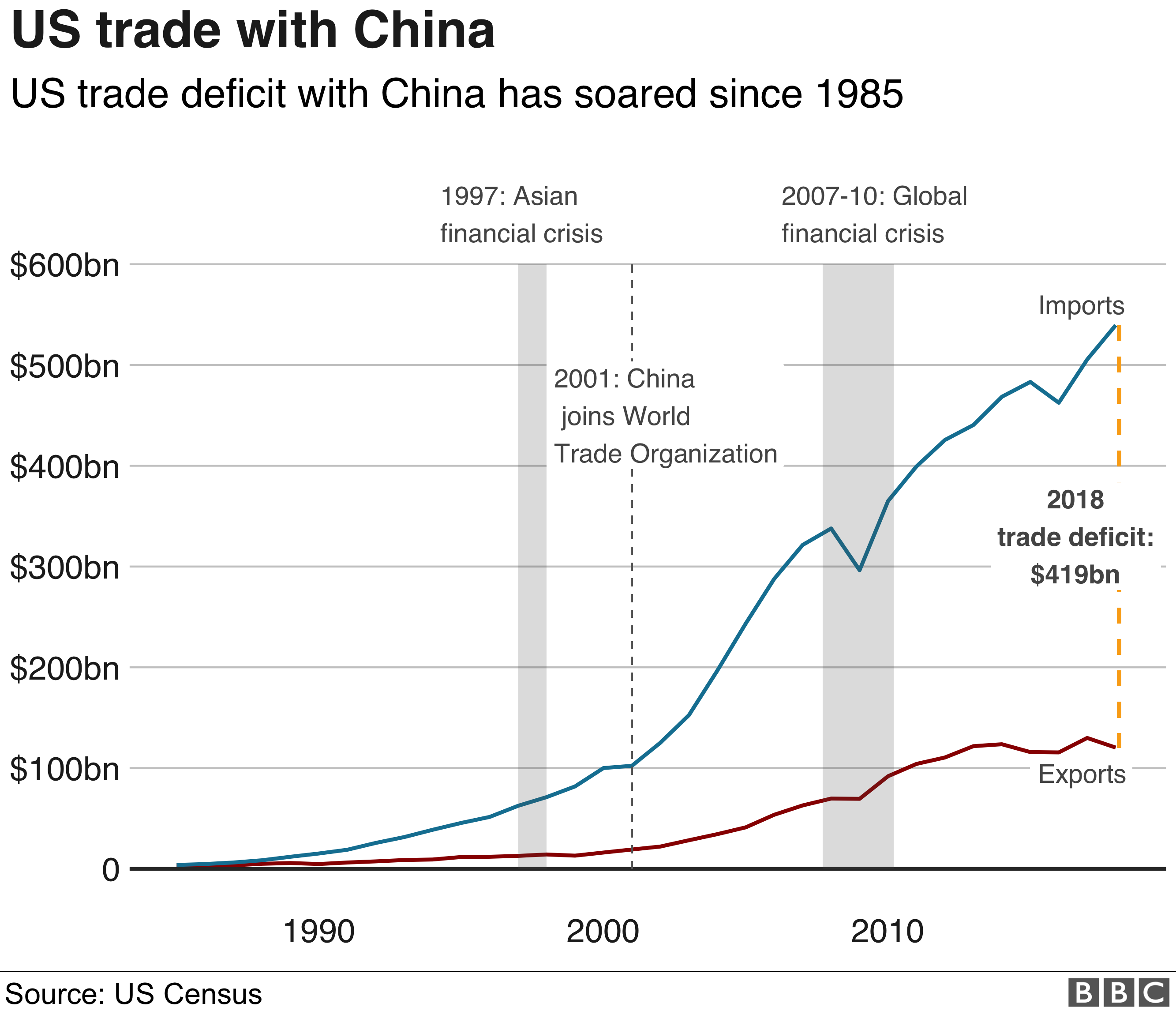

However, it wasn’t all sunshine and roses. The Nasdaq Golden Dragon Index, measuring Chinese stocks, took a hit, dropping 0.4%. Specifically, NIO tumbled 3.77% and Xpeng suffered a 3.5% decline. It’s a stark reminder that global markets are interconnected, and risks remain.

Diving Deeper: Understanding the Tech Bounce

Tech’s resurgence is fueled by renewed optimism about artificial intelligence and the potential for falling interest rates. This creates a sweet spot for growth stocks.

Tesla’s jump stemmed from improving delivery numbers and positive sentiment surrounding its AI advancements. Investors are betting big on the company’s ambition.

The Nasdaq Golden Dragon Index’s weakness reflects broader concerns about China’s economic recovery and regulatory uncertainty. These are factors to watch closely.

Remember, the market is a forward-looking machine. Today’s moves are based on expectations for the future, not solely on current conditions. Stay vigilant!