Alright folks, let’s talk corn – because frankly, this market is a rollercoaster right now! We’ve got a fascinating interplay of factors brewing, and ignoring it could be expensive. The US planting pace is outpacing expectations, suggesting a potentially massive harvest. This alone should be bearish, but it’s far from the whole story.

Photo source:heartlandfarmpartnersinfo.com

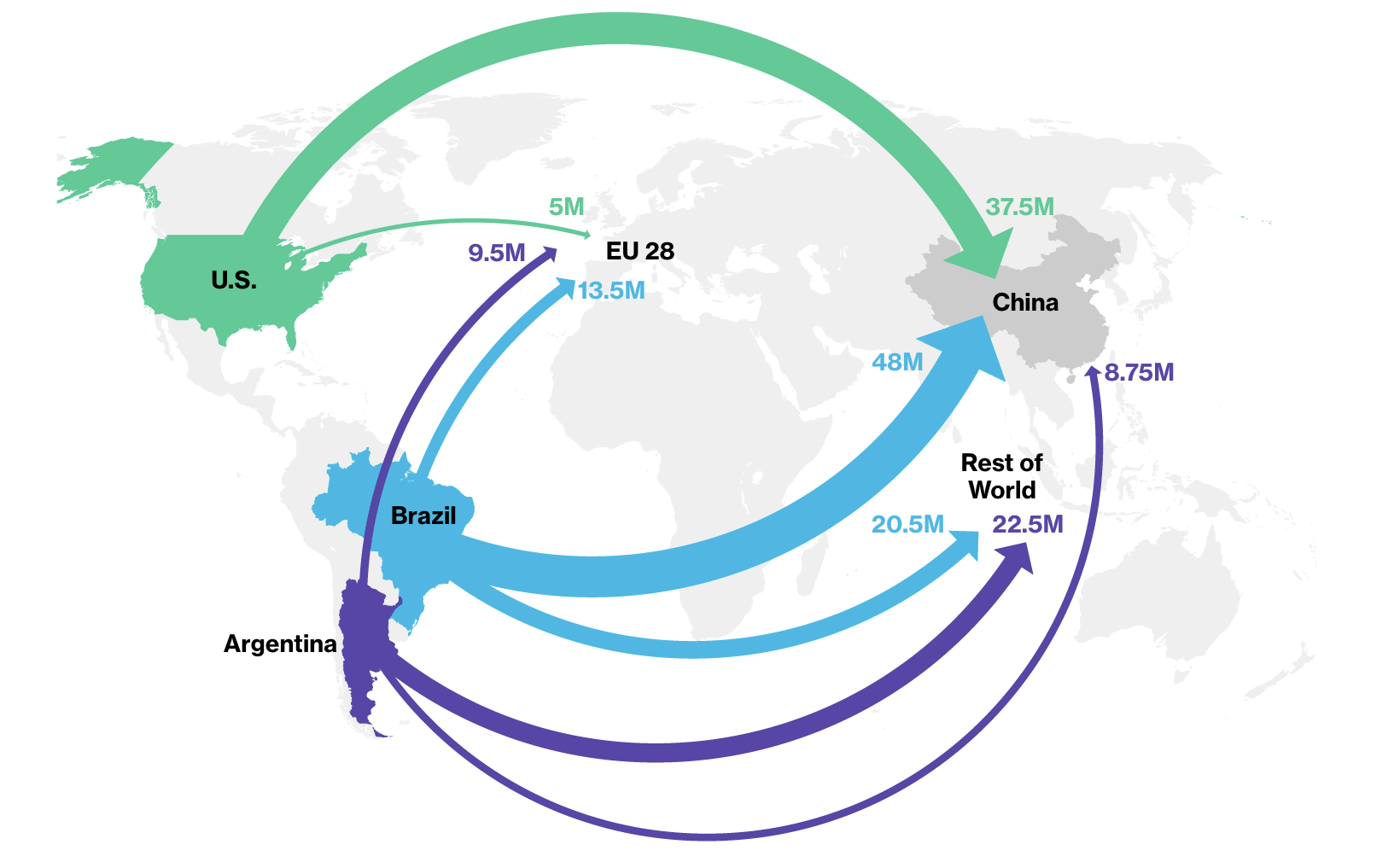

Brazil’s second-season corn crop is shaping up to be a stunner – a real bounty, frankly. While the initial crop had issues, they’ve bounced back with a vengeance, meaning increased global supply. However, Argentina is throwing a wrench in the works. Harvest delays due to persistent dryness are creating a significant bottleneck there, keeping underlying support in place.

So, where does this leave us? A tug-of-war between burgeoning supply from the US and Brazil, and constrained supply from Argentina. I’m seeing a short-term price consolidation, but be warned, this volatility isn’t over.

Let’s breakdown the core fundamentals.

Firstly, US planting progress is vital. Faster planting typically implies larger yields, assuming favorable weather persists throughout the growing season. This could dramatically impact global pricing.

Next, Brazil’s second-season corn is a game changer. It’s critical for offsetting production concerns elsewhere and dictates the size of the overall global supply picture.

Finally, keep a laser focus on Argentina. As a significant exporter, their harvest delays affect global availability, and potential quality concerns must also be considered. These delays creates an interesting dynamic and inject some uncertainty.

Don’t get complacent, traders. Position yourselves wisely, and understand this isn’t a simple Buy or Sell situation. It’s about anticipating the short-term volatility and identifying the long-term winners.