Friends, buckle up! The main container shipping contract for the Europe route just took a nosedive. We saw a dramatic surge earlier, briefly flirting with the upper limit, peaking near 1900.0 points. But let’s be real, that spike was unsustainable.

Now, the gains have been significantly pared back, currently settling at around a 9% increase. This volatility is exactly what I’ve been warning you about! Don’t get caught chasing phantom rallies.

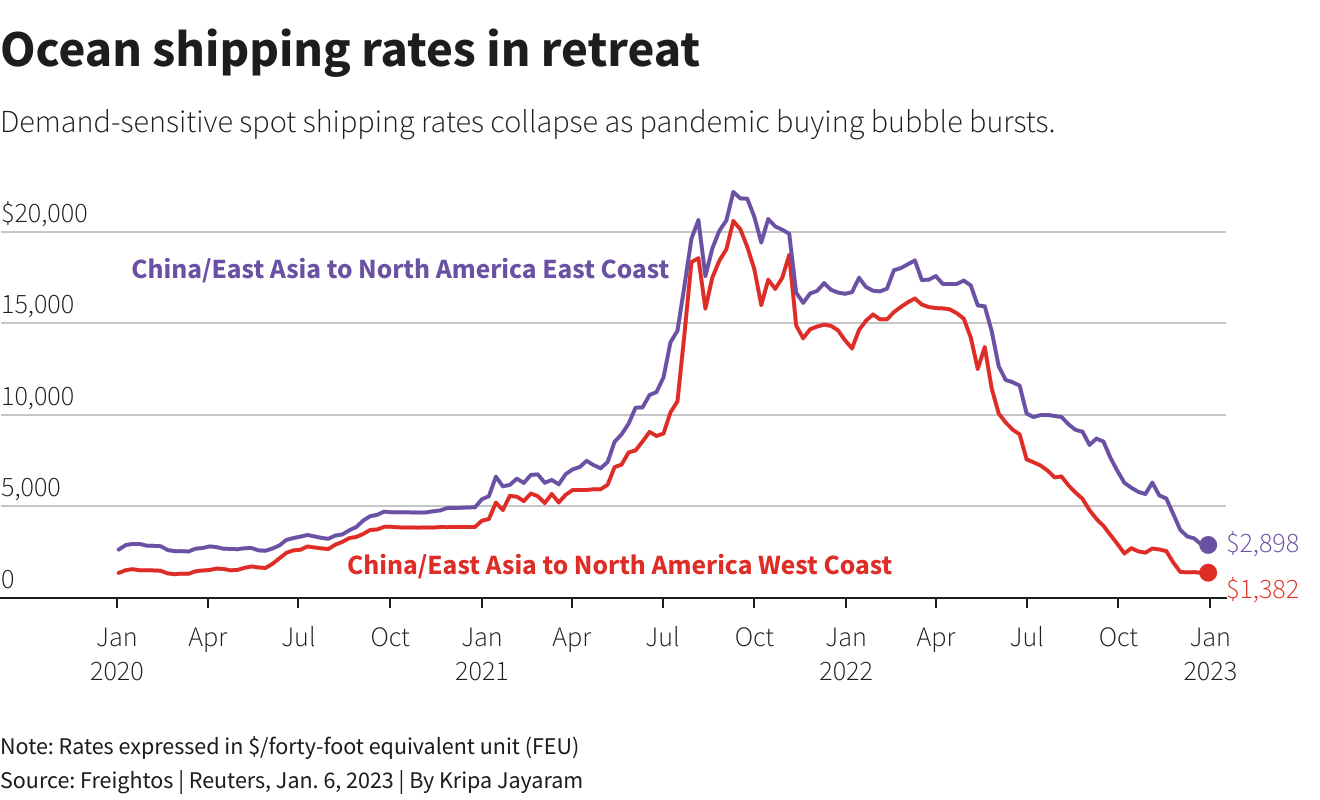

Let’s quickly dissect what’s happening. Container rates are notoriously cyclical. Increased capacity, coupled with softening demand – a common pattern after peak season – contribute heavily to rate corrections.

Understanding Container Rate Cycles:

Container shipping rates fluctuate based on a simple principle: supply and demand. When demand exceeds capacity, rates soar. Conversely, when capacity outstrips demand, rates decline.

Peak season, typically prior to major holidays, drives up demand. After this rush, demand cools, and shipping lines add capacity to capitalize on past gains, leading to downward pressure on rates.

Effective capacity management and demand forecasting are crucial for carriers. However, anticipating shifts in global trade is incredibly complex, creating inherent volatility in the market.

This is a stark reminder that in the shipping world, what goes up must come down. It’s crucial to remain grounded and avoid emotional trading decisions. We’ll continue to monitor this closely. Stay tuned for further analysis – and don’t hesitate to ask if you need a sound strategy!