Alright, folks, let’s break down the whirlwind of news from yesterday and this morning. The signals from Beijing are clear: they’re sticking to that ‘moderately loose’ monetary policy to fuel quality economic growth. Governor Pan Gongsheng reiterated this, and Finance Minister Lan Fo’an doubled down, promising a more proactive macro approach to hit those growth targets. Sounds good on paper, but let’s be real – execution is everything.

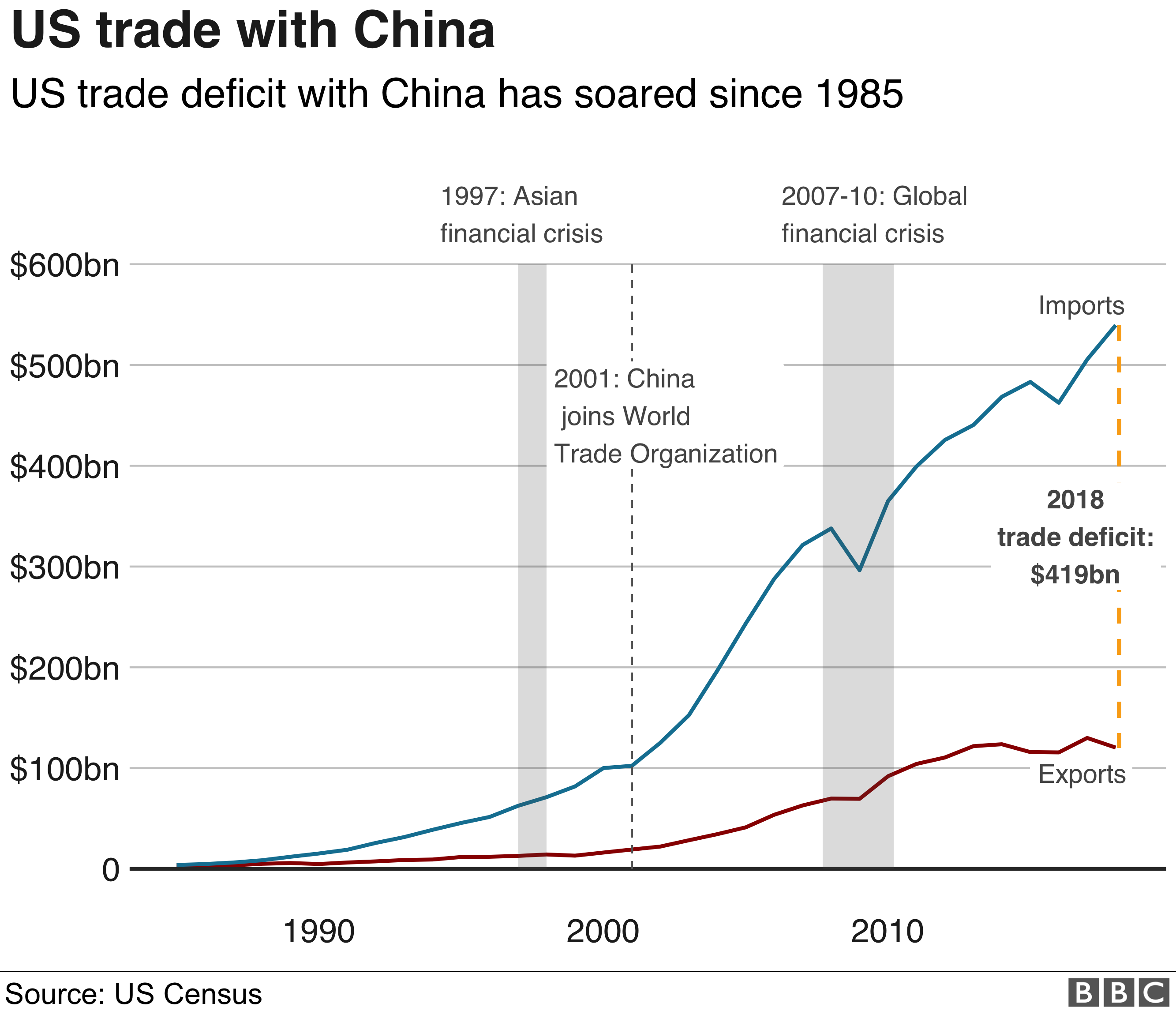

We also saw the Trade Friction Response meeting kick off for 2025, which suggests China is preparing for continued trade headwinds. And the diplomatic shots fired? The Foreign Ministry slammed the US for misinformation regarding tariff talks – a clear ‘don’t try to pull a fast one’ message.

Domestically, consumer spending is getting a boost from trade-in programs, exceeding 720 billion yuan and benefiting over 120 million people. That’s a positive sign, but it’s still fragile. Regulatory action is also picking up, with the Ministry of Commerce cracking down on fake marketing and IP theft.

Now, to the real chaos: Trump. Let’s unpack this.

Trump’s Trade Tango: He’s talking ‘fair’ tariffs for everyone, signaling no extended pauses and a potential deal within weeks. However, it’s all still dependent on his final say. Discussions with Japan included talk of increased corn imports and he stated they are nearing an agreement. A broader deal with South Korea is also in sight, aiming for completion by early July. Don’t hold your breath, though – this is Trump we’re talking about!

Inflation Alarm Bells: US one-year inflation expectations spiked to levels not seen since 1980, while consumer confidence hit a 20-month low. The Fed’s ‘mouthpiece’ is trying to cool down bets on a June rate cut – and honestly, they should be! The Fed’s financial stability report explicitly identified global trade wars and policy uncertainties as major risks – a pretty blunt admission.

Beyond Trade: Trump also floated the idea of banning Congress from trading stocks (finally!), hinted at progress in Russia-Ukraine talks, and is even engaging with Iranian officials about a potential temporary agreement. He’s also putting pressure on Europe to reject AI regulations, and cracking down on ‘birth tourism.’

Key Takeaways:

Policy Divergence: China is leaning into easing, while the US faces sticky inflation and Fed caution.

Trump’s Wildcards: His trade rhetoric is unpredictable and the potential for disruption remains high.

Global Risks: Trade wars and geopolitical tensions continue to loom large over financial stability.

Stay vigilant, people. This isn’t a time for complacency.