Alright, folks, hold onto your hats! Nick Timiraos, the actual Fed whisperer at the Wall Street Journal—the guy who consistently gets it right—is signaling that a June interest rate cut is looking seriously dicey. Seriously.

According to a report from Gold10, Timiraos is saying the April jobs report threw a wrench in those hopes. We’re talking about a slowdown that’s making Jerome Powell & Co. think twice. It’s a big deal!

Here’s the kicker: there’s only one more jobs report scheduled before the June meeting. That’s it. One shot. And right now, it doesn’t look good. The Fed doesn’t feel pressured to commit to anything next week, which practically screams ‘stay the course’.

Let’s unpack this a bit. Understanding the Fed’s reaction function regarding employment data is key. They prioritize sustainable maximum employment.

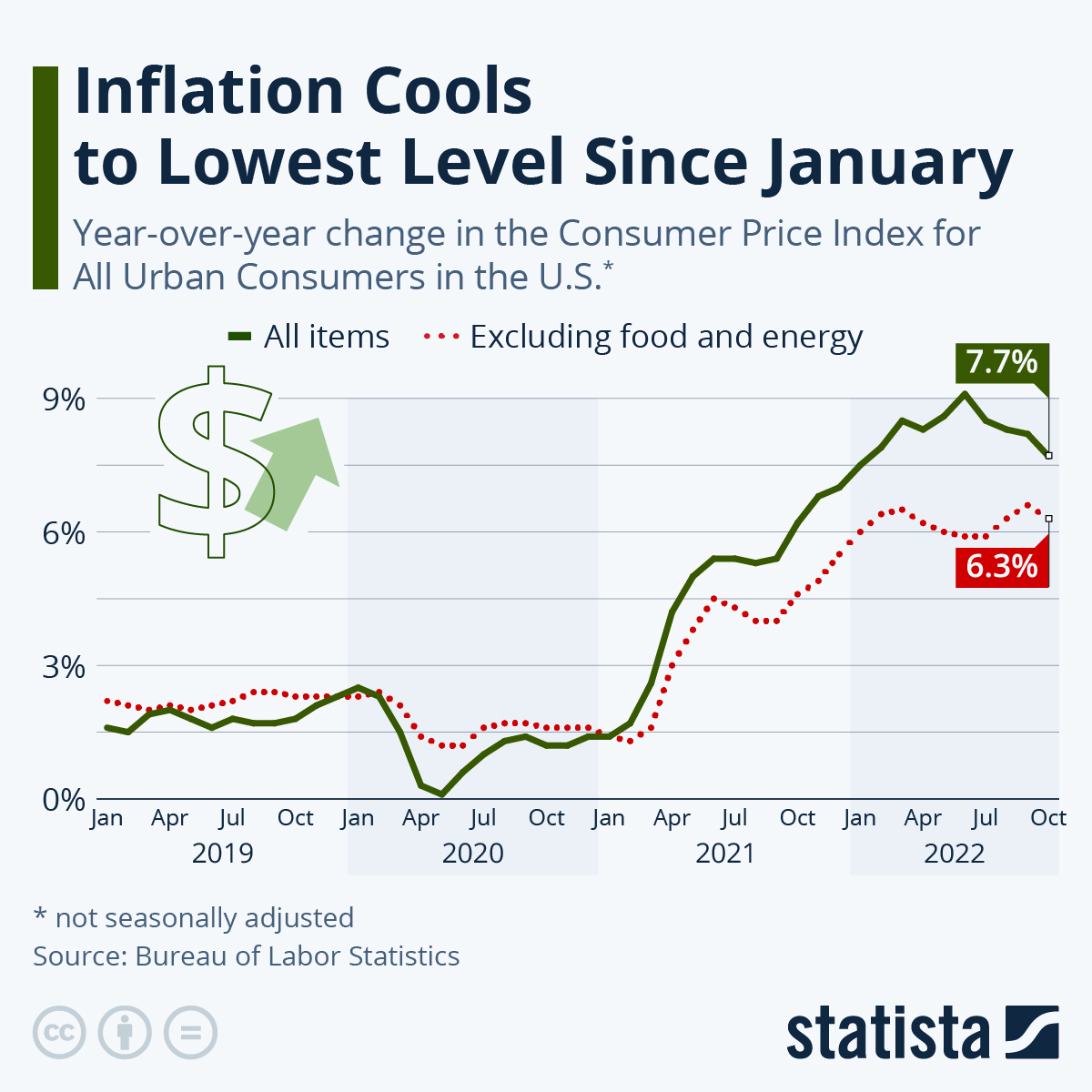

Strong job growth typically fuels inflation worries. The Fed sees this as a sign the economy is overheating. Consequently, they’re less inclined to lower rates.

Conversely, a weakening labor market suggests economic slowdown, potentially leading to lower rates. The April report didn’t give them the signal they needed for a cut.

Timiraos’ insights matter because he’s reliably close to the Fed’s thinking. Dismiss this at your own peril, investors. This isn’t some random analyst spouting nonsense; this is the inside track. Buckle up; it might be a bumpy ride!