Alright, folks, buckle up! We’ve got a packed week ahead, and two key data points are screaming for your attention. First up, this morning we’re getting the crucial China Caixin Services PMI for April. This isn’t just another number; it’s a pulse check on the world’s second-largest economy, and a leading indicator of global growth.

Later tonight, the US March trade balance will be unveiled. Honestly, the trade deficit has been a persistent thorn in the side of US economic narrative, and we likely won’t see a dramatic shift. But the details matter! A wider deficit suggests weakening global demand, while a narrower one could indicate strengthening US exports.

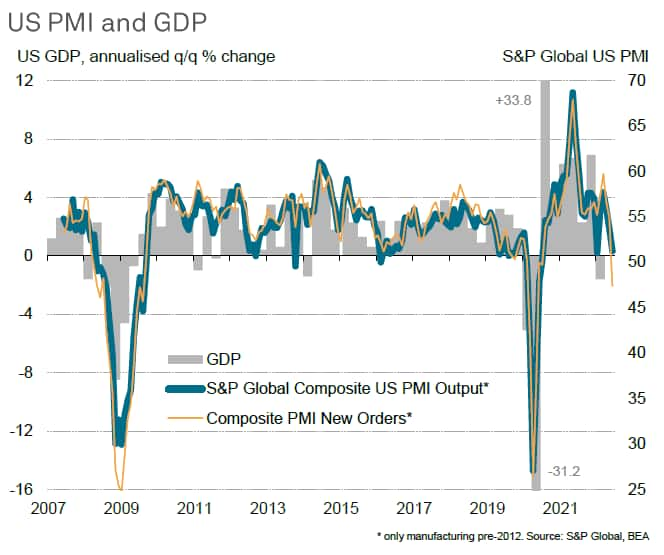

Let’s break down what the PMI actually means:

A Purchasing Managers’ Index (PMI) is a survey-based indicator of economic activity. Values above 50 signal expansion, below 50 indicates contraction. Services PMI specifically focuses on the service sector – everything from banking to tourism.

Why these numbers are vital:

The service sector is a huge chunk of most modern economies. A strong reading suggests consumer confidence and business investment are holding up.

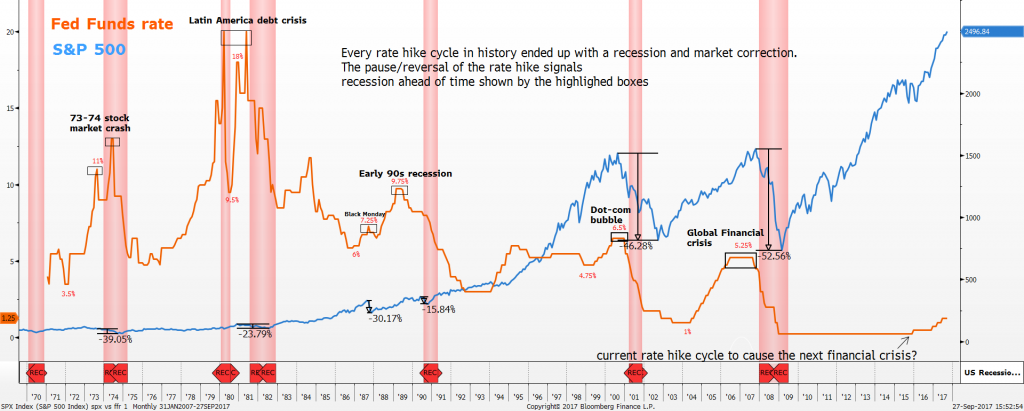

The Trade Balance Explained:

The trade balance is the difference between a country’s exports and imports. A deficit means a country is importing more than it exports. This can impact GDP calculations and currency values.

Don’t just sit there – download this week’s gorgeous calendar wallpaper (link on the right!) with these key dates clearly marked! Stay sharp, stay informed, and let’s navigate these markets together. Your money deserves it!