Alright, folks, let’s talk gold. As of midday today, April 16th, 2025, Shanghai Gold is trading at a hefty 779.86 yuan per gram. Now, that’s a significant 3.44 yuan premium over the international spot price of 776.42 yuan per gram. Don’t dismiss this as a minor fluctuation! This isn’t just about numbers; it’s about sentiment, it’s about market dynamics, and possibly, a warning sign.

What does this premium really mean? It’s a complex question, but here’s my take. A widening premium often indicates robust domestic demand for physical gold in China. Folks are voting with their wallets, hedging against uncertainty, and seeking safe-haven assets. Understandable, right?

But hold on, there’s more to the story. A stronger premium can also be a reflection of a weakening yuan. When the yuan dips, gold – priced in dollars internationally – looks more expensive for Chinese investors, therefore driving up local prices. We need to examine the currency’s performance closely.

Let’s dive a bit deeper into gold premiums. Gold premiums represent the difference between the spot price and the price paid for physical gold. These premiums can be influenced by a variety of factors, including import duties, transportation costs, and local demand and supply dynamics.

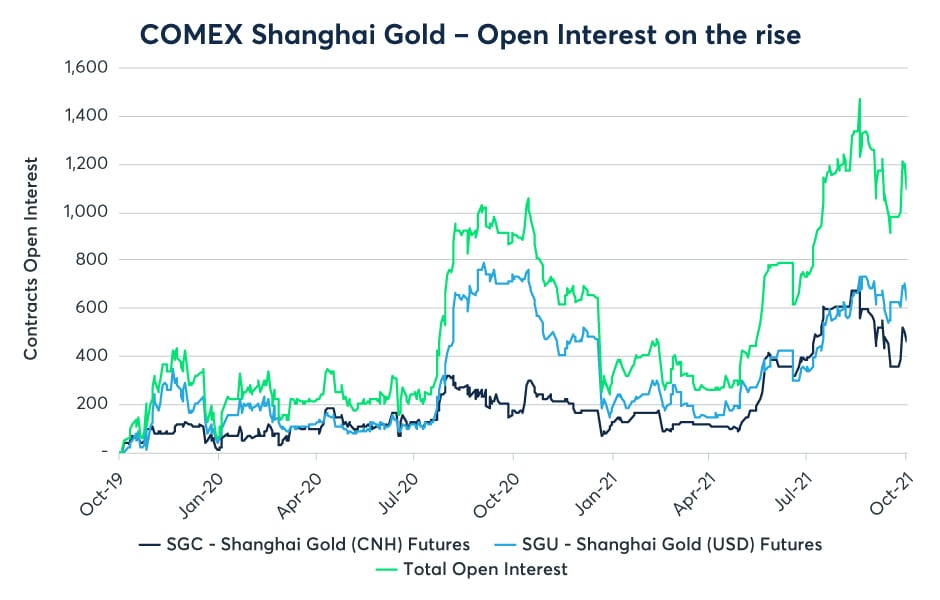

Historically, monitoring Shanghai Gold premiums has provided valuable insight into the Chinese market’s appetite for gold. It’s a barometer of economic anxiety and a key indicator watched by traders worldwide. Remember this tool in your arsenal!

Furthermore, lower supply from major gold-producing nations can also contribute to a higher premium. Keep tabs on global production figures alongside Chinese demand.

So, is this a bullish signal for gold overall, or is it a localized phenomenon driven by currency concerns? It’s likely a bit of both, and we need to stay vigilant. Don’t just blindly follow the herd; do your research!