Alright, folks, buckle up! The tungsten market is about to get interesting. A new research report from Citic Securities indicates that China’s Ministry of Natural Resources has significantly tightened the tungsten ore mining quota for 2025. We’re talking a 6.5% decrease in the first batch of quotas, totaling 58,000 tons – a steeper drop than last year.

Photo source:en.institut-seltene-erden.de

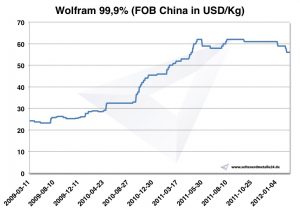

This isn’t just a minor adjustment; it’s a flashing neon sign signaling impending price increases. Several key factors are converging. Mining quotas are shrinking, environmental regulations are tightening their grip, and ore grades are declining. Plus, those crucial new projects? They won’t be online anytime soon.

But here’s the kicker: demand is soaring. Thanks to policies promoting equipment upgrades and the burgeoning solar photovoltaic tungsten wire sector, demand is rapidly accelerating. This combination of constrained supply and robust demand is a recipe for a higher tungsten price baseline.

Let’s break down the fundamentals a bit. Tungsten, often called “steel’s gray cousin,” boasts the highest melting point of all metals. It’s critical for diverse applications, including high-speed steel, cemented carbides, superalloys, and electronics.

Moreover, the strategic importance of tungsten is growing, especially amidst export control policies. Think about it – it’s vital for defense and advanced manufacturing. This means we’re likely to see a restructuring of the tungsten industry, focusing on higher value-added products and bolstering China’s strategic resource position. This is not just a trade; it’s a strategic play.

Prepare for volatility, and don’t underestimate the long-term implications of these tightening supply dynamics!