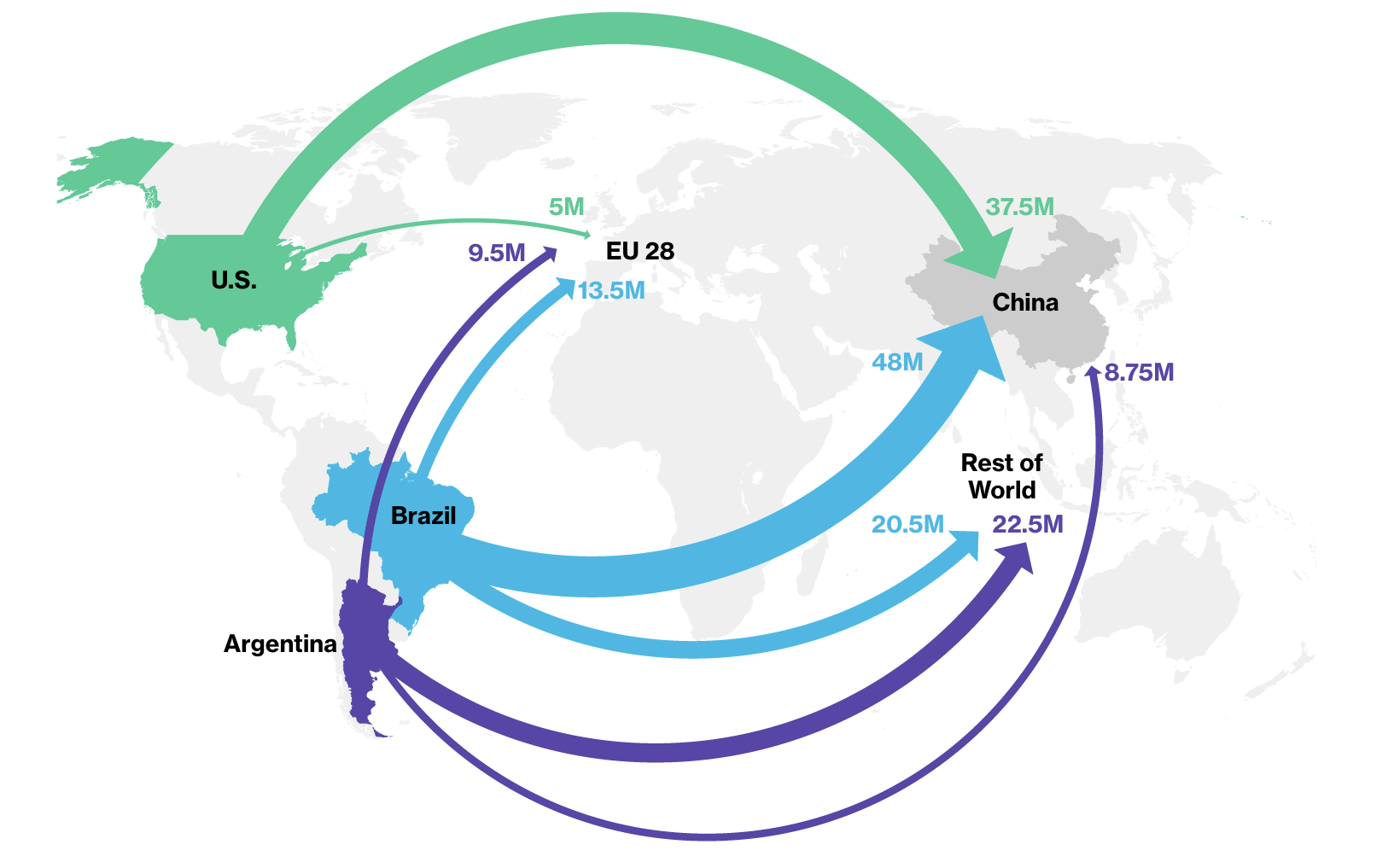

Friends, buckle up! The soybean market is in for a wild ride. We’re seeing a massive surge in South American soybean production – think Brazil and Argentina overflowing with beans. Simultaneously, Chinese soybean imports have taken a significant dive. This isn’t just a blip, folks; it’s a potential paradigm shift.

Photo source:www.greenchoicenow.com

What does this mean for global trade and, crucially, for prices? It’s a question keeping traders up at night. The short answer? Expect volatility. A lot of it.

Now, all eyes are on the USDA May WASDE report. Rumors are swirling that the new crop estimates could be reduced, potentially offsetting some of that South American glut. But let’s be real, relying on whispers isn’t a strategy.

Let’s break down the underlying dynamics:

Soybeans are a crucial component of global animal feed, especially in China. Demand is consistently high. However, fluctuating weather patterns in key growing regions play huge role.

South America’s recent favorable weather led to record yields. This significantly increased global supply. Subsequently reducing the prevailing need for imports.

The USDA’s WASDE report is critical. It provides a detailed analysis of supply, demand and stock levels for major agricultural commodities.

China’s import patterns directly influence global market balance. Any major shift in their buying behavior has ripple effects across the world.

This isn’t just about farmers and traders; it’s about understanding the interconnectedness of the global food system and making smart, informed decisions. Stay tuned as we dissect the USDA report and navigate this rapidly changing landscape. Don’t get caught holding the bag!