Friends, followers, gold bugs! Let’s talk about what’s really happening with gold. After last week’s parabolic surge to record highs, the yellow metal is finally taking a breather – and a bit of a tumble. We’re seeing prices dip, currently hovering around $3305, a hefty 5% drop from that peak above $3500. Frankly, it was starting to feel unsustainable.

This isn’t a sign of a failing narrative, but a healthy correction. The speed of the rally was simply too hot to handle! Traders are locking in profits, and that’s just smart money at work. We saw a massive volume spike in SPDR Gold Shares ETF options last week, exceeding a record 1.3 million contracts. That screams ‘overheated’ to me.

Barclays is calling it, and I agree – a pullback was inevitable. Their analyst, Stefano Pascale, rightly points out that prices were running well ahead of fundamentals like the dollar and real interest rates. The technicals were screaming ‘overbought.’

To dive a little deeper, here’s some context for those newer to the gold market:

Gold prices are influenced by a complex interplay of factors. Macroeconomic conditions, geopolitical stability, and investor sentiment all play significant roles.

Option trading volume is a key indicator of market positioning. Surges in volume, especially in call options, often signal speculative fervor.

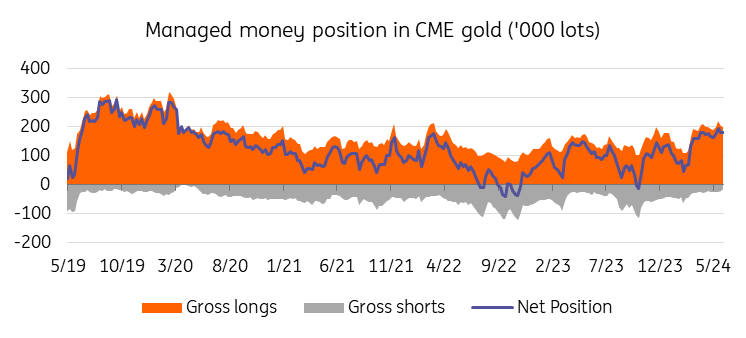

The Commitment of Traders (COT) report, like the one from the CFTC, provides a snapshot of large speculators’ positions, revealing trends in bullish or bearish bets.

Fund managers are also demonstrating a shift in sentiment, reducing their net long positions in gold futures and options to a 14-month low. This isn’t panic selling, it’s prudent risk management. Don’t mistake this for a bearish disaster! Think of it as opportunity. Be prepared for continued volatility and potential dips. I’ll be watching closely, and you should too. Don’t catch a falling knife, but this might be a chance to add to your positions strategically. This market is speaking, are you listening?