Alright, folks, let’s break down what’s really happening in the Chinese economy. We just got a wave of data – some encouraging, some… less so. First, the US-China trade talks are showing “substantial progress,” according to Beijing. Translation? Both sides are talking, and that’s a win, but let’s wait for the fine print.

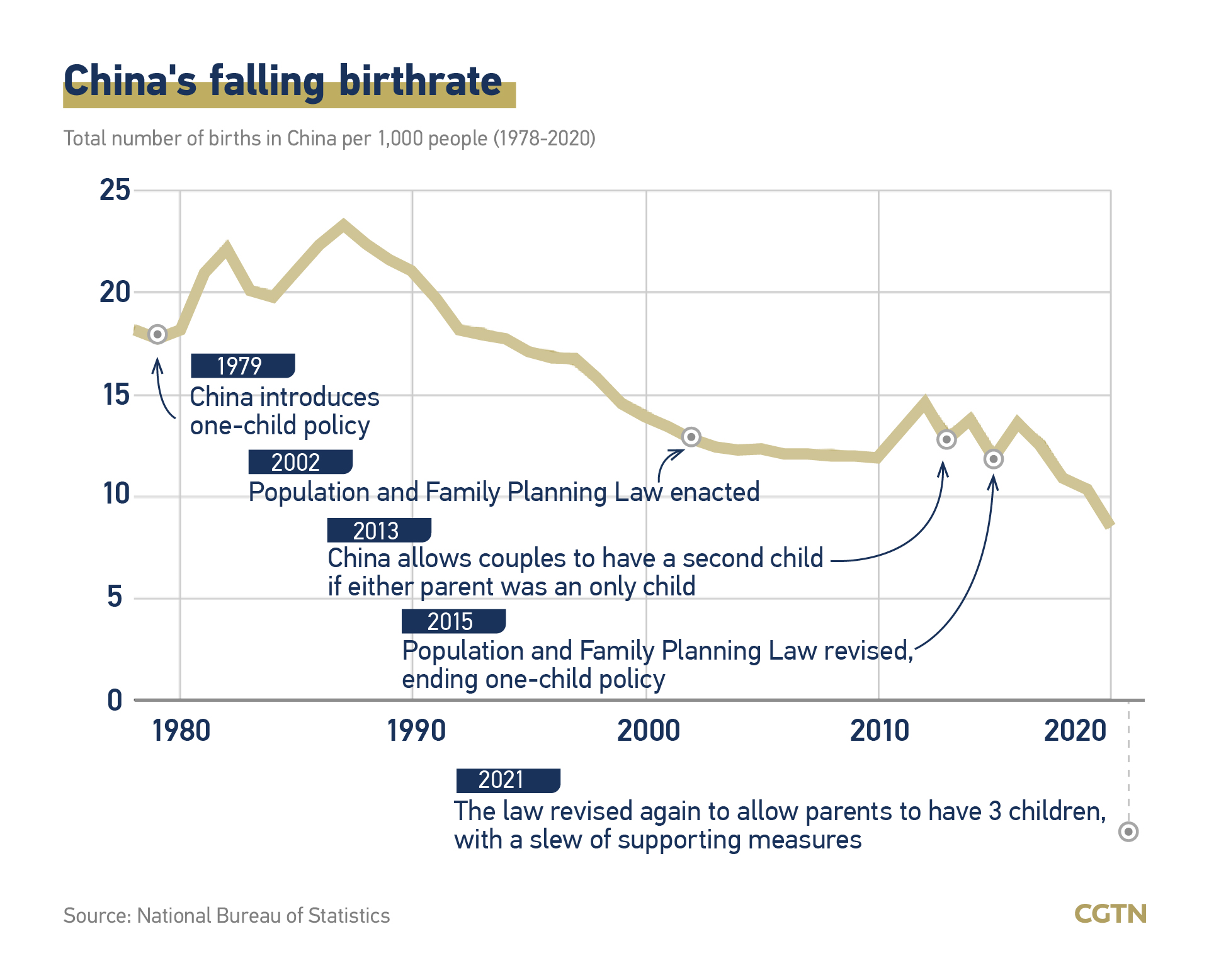

Now, for the numbers. April CPI fell 0.1% year-on-year, and PPI dropped 2.7%. Yep, deflationary pressures are still a concern. This isn’t a crash, but it’s a flashing yellow light.

To counter this, the PBOC launched a new lending program for consumer spending and elder care, offering 1.5% interest rates for up to 3 years. A clever move to stimulate demand, but will it be enough?

The PBOC also paused its treasury bond purchases, citing market conditions. That’s a signal that they’re stepping back, letting the market breathe…or bracing for something else. We’ll see.

On a brighter note, auto sales jumped 14.5% in April! Demand is clearly there, proving that the consumer isn’t entirely sidelined.

