Folks, the tariff rumors weren’t just whispers – they’ve landed with a goddamn thud! The market’s already reacting, and I’m telling you, we’re staring down the barrel of some serious volatility. We’re likely to see a wild swing between euphoric rallies fueled by hopeful narratives and outright panic selling as reality bites.

This isn’t just about trade; it’s about sentiment. Fear and greed are battling it out, and right now, fear is gaining ground. Expect a ‘whipsaw’ effect, where both bulls and bears get absolutely wrecked.

Let’s delve deeper. Understand that tariffs are taxes imposed on imported goods. They aim to make foreign products more expensive, theoretically boosting domestic production.

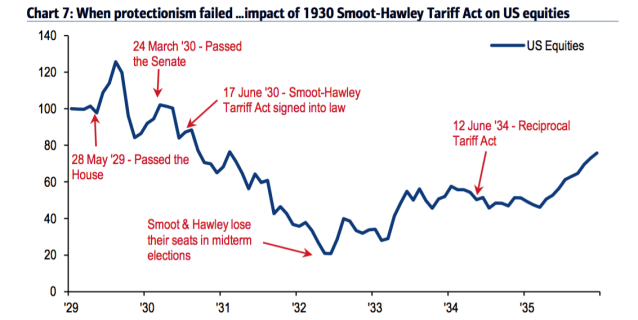

However, they often backfire. Higher import costs drive up prices for consumers and businesses, squeezing profits. This reduces consumer spending and business investment, ultimately slowing economic growth.

Furthermore, tariffs escalate trade tensions, triggering retaliatory measures from other countries. This leads to a downward spiral of protectionism, harming global trade and the overall economy. It’s a damn mess, frankly.

The current situation is particularly dangerous because it hits US equities at a vulnerable moment. Valuations are stretched, and growth is already slowing. A tariff shock could be the catalyst for a significant correction, or even worse.

The bottom line? Buckle up. This is going to be a bumpy ride. Don’t chase the rallies, and for God’s sake, protect your capital!