Hold on to your hats, folks! The Beijing-Tianjin-Hebei (Jing-Jin-Ji) region just dropped a bombshell – a whopping 724 million credit records are now fully shared across the three jurisdictions. Seriously, that’s a mountain of data! This isn’t just some incremental improvement; this is a fundamental shift in how credit information flows.

The breakthrough comes via two newly established standards: the ‘Data Element Exchange Specification for Unified Social Credit Codes for Legal Persons and Other Organizations’ and the ‘Data Sharing and Application Specification for Unified Social Credit Codes for Legal Persons and Other Organizations.’ Sounds thrilling, right? Okay, maybe not. But trust me, this is huge.

For years, the region has been plagued by fragmented data standards and insufficient sharing. It’s been a pain in the ass for businesses, regulators, and frankly, anyone trying to get a clear picture of the economic landscape. This new framework aims to fix that – and it’s already showing promise.

Since signing a cooperation agreement last November, Jing-Jin-Ji authorities have focused on three key areas: standardizing data, deepening information sharing, and boosting collaborative regulation. It’s a trifecta of efficiency, if you ask me.

Let’s dig a bit deeper into what this whole ‘social credit code’ business actually means.

Understanding the Social Credit System (A Quick Deep Dive)

China’s Social Credit System (SCS) isn’t about simply your personal credit score like in the West. It’s far more expansive and includes data on a company or individual’s legal compliance, ethical behavior, and even social interactions.

It’s designed to foster trust and accountability within society and the market. The SCS uses a unique ‘Unified Social Credit Code’ to identify entities, allowing for consistent tracking and evaluation.

Data sources for the SCS include payment history, court records, regulatory filings, and even publicly available information. Think comprehensive.

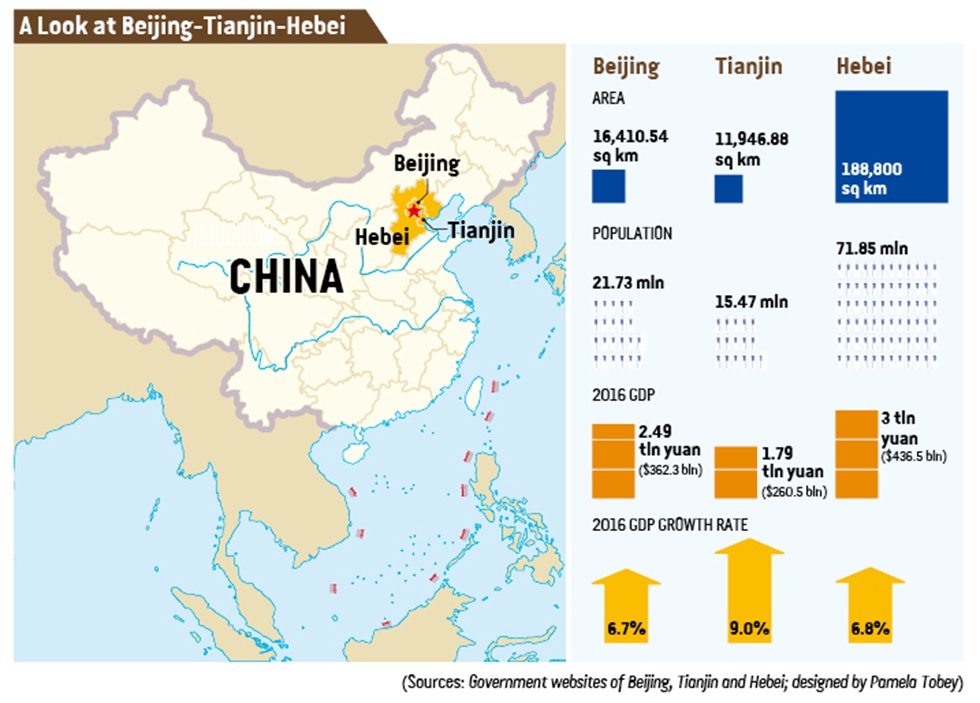

Sharing this data across provinces like Beijing, Tianjin, and Hebei increases transparency and allows for quicker identification of risks and non-compliance. It also stymies potential fraud.

This level of connectivity offers enormous potential for regional development and streamlined oversight. But let’s be real, we need to keep a close eye on potential privacy concerns and how this data is being used. This isn’t just about efficiency – it’s about power and control, and we need to demand accountability.