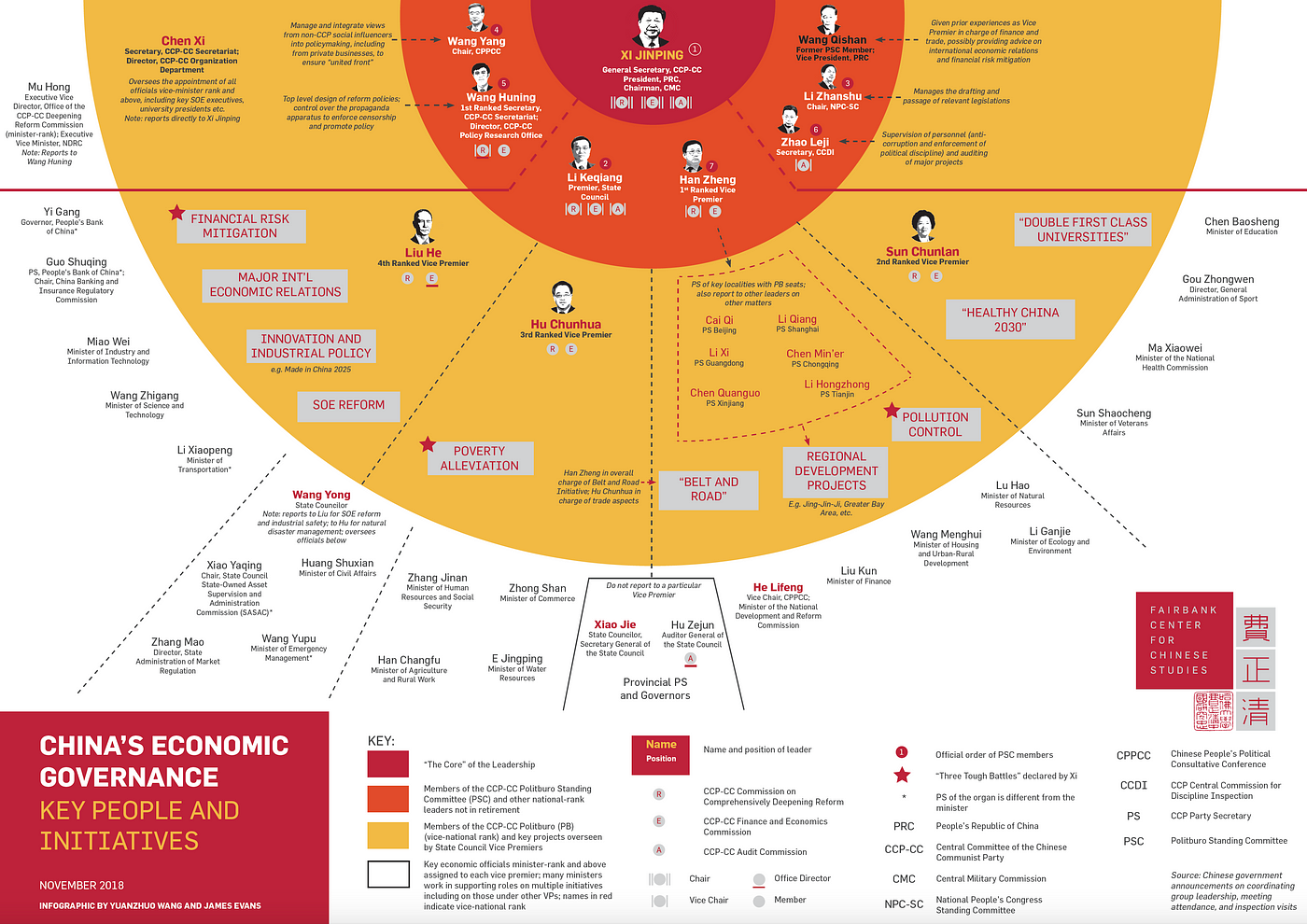

The State Council is already looking ahead, planning the next five-year plan (2026-2030) to reshape China’s economic landscape. Big picture stuff.

China’s current account surplus hit a hefty 1.1885 trillion yuan in Q1 – still a trade powerhouse. And regulatory changes are brewing with proposed revisions to the Securities Settlement Risk Fund Management rules.

Let’s quickly unpack some key terms:

CPI (Consumer Price Index) gauges the average change over time in the prices paid by urban consumers for a basket of consumer goods and services.

PPI (Producer Price Index) measures the average change over time in the selling prices received by domestic producers for their output.

Re-lending is a tool used by central banks to provide funds to commercial banks, encouraging them to lend to specific sectors.

Now, onto the stock movers:

CATL is grabbing headlines with its Hong Kong IPO price, and its Vice Chairman is donating a massive stake to Fudan University – talk about a philanthropic gesture! ST Youtree is undergoing a trading revocation and risk warning removal (good news for them!).

We’ve got a batch of stocks seeing crazy gains – Wanxiang Qianchao (2-day streak), Hongqiang Shares (8 boards in 14 days), and Chengfei Integration (3-day streak). But remember, these hyper-growth situations demand caution.

Maiwei Biology is facing an investigation into alleged short-term trading by its chairman. Dragonpan Technology landed a massive 5+ billion yuan deal for iron phosphate cathode material. Shandong Zhanggu and Hengyi Da are also making waves.

Finally, Heng’erda is expanding into high precision CNC machine tools, signaling a push for advanced manufacturing.