Okay, folks, buckle up! Fed Governor Christopher Waller just threw a massive wrench into everyone’s rate cut expectations. Speaking today, Waller basically said don’t even think about seeing a rate cut until we see some serious movement on the tariff front.

Photo source:www.marketwatch.com

He’s forecasting a possible cut… but not until the latter half of 2025. Yes, you read that right. We’re talking almost a year and a half from now. And it’s directly tied to what happens with those pesky tariffs.

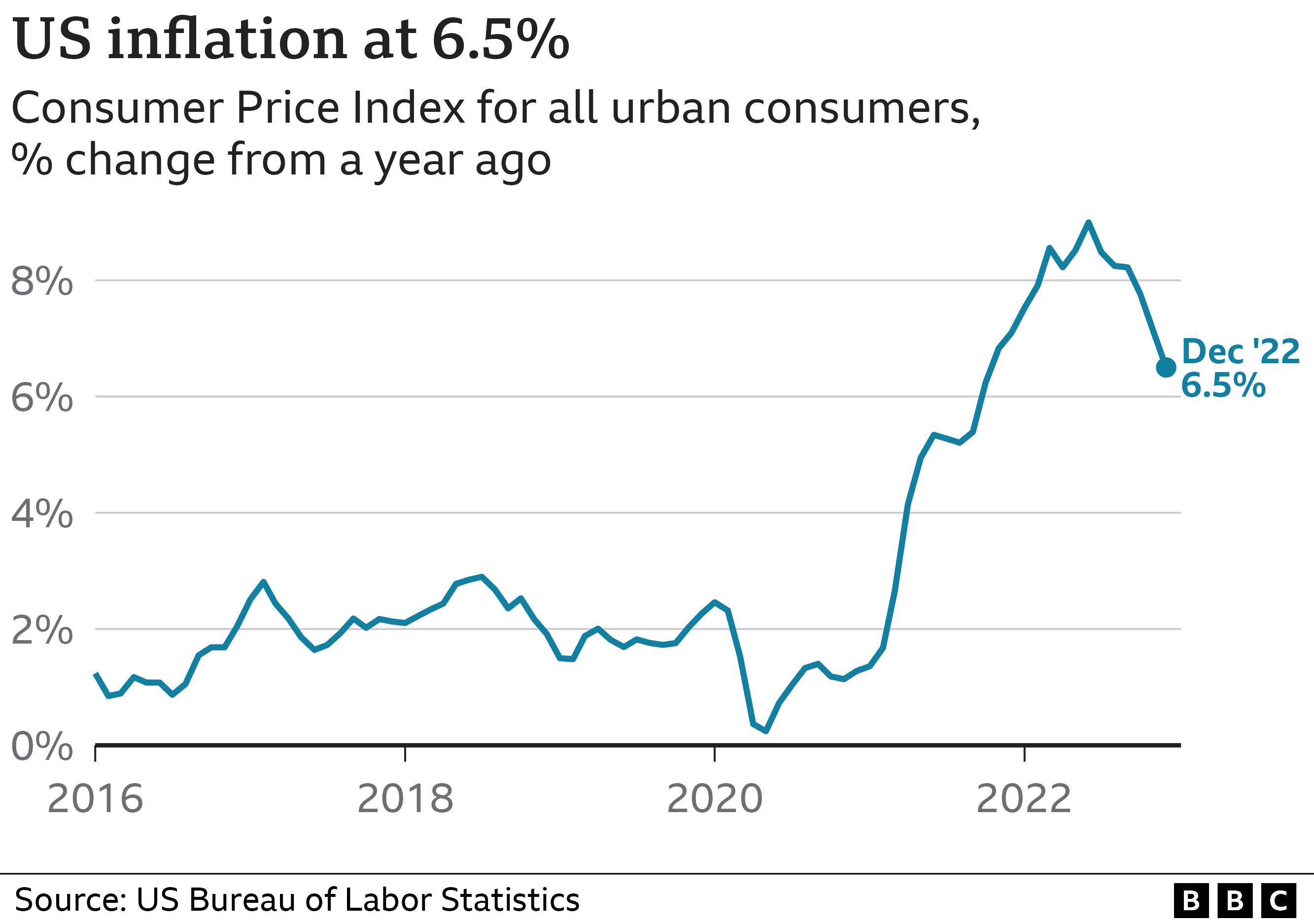

Let’s break down what this means a little further. Tariffs, for those unfamiliar, are essentially taxes on imported goods. They impact inflation by making those goods more expensive. When tariffs go down, it should lower prices, which, in turn, allows the Fed more breathing room to loosen monetary policy.

Essentially, Waller’s argument is this: Inflation is still too damn high, and tariffs are a significant contributor. Get those tariffs under control, and then we can talk about easing up on the interest rates. Simple as that, right? (It’s never really simple, is it?)

