Alright, folks, let’s cut through the noise. Earlier today, a flurry of panic spread after analyst Ming-Chi Kuo suggested iPhone assembly lines in China were shut down as of April 9th, with no clear indication of resumption. He even linked it to potential tariff adjustments by the US – a loaded statement designed to grab headlines, and it did.

But hold your horses! I’ve spoken directly with sources within the supply chain, and here’s the real story: production lines are not halted. The initial reports were, to put it bluntly, a complete fabrication.

This episode, however, underscores the incredibly sensitive nature of the US-China tech relationship. Here’s a quick breakdown for those keeping score:

The Tariff Game: The US imposed tariffs on Chinese goods, including some components used in iPhones. The idea of removing these “equalizing tariffs” has been tossed around as a potential de-escalation tactic.

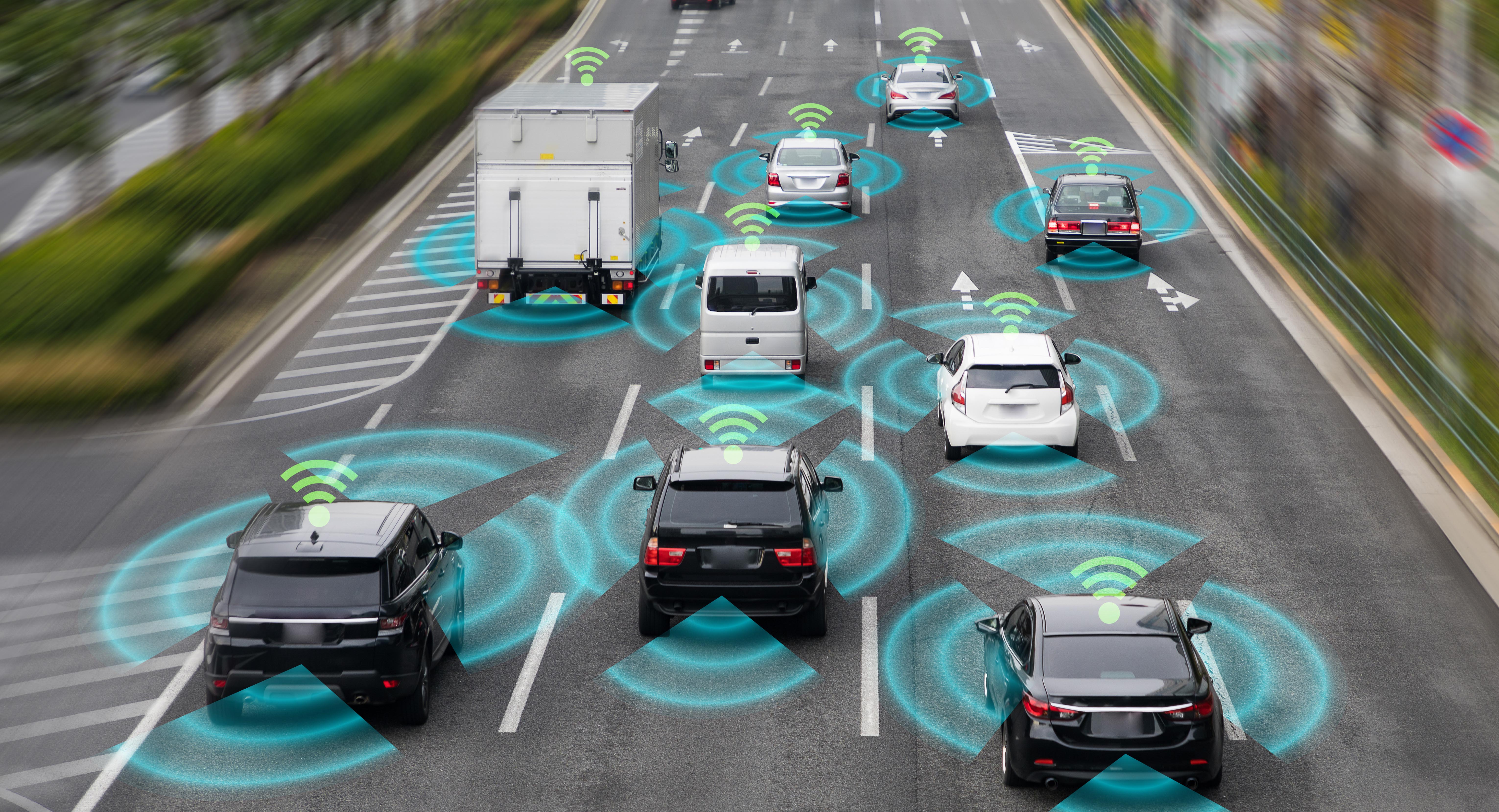

Supply Chain Sensitivity: iPhone production is deeply intertwined with the Chinese supply chain. Disruptions anywhere have massive ripple effects.

Analyst Influence: Analysts like Kuo wield significant influence, and their pronouncements can move markets – even when they’re based on flawed information. This isn’t the first time, and won’t be the last.

We’re constantly navigating a geopolitical minefield, and it’s crucial to separate fact from fiction. Don’t let the headlines dictate your investment decisions. Always dig deeper – I will continue to do so for you.

Understanding the link between trade policy, global supply chains, and tech manufacturing is paramount in today’s market. The iPhone, as a bellwether product, often reflects these broader economic forces. Stay vigilant, stay informed, and remember – fear is often the biggest enemy of sound financial strategy.