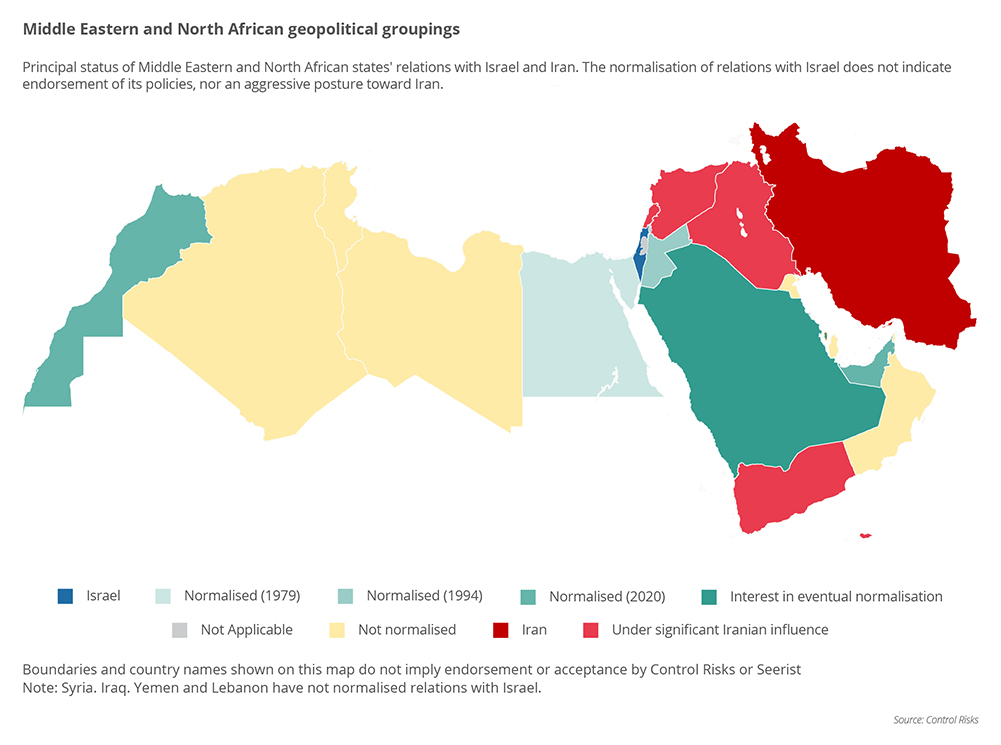

Friends, buckle up. The situation in the Middle East isn’t just heating up – it’s threatening to boil over. We’ve got a volatile cocktail brewing, and frankly, the market is criminally underpricing the risk.

The latest intel paints a grim picture. Yemen’s Houthi rebels are reporting a devastating US strike on a fuel port, resulting in a horrific loss of life – 58 dead and 126 wounded. This is beyond concerning, it’s a potential spark for wider regional conflict.

And the anti-American sentiment is spreading like wildfire. We’re seeing outright attacks on American brands – KFC locations in Pakistan were targeted in over ten incidents. This isn’t just about Israel anymore; this is about a palpable rage directed at US foreign policy.

Now, let’s talk nuclear. The US is cornering Iran. Secretary Rubio is publicly challenging Europe to re-impose sanctions if Iran gets too close to a weapon. It’s a ‘draw a line in the sand’ moment, and Europe, predictably, is wavering.

But Iran isn’t backing down. Russia’s Lavrov says they’re open to a deal within the existing framework of the nuclear agreement. Iran’s Foreign Minister is actively wanting Russia’s involvement in any new deal.

Here’s the kicker: Iran has drawn some very firm red lines. They’re not dismantling centrifuges, they’re not reducing enrichment levels to zero, and they won’t even discuss their missile program. This is a tough negotiating stance, to say the least.

What’s truly worrying is the chatter coming out of Washington. Sources say National Security Advisor Woltz and Secretary Rubio are both leaning towards a military strike against Iran’s nuclear facilities. This is where things get really dangerous.

Let’s break down the nuclear issue further:

Iran’s nuclear program has been a source of international contention for decades. The primary concern revolves around the potential for Iran to develop nuclear weapons, altering the regional power balance.

The Joint Comprehensive Plan of Action (JCPOA), signed in 2015, aimed to curb Iran’s nuclear activities in exchange for sanctions relief. Sadly, the US withdrew from the JCPOA in 2018.

Iran maintains its nuclear program is solely for peaceful purposes, such as energy production and medical isotopes. However, the international community remains skeptical.

Any military strike on Iran’s nuclear facilities could trigger a wider conflict, potentially involving regional powers and escalating global instability. The stakes are incredibly high.