Folks, let’s cut to the chase: the latest GDP figures are flashing red. The U.S. economy contracted in the first quarter of 2024, and while mainstream media is scrambling for explanations, the truth is staring us right in the face – it’s the tariffs. The Commerce Department’s data revealed a concerning dip, and the patterns are crystal clear.

Businesses, bracing for the inevitable pain of escalating tariffs, went on a pre-emptive import binge. They were stocking up before the costs went through the roof, creating a temporary, artificial boost in the months leading up to Q1, which then predictably reversed. This isn’t growth, it’s a distortion.

But here’s where things get really ugly. This isn’t a one-time blip. The relentless barrage of new tariffs is injecting a heavy dose of uncertainty into the market. Now, let’s drill down on why this is so dangerous.

Understanding the Tariff Impact: Tariffs are essentially taxes on imported goods. While the intention might be to protect domestic industries, the reality is often far more complex. They increase the cost of goods for consumers and businesses alike.

Inflationary Pressures: Higher import costs translate into higher prices for everything from raw materials to finished products. This fuels inflation, eroding purchasing power and squeezing households.

Supply Chain Disruptions: Tariffs can disrupt established supply chains, forcing companies to seek alternative (and potentially more expensive) sources. This inefficiency further contributes to inflation.

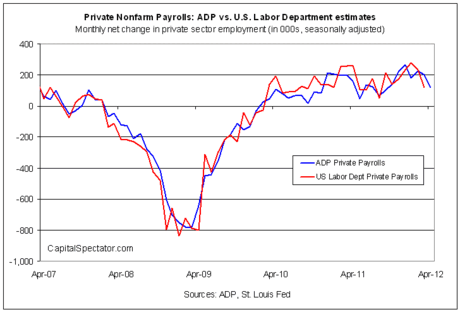

Potential for Job Losses: As businesses struggle with higher costs, they may be forced to reduce investment and even lay off workers. The promise of ‘bringing jobs back’ often falls flat when faced with the cold reality of tariff-induced economic slowdown.

We’re likely looking at a future where sustained tariffs mean not just slower growth, but potentially rising inflation and – yes, you heard it here first – increased unemployment. This isn’t economic policy; it’s economic sabotage. The chickens are coming home to roost, and the American consumer is going to pay the price. This self-inflicted wound could have serious implications down the line, and frankly, it’s a disaster in the making. Don’t let anyone tell you otherwise.