Hold onto your hats, folks. The CFTC report just dropped, and the numbers are screaming… speculation. As of the week ending April 15th, speculators dramatically increased their net long positions in WTI crude oil futures by a whopping 39,021 contracts, bringing the total to 76,370 contracts. That’s a significant jump, and frankly, it’s raising some serious eyebrows.

Now, what does this really mean? It suggests a growing belief among traders that oil prices are headed higher. But before you jump on the bandwagon, let’s be clear. These are speculators we’re talking about. They’re driven by sentiment and momentum, not necessarily fundamentals. And that makes this a potentially dangerous game.

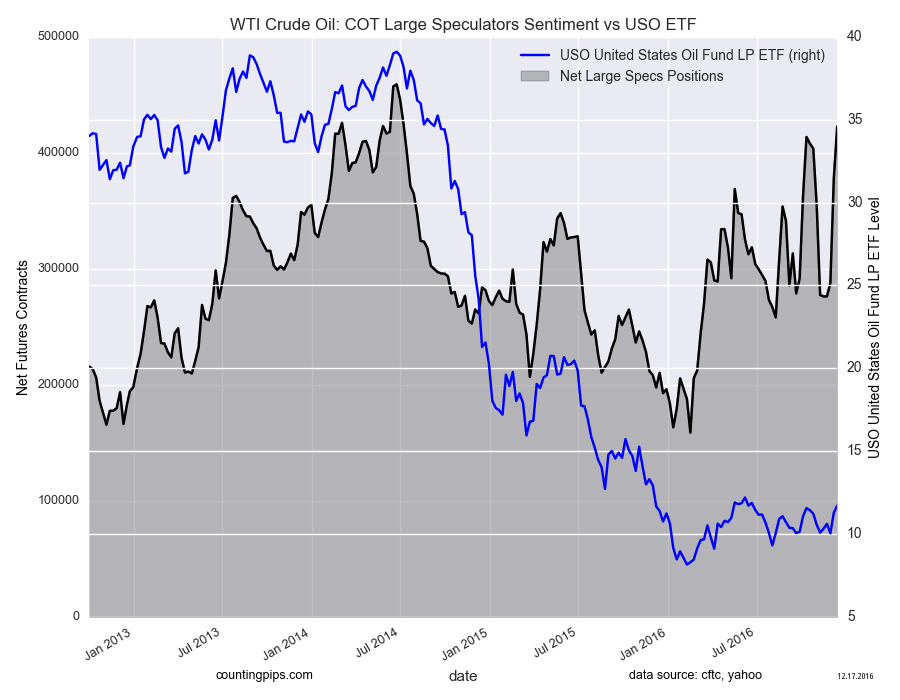

Let’s unpack what’s happening beneath the surface. Understanding net positioning is key to identifying potential market turning points. A large net long position, like we’re seeing now, often signifies a crowded trade.

Essentially, too many people are betting on one outcome. This creates a vulnerability. Should something shift – maybe a surprise increase in production, softening global demand, or just a profit-taking spree – these speculators could rush for the exits, triggering a sharp sell-off.

Think of it like a packed elevator. Everyone’s heading up, feeling confident. But the slightest tremor, and suddenly, it’s a chaotic scramble to get off.

Here’s a brief primer on net positioning:

Net Long Position: The difference between the number of buy (long) contracts and sell (short) contracts held by traders. Indicates bullish sentiment.

Speculators: Traders who aim to profit from price fluctuations, rather than taking or making delivery of the underlying commodity.

Crowded Trade: A situation where a large number of traders are positioned in the same way, creating potential for rapid reversals.

So, while this report clearly shows rising bullish sentiment, don’t mistake it for a rock-solid signal. Stay vigilant, manage your risk, and remember – the market is rarely as straightforward as it seems. This could very well be a trap for the unwary.