This is a huge signal, a cold splash of reality for anyone hoping for quick relief. It suggests the Fed is taking a decidedly hawkish stance, prioritizing price stability over rushing into a potentially premature easing cycle. Now, let’s get into a bit more detail about the interplay between tariffs and monetary policy:

Understanding Tariffs and Inflation: Tariffs directly impact the cost of imported goods, potentially leading to higher consumer prices. These increased costs contribute to overall inflation.

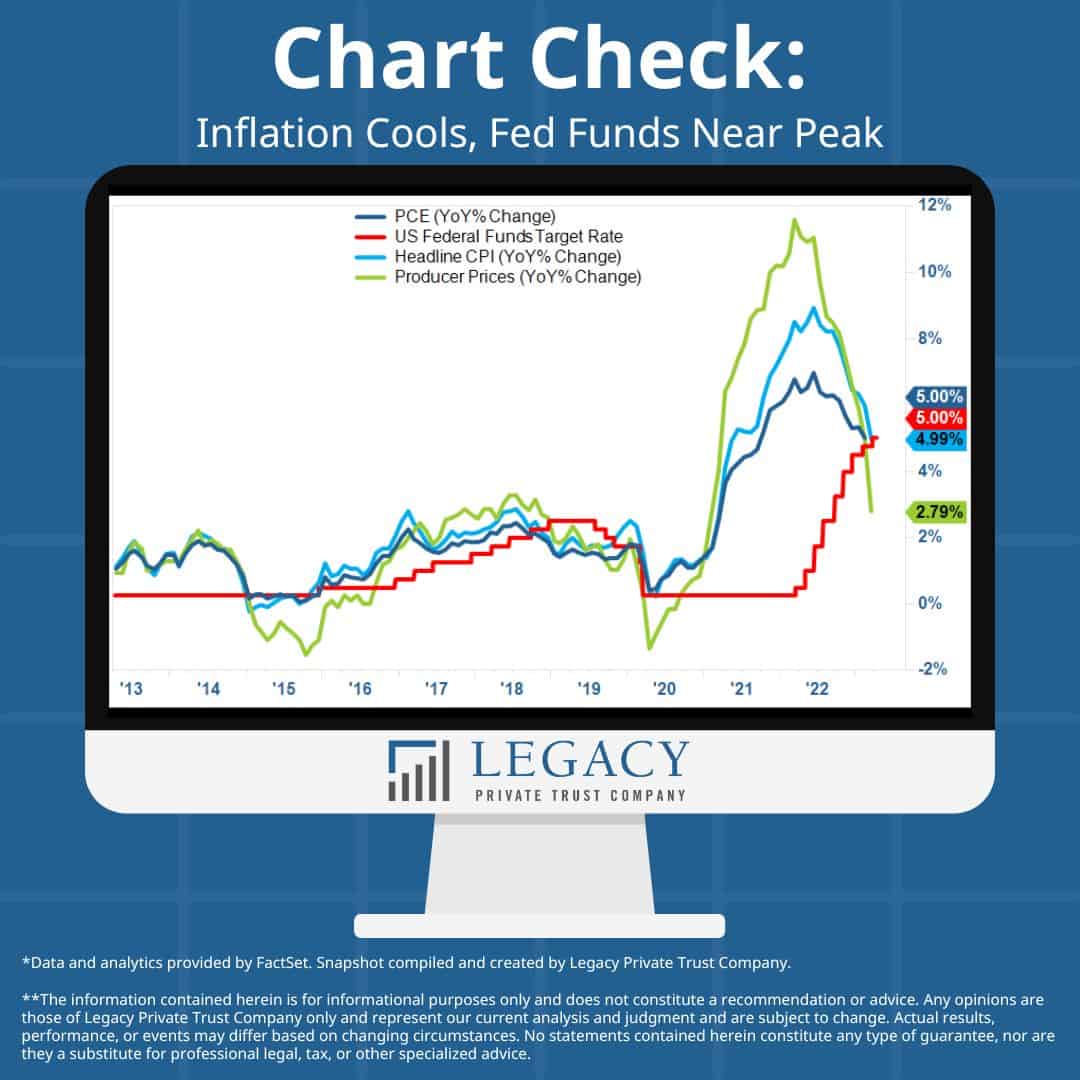

The Fed’s Dual Mandate: The Federal Reserve operates under a dual mandate: price stability and maximum employment. Controlling inflation is paramount when it’s running hot.

Monetary Policy Tools: Interest rates are the Fed’s primary tool. Lowering rates stimulates the economy, but risks fueling inflation. Raising rates slows things down, curbing price increases.

The Tariff-Rate Connection: A decrease in tariffs can ease inflationary pressures, giving the Fed more flexibility to consider rate cuts. Conversely, rising tariffs can complicate matters and delay potential easing.