Hold onto your hats, folks! JPMorgan just pulled off something seriously groundbreaking. They’ve officially settled a tokenized U.S. Treasury bill transaction on a public blockchain, and honestly, it’s about damn time. This isn’t some quiet experiment; this is real money, moving on real chains, thanks to the wizardry of Chainlink and Ondo Finance.

This move isn’t just a technical feat; it’s a massive middle finger to the outdated, clunky systems that have plagued finance for decades. We’re talking faster settlement, increased transparency, and a level of accessibility we’ve only dreamed of. The implications are enormous!

Let’s break down the WHY behind this move:

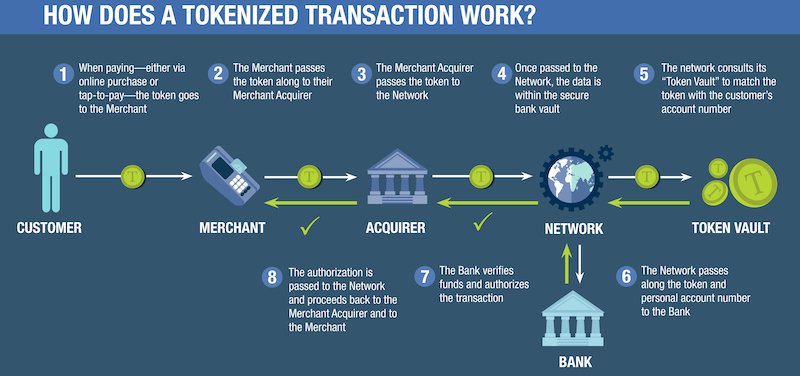

Tokenization, in essence, is about representing real-world assets – like Treasury bills – as digital tokens on a blockchain. It increases liquidity and fractional ownership. This allows smaller investors to participate.

Blockchain technology offers immutable record-keeping. Every transaction is publicly verifiable, reducing the risk of fraud. This fosters trust and transparency in the financial system.

Automated processes via smart contracts reduce the need for intermediaries. This leads to faster settling times and lower transaction costs, ultimately making finance more efficient.

Think about it: no more waiting days for settlements to clear! No more armies of middle-men taking their cut! This is a genuine revolution brewing, and JPMorgan, for all its past sins, is now helping to lead the charge. It’s about opening finance to everyone, not just the elite. I’m calling it now – this is the beginning of a seismic shift in the financial world, and I, for one, am absolutely here for it!